The Indian IT sector has grown dramatically in the last decade or so because of the global increase in IT usage. Equalisation Levy is nothing but Taxing Cross-Border E-commerce transactions. It is critical to remember that a tax on the IT sector was implemented in India in response to the government’s increasing tax challenges. Equalisation Levy is nothing but Taxing Cross-Border E-commerce transactions.

The equalization levy is a vital tax system that allows businesses to regulate their business models in accordance with existing conventions. E-commerce platforms and digital transactions are widely used in India. This reliance is expected to grow in the coming years.

To gain a better understanding, keep in mind that tax disputes can cause massive problems for the Indian economy, with IT being one of the most notable sectors. Tax disputes may include challenges to nexus, data valuation, and user contribution. Companies with international operations are more vulnerable to these disputes.

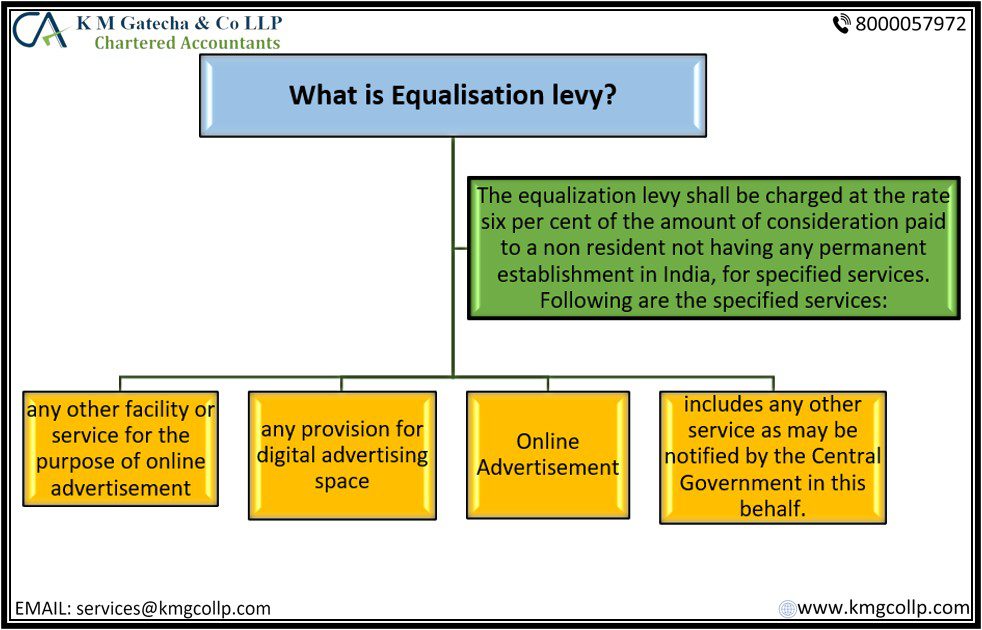

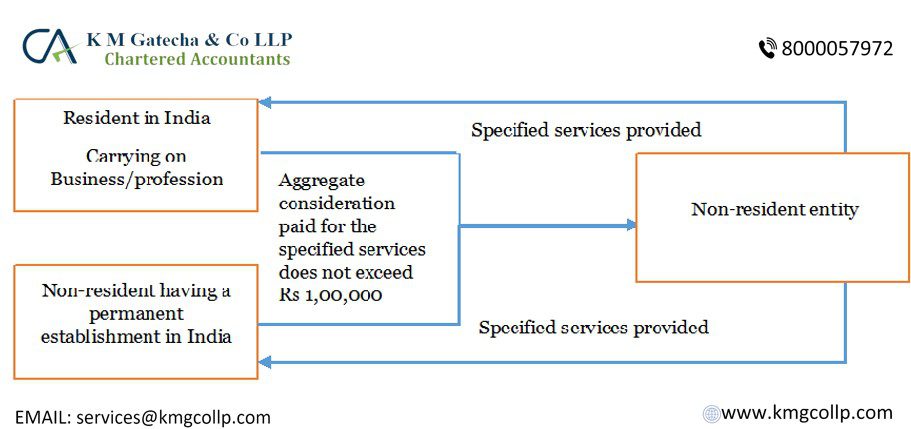

As a result, the equalization levy India system has two primary conditions for this tax’s applicability. These are:

- Payment should be made to a non-resident service provider who does not have a permanent establishment in the country.

- The annual payment made to a service provider should be more than one lakh rupees in one fiscal year.

Equalisation Levy Services

The equalization levy scheme does not apply to all e-commerce or telecommunication services because it was just implemented in 2016 and is not a component of the Indian Income Tax Act (1961). Instead, it is mandated by the Finance Act of 2016, a piece of legislation that awards some tasks and modifies the law in relation to the total public debt and revenue. Therefore, this measure adds further provisions to the financial model.

In India, the following two particular services are subject to the equalization levy section:

- Online advertisements

- Any digital space that may be further modified for advertising.

Equalisation Levy Expansion

India has implemented a modernized version of the equalisation levy (EL) taxing system as of 2020. All e-commerce operators who are non-residents of India must be subject to this direct tax under the new framework established by the Finance Act, 2020.

This updated version of EL states that every non-resident digital operator who offers e-commerce services is subject to a 2% tax. The e-commerce supply or service must consider it in order for this rate to be applicable.

Rate of Tax

- The applicable rate of tax is 6% of the gross consideration to be received or receivable under Section 165.

- The applicable rate of tax is 2% of the gross consideration to be received or receivable under Section 165A

This new equalization levy system has two important features:

This new EL will not apply to transactions that are already covered by the EL under the Finance Act of 2016. This means that the new taxation system excludes online advertising and digital space provision.

- This new EL applies to non-resident e-commerce operators who sell to Indian residents and those who use an Indian IP address.

- The threshold limit for this new tax is 2 crore rupees, as opposed to 1 lakh rupee for the equalization levy in 2016.

Frequently Asked Questions: -

Under the Finance Act of 2016, the EL rate was 6%. This means that a 6% tax rate is currently being applied to the gross consideration to be paid.

The required EL should be deposited by the first week of the month following the month of purchase. The deposit should be made to the credit of the Central Government.

The EL 2.0 is applicable to the following services:

- An e-commerce operator’s online goods sale

- Provisions for online services owned and managed by an e-commerce operator

Disclaimer: The main goal of this article is to “assist investors in making informed financial decisions.” The above information is provided only for educational purposes. Readers are advised to exercise caution and seek professional counsel before relying on the above information. K M Gatecha & CO LLP is not liable for any loss or harm incurred by readers who take action based on the information provided in this article. “Please keep in mind that the opinions expressed in this Blog/Comments Section/Forum are clarifications intended for the readers’ reference and guidance as they investigate further on the topics/questions raised and make informed decisions. These are not intended to be investment advice or legal advice.”

Table of Contents

Toggle