LLP ROC Filings

Call Us Today +91 80000 57972

For an LLP, filings must be done regularly to maintaining compliance and avoid hefty fines. LLPs have far fewer requirements than Private Limited companies, but the penalties are much more severe. Whereas a Private Limited firm may only incur a penalty of INR 1 lakh for non-compliance, an LLP could be charged up to INR 5 lakh. We provide the best LLP ROC filings services in Ahmedabad.

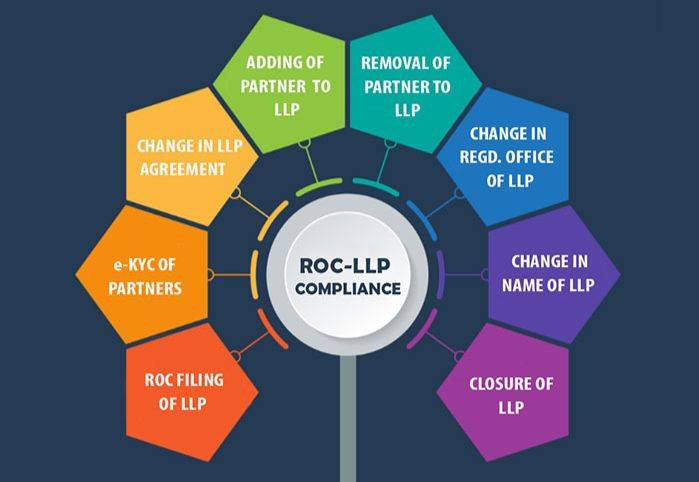

Compliances by LLP

As Limited Liability Partnerships are considered to be individual legal entities, it is the responsibility of the chosen partners to keep accurate financial records and to submit an annual report to the Ministry of Corporate Affairs (MCA) each year.

LLPs do not need to audit their books of accounts unless their yearly revenue surpasses Rs. 40 lakhs or the contribution is more than Rs. 25 lakhs. Therefore, if an LLP meets the criteria, they will not be obligated to audit their books of accounts, which makes the yearly filing process easier.

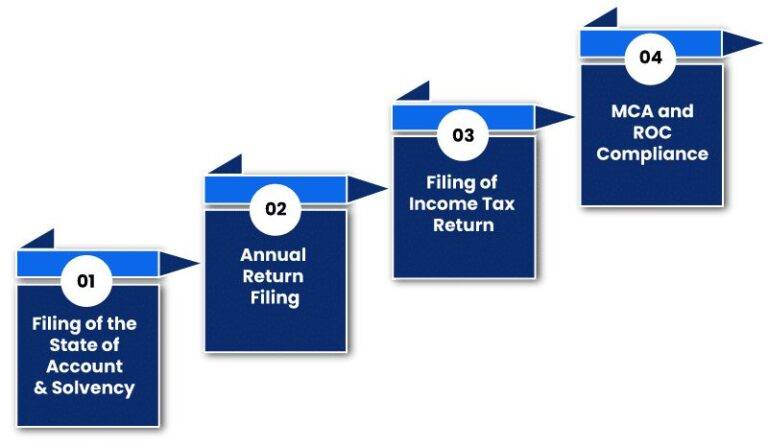

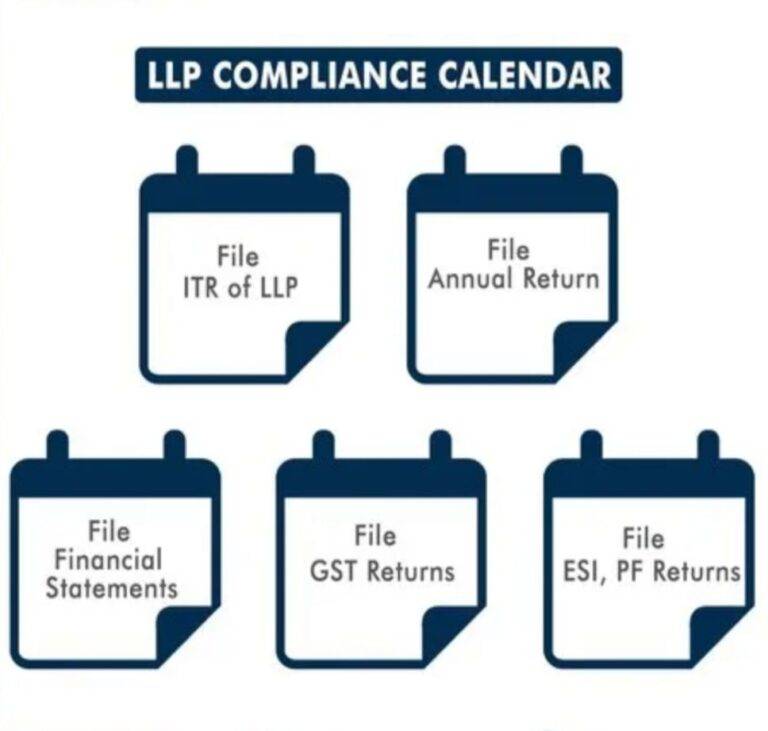

Limited Liability Partnerships must submit their Statement of Account & Solvency within 30 days after the completion of the first 6 months of the financial year and the Annual Return within 60 days after the end of the financial year.

