GST registration for foreigner

Call Us Today +91 80000 57972

Foreign Non-Resident Taxpayer – GST Registration Following the implementation of GST, the Government of India made it mandatory for all foreign non-resident taxpayers to register for GST when they supply goods or services to people in India. According to the GST Act, a "non-resident taxable person" is anyone who occasionally takes part in transactions associated with the provision of goods or services, whether as the primary person or as an agent or in any other capacity, but does not have a fixed place of business/residence in India.

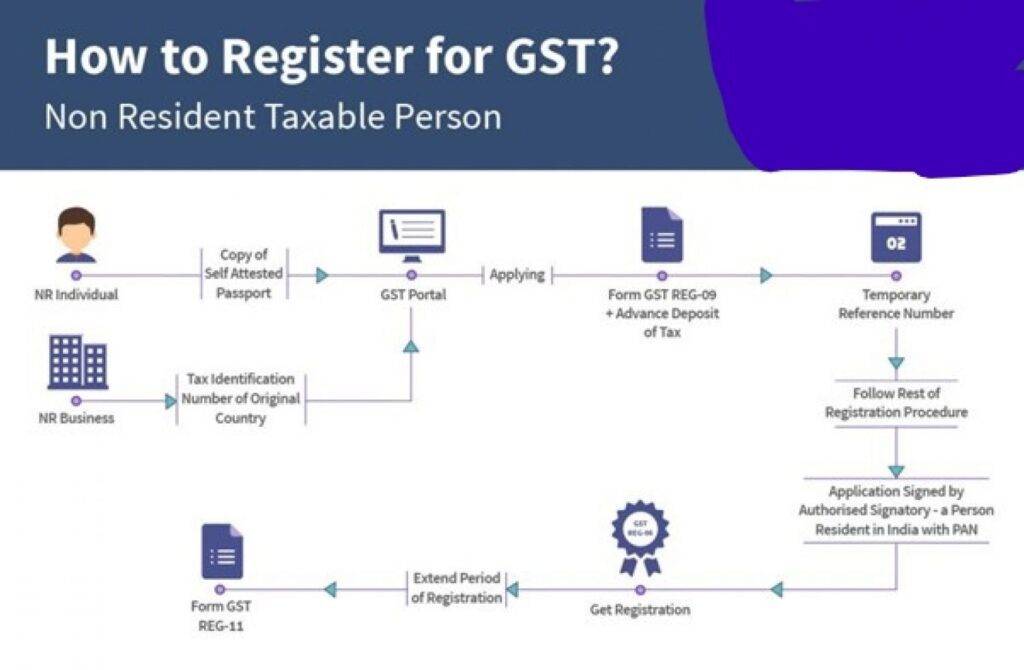

Foreign Non-Resident Taxpayer – GST Registration Procedure

All foreign Non-residents from other countries are obligated to get a GST registration at least 5 days before they begin their business operations or provide services to people living in India. To get a GST registration in India, the following steps can be taken by a foreign non-resident taxpayer.

