GST registration In Ahmedabad

Call Us Today +91 80000 57972

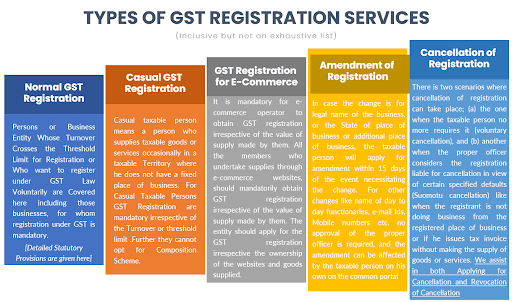

The expert GST registration services provided at K M GATECHA & CO LLP makes your GST registration and procurement a breeze and hassle-free process. We are also well known for GST registration services,GST registration services for export of services,GST registration for partnership firm,GST registration for proprietorship,GST registration for private limited company,etc. Hence we are well known as best CA for filing GST return in Ahmedabad. Our team of experts help clients in day to day GST compliance services. If you are a business owner or a service provider in Ahmedabad, you need to register for GST if your annual turnover exceeds Rs. 20 lakhs (Rs. 10 lakhs for special category states). GST registration is mandatory for certain categories of taxpayers, such as inter-state suppliers, e-commerce operators, casual taxable persons, non-resident taxable persons, etc. GST registration services in Ahmedabad can help you obtain your GST number or GSTIN (Goods and Services Tax Identification Number) in a hassle-free manner. GSTIN is a 15-digit alphanumeric code that is unique for each taxpayer. It is used to file GST returns, pay GST dues, claim input tax credit, and comply with other GST provisions.

GST registration services in Ahmedabad

GST registration services in Ahmedabad

The GST registration services in Ahmedabad that we supply is as follows: –

• Collection of documents:

· A team member will get in touch with you to aid you to give details about the documents needed.

· The documents will be then collected by us.

• Applying for GST

· Our expert team will verify all the documents

· After verification, the registration process will be initiated

· A team member will keep you updated about the progress of verification and registration

· After registration of GST, ARN will be at once provided to you for tracking

• Obtaining certificate

· Verification of form and documents is done by GST officer then the GST certificate is issued

· The GST certificate is generated within 3-7 working days

• Re-filing and rectification

· If due to any problem or error from clients’ or company’s side, then the service of refiling/rectification of application for certificate is also supplied.

GST registration in Ahmedabad

Who needs GST?

First GST applied to all businesses who had a turnover of INR 20 lakhs or above then it was revised for all Businesses with turnover of INR 40 lakhs and above.

So, any entity be it trading, manufacturing, professional, business or individual which has a turnover of 40 lakhs or above is needed to compulsorily have a GST Number.We are well known for GST registration services,GST registration services for export of services,GST registration for partnership firm,GST registration for proprietorship,GST registration for private limited company,etc.

Our GST registration services in Ahmedabad can also assist you with other aspects of GST compliance, such as:

• Filing monthly, quarterly, and annual GST returns

• Generating and verifying e-way bills for transportation of goods

• Reconciling input tax credit with GSTR-2A

• Applying for GST refunds, amendments, cancellations, etc.

• Resolving GST notices, audits, assessments, etc.

• Advising on GST rates, exemptions, classifications, etc.

We are known as best GST consultant in Ahmedabad.K M GATECHA & CO LLP is known for its best functioning as leading GST return filing consultant in Ahmedabad.Thus we help our clints for GST registration in Ahmedabad. As best GST consultant in Ahmedabad ,we also help our client in solving GST query. Thus our GST consultancy services includes complete package of GST services. Our GST services includes GST cancellation services, change in GST registration services and also GST return filing consultant.

Which Documents a required for a GST number

The main documents needed for a GST number

- PAN card

- Aadhar card

- Proof of business registration

- Photographs, identity and address proof of person/s in charge

- Business’ address proof and bank account statements

- Authority letter

- Other documents as per type/nature of business.

What are the advantages of GST number?

