Company ROC Filing

Call Us Today +91 80000 57972

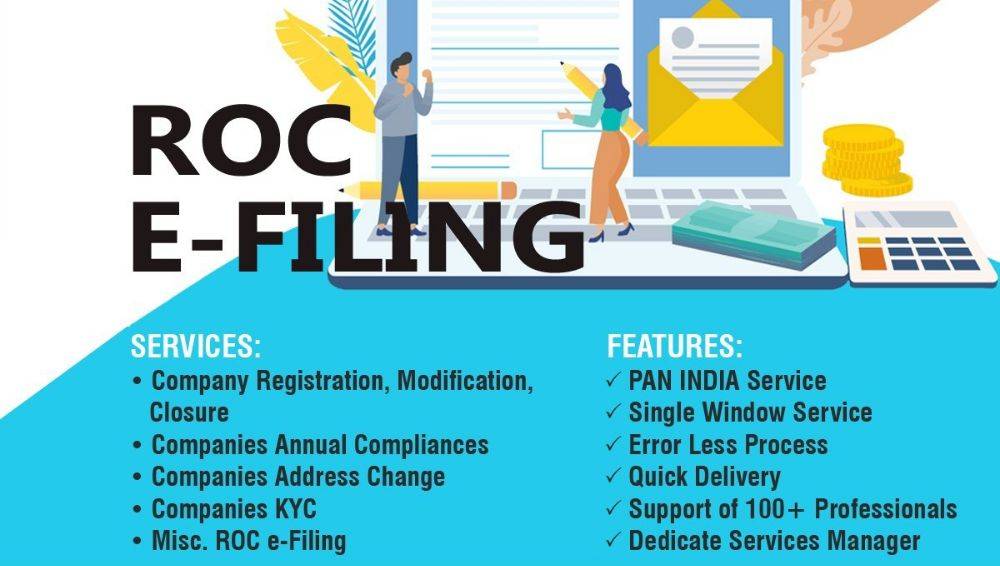

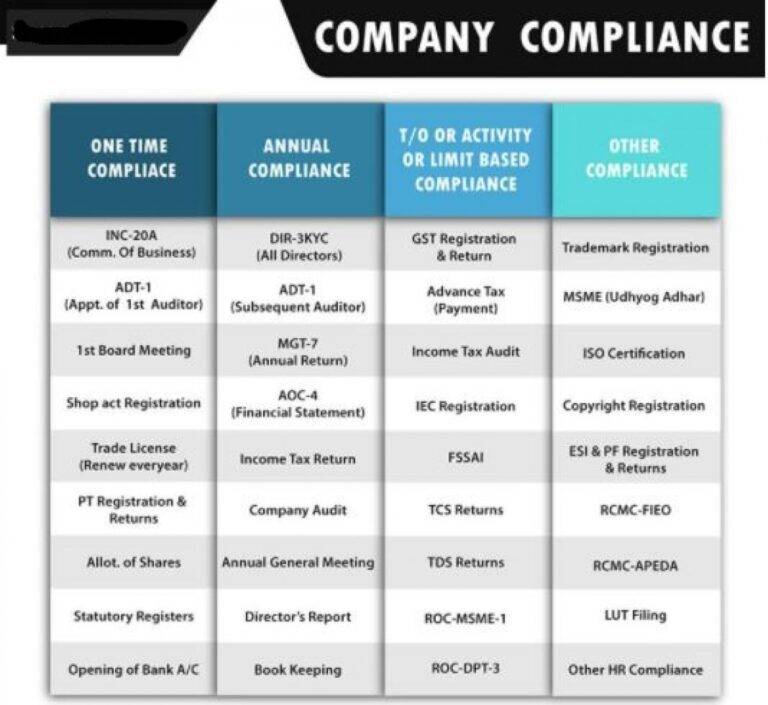

Every business is required to file the annual accounts and annual return as per The Companies Act, 2013 within 30 and 60 days respectively from the conclusion of the Annual General Meeting. The ROC filing of the yearly accounts is regulated under Section 129(3), 137, of The Companies Act, 2013 combined with Rule 12 of the Company (Accounts) Rules, 2014 and the yearly return is regulated under Section 92 of the Companies Act,2013 in combination with Rule 11 of the Companies (Management and Administration) Rules, 2014. We offer the best company ROC filing services in ahmedabad.

The process of ROC filing the annual return and annual accounts can be easily understood by the following process:

- A Board Meeting should be held to give permission to the auditor to prepare the financial statements in accordance with Schedule III of the Companies Act, 2013. Additionally, the Director or Company Secretary should be given authority to arrange the Board Report and Annual Return in accordance with the Companies Act, 2013. (Company ROC Filing)

- A further Board Meeting is needed for the directors to approve the draft financial statements, Board Report and Annual Return.

- An Annual General Meeting of the Company should be held and the necessary resolutions passed. It is important to note that the financial statements are only considered final when accepted by the shareholders at the General Meeting. Hire the best CA in ahmedabad.