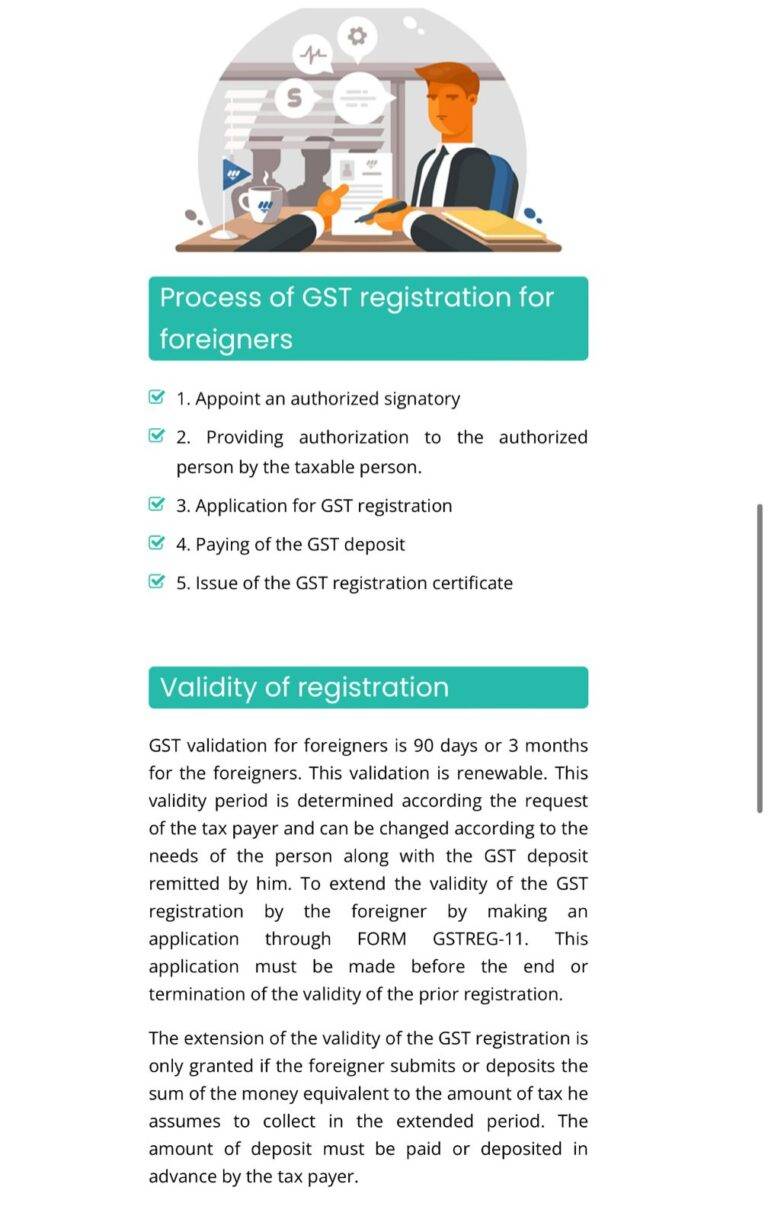

Step 1: Appoint an Authorized Signatory

Before beginning the GST registration process, foreign non-resident taxpayers must appoint an authorized signatory in India who is a person with a valid PAN in order to sign their application for GST registration as a non-resident taxable person. This appointed signatory will also be responsible for GST compliance.

Step 2: Provide Authorization to Authorised Signatory

The officers or promoters of the foreign company must draw up and sign a GST Declaration, confirming the appointment of a person with authority in India who is accepting the responsibility of ensuring the foreign company follows GST regulations.

Step 3: Apply for GST Registration For Foreigner

Once all necessary paperwork and procedures are finished, a non-resident taxable person must submit an application for GST registration. After submitting the application, the Portal will provide a temporary reference number which must be used to pay the GST deposit.

Step 4: Pay GST Deposit

Non-residents liable for taxation must deposit a sum to receive GST Registration For Foreigner. This amount will vary depending on the duration of the GST registration sought and the estimated GST liability the taxpayer is likely to incur during that time. As such, the deposit must be paid into an approved bank, based on the validity and the expected tax obligation. Once the deposit is paid, the taxpayer’s online cash account will be credited with the amount. This deposit can then be used to cover any GST payments.

Step 5: GST Registration Certificate Issued

Upon receipt of the GST deposit and the required documents, a GST registration certificate is issued. The validity period for the GST registration certificate for foreign non-resident taxpayers and casual taxable persons is fixed. If the foreign non-resident taxpayer needs to extend the registration, they must submit an application for an extension before it expires.