Unlike Companies, Limited Liability Partnerships are obligated to keep the financial year from April 1st to March 31st. Thus, the Statement of Account & Solvency must be submitted no later than October 30th each financial year, while the annual return for LLPs is due by May 30th annually even if the LLP has not conducted any business in that specific financial year. Certain annual filings are compulsory regardless if the LLP has started any business or not. We provide the best LLP ROC filing services in Ahmedabad.

Statements of Accounts and Solvency (LLP ROC Filings)

LLPs that are enrolled must have their financial records in order and provide information regarding profits and other business finances in Form 8 each year. This form must be signed off by the designated partners and verified by a certified chartered accountant, company secretary, or cost accountant. If the statement of accounts & solvency report is not sent in by the due date of October 30, a penalty of Rs. 100 per day will be imposed. We provide the best LLP ROC filing services in Ahmedabad.

Filing Annual Return (LLP ROC Filings)

Form 11 is a required document that must be submitted by the 30th of May every year and serves as a summary of the LLP’s management operations, such as the number of partners and their names. Contact Us!

Filing and Audit requirement under Income Tax Act (LLP ROC Filings)

As previously mentioned, Limited Liability Partnerships with revenue greater than Rs.40 lakh or a contribution of more than Rs.25 Lakh must have their accounting books audited by a practicing Chartered Accountant under the Limited Liability Partnership Act, 2008. The filing deadline for tax returns for LLPs that are required to have their books audited is September 30th.

Note – Starting from the 2021-22 Assessment Year (2020-21 Financial Year), the threshold for a tax audit has been increased from Rs.1 crore to Rs.5 crore, subject to the condition that the cash transactions of the taxpayer in terms of receipts and payments do not exceed 5% of the gross receipts or payments as per the Income Tax Act, 1961.

For Limited Liability Partnerships that are not subject to a tax audit, the due date for filing taxes is July 31st. Those LLPs which have been involved in international transactions with related enterprises or have taken part in specific Domestic Transactions must submit Form 3CEB, signed by a practicing Chartered Accountant. LLPs which are obligated to submit this form must complete their tax filing by November 30th.

Limited Liability Partnerships should submit their income tax return using Form ITR 5. This form can be completed and submitted electronically through the official income tax website with the assistance of the designated partner’s digital signature. We provide the best LLP ROC filing services in Ahmedabad.

Check out the best LLP ROC Filings services in Ahmedabad.

Recent Posts

- GST Appeals Basics: Procedure, Time Limit, Rules, Fees, Form

- Know Your TAN: How To Get Tan Number & Download TAN Certificate

- Dormant Company – Section 455 of Companies Act , 2013

- Appointments, Roles, Responsibilities of Company Secretaries and their Removal

- Types of Directors in a Company

- Application For Strike Off Of A Company

- How to Calculate Company Valuation?

- Can You Change the Tax Regime When Filing Your Income Tax Return?

- How to Choose the Right ITR Form for FY 2023-24 (AY 2024-25)

- Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It

FAQS on LLP ROC Filings

Form 8 must be completely filled out by October 30th. If it is not filed on time, a fine of Rs.100 per day will be imposed.

The following documents must be attached with Form 8:

Form 8 must be completely filled out by October 30th. If it is not filed on time, a fine of Rs.100 per day will be imposed.

- It is mandatory to provide a disclosure under the Micro, Small and Medium Enterprises (MSME) Development Act, 2006

- Statement of any contingent liabilities should be included if applicable.

- Any other relevant information can be provided as an optional attachment.

Form 8 needs to be digitally signed by two Designated Partners of a Limited Liability Partnership or by Authorised Representatives of a Foreign Liability Partnership if the total turnover of the LLP is no more than Rs 40 lakh or the partner’s contribution obligation is no more than Rs 25 lakh.

If Form 11 is not submitted by the Limited Liability Partnership by May 31, a fee of Rs 100 will be imposed per day for any delays. Additionally, this amount can grow over time since there is no limit to the penalty.

Form 11 requires details regarding the partner’s investment and activity with the Limited Liability Partnership, as well as any other businesses or LLPs in which the partner holds a similar role. It is important to be mindful when filling out Form 8, as the details given must be consistent with those in Form 11.