Increase in authorized capital services

Call Us Today +91 80000 57972

KMG CO LLP provides comprehensive services to clients in India and abroad, ranging from incorporation to compliance and consultancy. Moreover, it is easy, affordable and speedy to increase share capital with them. KMG CO LLP firm additionally assists entrepreneurs with private and public limited company registration, LLP registration, HUF, One Person Company and other associated compliances.

Increase in authorized capital services

In regards to a company, the Authorized Capital is defined by the capital clause of the Memorandum of Association of the company. This authorized capital the total number of shares a company can issue to shareholders. Companies can raise capital up to the amount specified in the clause. If more capital is needed, the members must pass a special resolution at a general meeting to modify the capital clause. An increase of authorized capital may be necessary for issuing new shares and/or infusing more capital into the company.

Increase in Authorized Capital Process Flow

Check out the best Increase in authorized capital services

Recent Posts

- GST Appeals Basics: Procedure, Time Limit, Rules, Fees, Form

- Know Your TAN: How To Get Tan Number & Download TAN Certificate

- Dormant Company – Section 455 of Companies Act , 2013

- Appointments, Roles, Responsibilities of Company Secretaries and their Removal

- Types of Directors in a Company

- Application For Strike Off Of A Company

- How to Calculate Company Valuation?

- Can You Change the Tax Regime When Filing Your Income Tax Return?

- How to Choose the Right ITR Form for FY 2023-24 (AY 2024-25)

- Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It

FAQs on Increase in authorized capital services

By increasing the authorised capital of your company, it can access further credit from banks and other financial institutions. The Memorandum of Association and Articles of Association of the enterprise are essential for modifying the authorised capital.

The shareholders can grant authorization for the company to raise its authorized capital whenever it wants to. Furthermore, the paid-up capital increases the equity and overall value of the business.

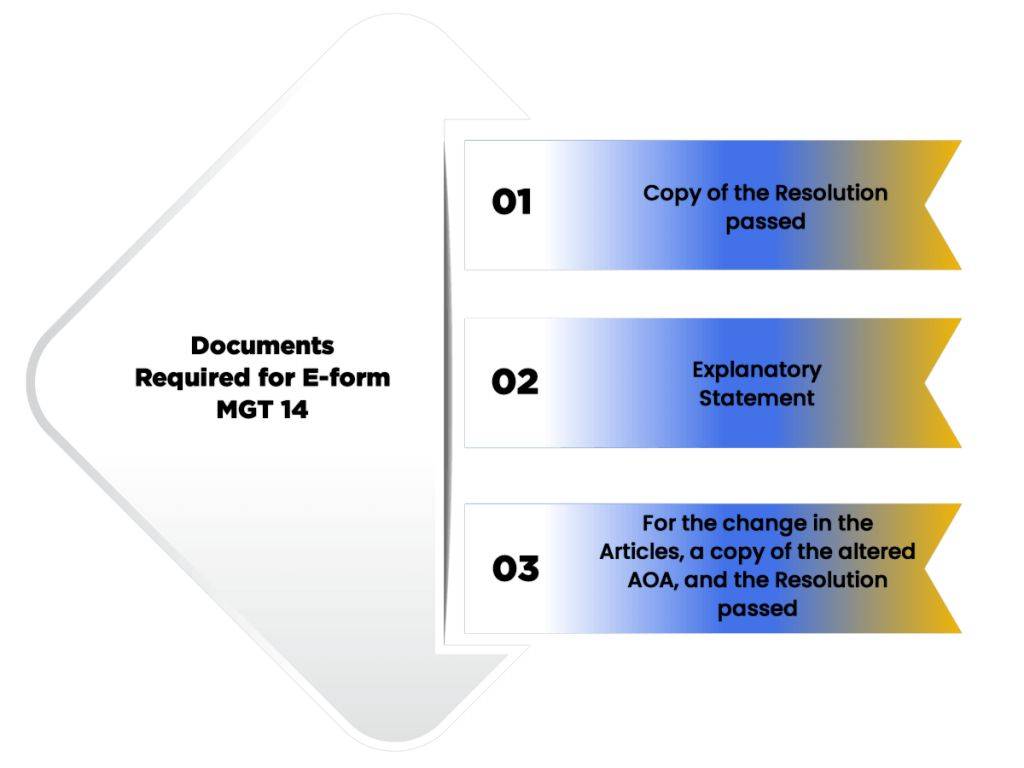

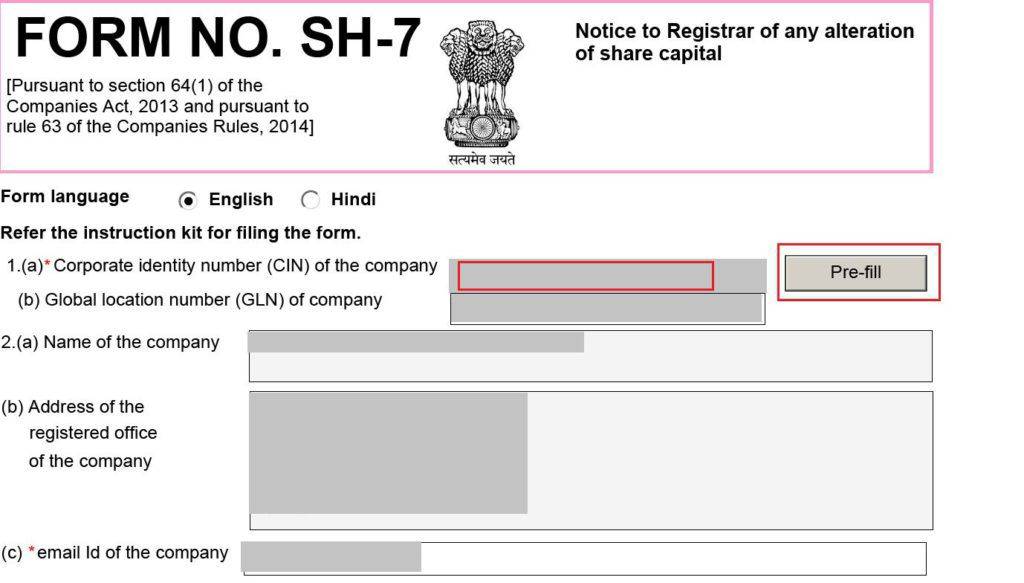

Form SH-7 must be submitted to the Registrar of Companies(RoC) within 30 days of the resolution being passed. The purpose of this form is to inform the Registrar concerning the particulars of the rise in authorised capital.

It is important to note that the total amount of shares that the company is allowed to issue can be much larger than the amount already issued and being traded on the secondary market. This gives the company the possibility to sell more shares in the future if needed.

Some companies will opt to raise their stock to substitute borrowing loans. This has the benefit of avoiding any interest charges. Though dividends may be paid to stockholders, this relies on the performance of the business and there is normally no requirement to pay dividends.

A rise in the overall capital shown in a business’s financial statement is usually an bad sign for shareholders as it implies the distribution of additional stock, which dilute the worth of current investors’ shares.