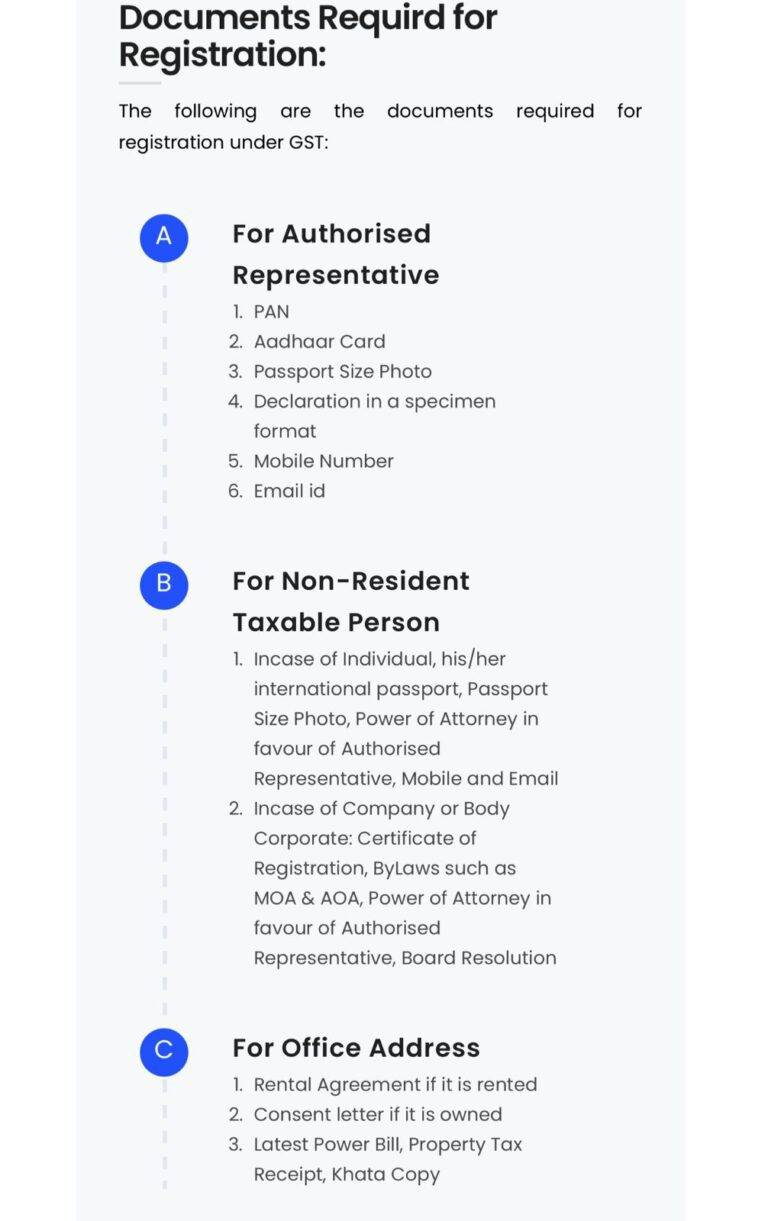

Documents Required for GST Registration For Foreigner

PAN or Tax Identification Number of the Applicant

All individuals who are taxpayers living in India should have a Permanent Account Number (PAN). However, foreign non-residents who are applying for GST registration, regardless of whether they are incorporated or established outside India, do not have to provide a PAN.

- Proof of Business Incorporation

In order to confirm the legitimacy of the business, the taxpayer must present proof of business registration or a certificate of incorporation from a relevant body of the foreign Government.

Identity & Address Proof of Promoters with Photographs

To sign up for GST, the person must submit valid identity and address documents of the business owners. For foreign nationals, they must attach a scanned copy of their passport with their VISA details as well as other papers.

For a signatory who is approved in India, they must provide their PAN card along with proof of address such as a passport, driver’s license, voter ID, and other necessary government documents.

Proof of Address

Proof of ownership of the premises, such as a recent Property Tax Receipt, a Municipal Khata copy or an Electricity Bill copy, is necessary.

For rented or leased premises, a valid rental/lease agreement must be provided, along with supporting documents that demonstrate the lessor’s ownership of the premises, such as the most recent property tax receipt, a copy of the municipal khata, or a copy of the electricity bill.

For all other cases, the applicant must provide a copy of the Consent Letter along with relevant evidence of the Consenter’s ownership of the premises, such as a Municipal Khata copy or an Electricity Bill copy.

Bank Account Statement

A scanned copy of the first page of a banking passbook, the pertinent page of a banking statement, or a scanned copy of a voided check with the name of the Proprietor or Business entity, Bank Account Number, MICR, IFSC, and Branch code must be uploaded.

Check out the best Share Transfer & Transmission Services

Recent Posts

- GST Appeals Basics: Procedure, Time Limit, Rules, Fees, Form

- Know Your TAN: How To Get Tan Number & Download TAN Certificate

- Dormant Company – Section 455 of Companies Act , 2013

- Appointments, Roles, Responsibilities of Company Secretaries and their Removal

- Types of Directors in a Company

- Application For Strike Off Of A Company

- How to Calculate Company Valuation?

- Can You Change the Tax Regime When Filing Your Income Tax Return?

- How to Choose the Right ITR Form for FY 2023-24 (AY 2024-25)

- Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It

FAQS on GST Registration For Foreigner

A person who does not have a permanent residence and is taxable can register for GST if they conduct business periodically.

Transmission is the process of transferring the ownership of shares from one person to another, without the involvement of the company’s registrar or transfer agent. In this process, the transferor is the one who transfers the shares and the transferee is the one who receives the shares.

Any organization or business required to obtain GST registration must submit an application within 30 days.

The primary authorized signatory for any action taken on the GST portal on behalf of a taxpayer is usually the business’ promoter or any person assigned by them.