- Makes the business a legally recognize supplier of goods and service

- Legally authorized to collect tax from customer and pass on tax to suppliers

- Business can claim input tax credit on purchases

- Seamless flow of input tax credit from supplier to recipients on a national level

- Ease of doing business

By availing GST registration services in Ahmedabad, you can save your time and resources and focus on your core business activities. You can also avoid penalties and interest for non-compliance or late compliance of GST laws.GST registration services in Ahmedabad can help you comply with the GST regime and reap its benefits. By registering for GST, you can expand your business across India, claim input tax credit, reduce tax burden, increase transparency, and enhance customer trust.

FAQS-GST REGISTRATION SERVICES

GST registration requires following documents

- PAN card of company

- Aadhar card, photographs and pan card of owners and legal representative

- Email id and mobile number of all persons

- Place of business proof includes latest utility bill, legal ownership documents

- Existing business registrations proofs

Registration process includes as follow:

- Making application on gst website.

- Than aadhar need to be verified.

- ARN is generate

- GSTIN is approved

- GSTIN is a unique identification number given to each business that is registered under GST.

- It is unique to each business.

- Pre-GST existing businesses/Individuals

- Businesses with turnover above INR 40lakhs

- Casual/non-resident taxable person

- Agents of supplier and input service distributor

- Those paying tax under reverse charge mechanism

- E-commerce supplier or aggregator

- Any person supplying online information or database access or retrieval from a place outside India.

- Yes, GST registration is to be done online.

- Yes, for every state a different GSTIN is needed as the GSTIN depends on the place of operations

- For interstate supply or procurement

- If tax is paid under Reverse charge mechanism or person who must deduct tax under GST (TDS)

- Agents or person who supplies on behalf of another registered taxable person

- Input service provider

- Casual taxable person or non-resident taxable person

- No, an unregistered business cannot avail input credit tax.

- Once issues the validity of GST certificate is until it is surrendered or cancelled.

- You can register for as many GSTIN as many business verticals you have.

Benefits of GST registration includes claiming credit on inputs purchased and paying GST on supply of goods and services. Also after GST registration a person is considered GST recognized.

Use below form to contact us for GST registration services in Ahmedabad

Our Other CA Services

CA Firm in ahmedabad

Being the best ca firm in Ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Tax Consultant

We as the best tax consultant in Ahmedabad, india provide tax consultancy including direct and indirect tax consultancy.

Income Tax Services In Ahmedabad

We provide income tax audits, income tax return filing, corporate income tax services, etc.

Chartered Accountant In Ahmedabad

We as the most-trusted chartered accountant in Ahmedabad provide all chartered accountant services under one roof.

Tax Accountant

We provide tax accounting services for effective tax planning and making tax provisions.

Accounting firm in ahmedabad

We provide bookkeeping, accounting, tally accounting, zero accounting, quick book accounting, Zoho accounting services.

GST Consultant

Our GST services include GST registration services in Ahmedabad, GST consultancy, GST refunds services,gst registration for company, GST return filing, GST audit, GST compliances, etc.

Audit Firm in ahmedabad

We provide bank audits, stock audits, forensic audits, statutory audits, concurrent audits, tax audits, internal audits, information system audit services.

Got a Question?

FAQ

GST rate for consultancy services is 18%.

GST consultant is a professional who helps to manage goods and services matters like gst returns,taxes payment,tax reconciliation,ITC reconciliation,gst refund services,gst registration, classification of goods and services,etc.

GST rate for labour charges is widely 18%.

GST rate for labour contractor is 18%.

GST rate for works contract is 18%.

GST rate for professional services is 18%.

Highest gst rate in India is 28%

No, gst not charged on dental services.

There are four rates of GST for regular registered person those are 5%,12%,18% and 28%. For person registered under composition scheme there are two rates and those are 1% and 2%.

Yes, GST applicable on labour charges.

GST (short for Goods and service Tax) is a tax applicable on all goods and services expect petroleum products as of now (but demands are to bring them under GST purview as well).

It was introduced on 1st July 2017, with an aim of merging all state and central taxes along with all distinct types of cess under one taxation system.

It replaces VAT, Service Tax, Entertainment tax, octroi, luxury tax and many others.