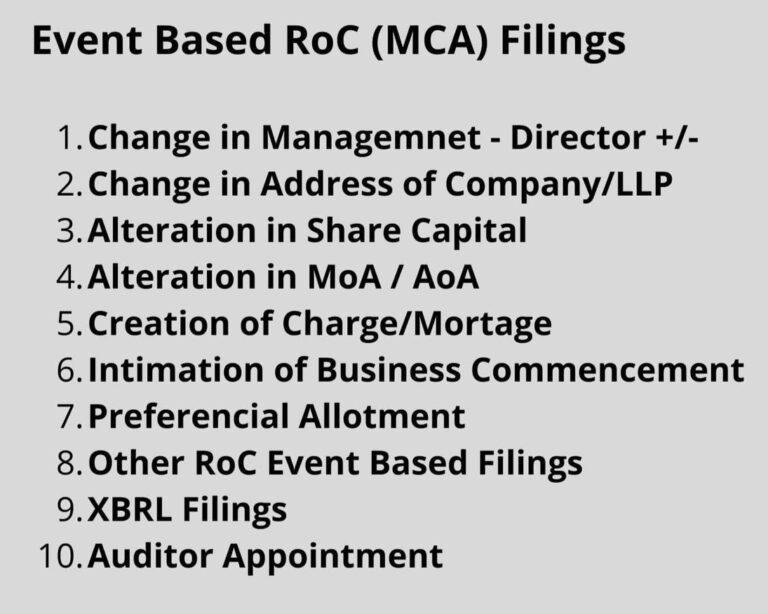

E-forms to be filed for ROC Filing Return (Company ROC Filing)

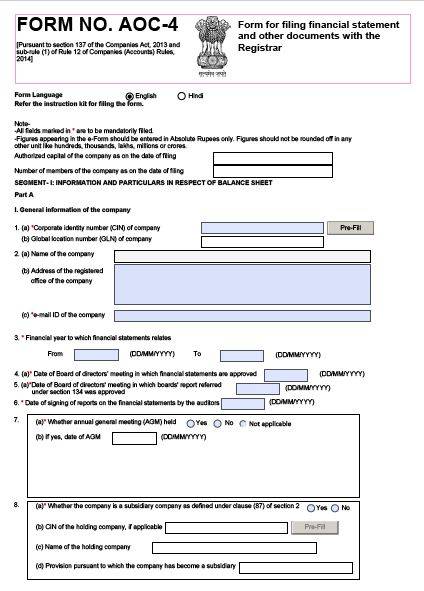

- Download form AOC-4 and MGT-7 from the MCA website under the MCA services menu, E-filing, and Company Forms Download.

- Fill the appropriate E-form for your company, attaching PDFs or XML documents if necessary, and press the Check form button. Attach the Digital Signature of the Director and a Practicing professional (if needed; OPCs and small companies are exempt). Then carry out a pre-scrutiny.

- Register as a Business User or Registered User on the MCA portal. Log in with your ID and password.

- After logging in, select Upload E-forms and browse to find the filled and signed form on your system’s location.

- Once you’ve uploaded the form, the system will open a payment window offering two options: Pay Later with the generated challan and pay within the allocated time frame, or pay with an internet banking or debit/credit card and save the payment challan for future reference.

- After doing the entire process, you can track the transaction status of your form by accessing the MCA services menu. All you need to do is enter the SRN no. generated in the challan, and you will be able to view whether your form has been approved or is still awaiting approval. Check out the best company ROC filing in Ahmedabad.

General Points to be Kept in Mind while Doing the Annual ROC Filing (Company ROC Filing)

- The notice for the Board Meeting should be sent to all the directors at least 7 days before and confirmation of receipt should be taken.

- According to Section 134 of the Companies Act, 2013, the financial statement, including any consolidated financial statement, must be signed by the company’s Board of Directors. At least one signature must be provided by the company’s chairperson if given authority by the Board, or by two directors, one of which must be the managing director and Chief Executive Officer if they are directors of the company, the Chief Financial Officer, and the company secretary if appointed. If it is a One Person Company, then only one director must sign.

- The company must create its financial records and keep them at its registered headquarters. If the company decides to store them elsewhere, then they must file AOC-5 after a board resolution has been passed.

- When uploading the forms, it is important to make sure that the form is the most recent version given on the MCA. Check out the best company ROC filing in Ahmedabad.

Check out the best Company ROC Filing in Ahmedabad

Recent Posts

- GST Appeals Basics: Procedure, Time Limit, Rules, Fees, Form

- Know Your TAN: How To Get Tan Number & Download TAN Certificate

- Dormant Company – Section 455 of Companies Act , 2013

- Appointments, Roles, Responsibilities of Company Secretaries and their Removal

- Types of Directors in a Company

- Application For Strike Off Of A Company

- How to Calculate Company Valuation?

- Can You Change the Tax Regime When Filing Your Income Tax Return?

- How to Choose the Right ITR Form for FY 2023-24 (AY 2024-25)

- Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It

FAQS on Company ROC Filing

Submission of different documents and reports to the Registrar of Companies (ROC) is known as ROC filing. Every corporation registered in India is required to submit certain forms to the ROC, a division of the Ministry of Corporate Affairs, every year.

Yes, all companies registered in India under the Companies Act 2013 must submit a yearly filing to the Registrar of Companies to ensure they are following the laws and regulations.

As per Section 92(4) of the Companies Act 2013, all entities that are regulated by the Ministry of Corporate Affairs (MCA) must submit their yearly returns using Form MGT-7 and pay the applicable fees to the Registrar of Companies (RoC) within sixty days of the Annual General Meeting (AGM). If the company fails to do so, it will have to pay a penalty of Rs 100 per day without any exceptions.