CHANGE IN REGISTERED OFFICE ADDRESS OF BUSINESS

Call Us Today +91 80000 57972

We, at K M Gatecha & Co LLP, provide complete set of services required by any organization, company, or individual in respect to their financial and investment, taxation, registration, and government compliances. We believe in providing the most efficient and effective services to our clients through our expert team of knowledgeable employees.

One of those services includes “Change in Registered office address of Business”. Change in Registered address for a company is a complex and time-consuming process and if any error is committed at any stage of the process, it can lead to complications, penalties, and delays in the same.

In those services we also provide ROC filing services which are required by a company for the purpose of filing audited financial statement and annual returns under section 129 and 137 of the Companies Act,2013.

Under section 92 of Companies Act,2013, the annual returns musts be submitted to the ROC.

The above compliances must be completed within 30 and 60 days from the conclusion of Annual General Meeting (AGM).

ROC filing process is complex and can attract penalties if the filing is delayed and that is the reason, we at K M Gatecha & Co LLP take exceptional care that the filing is done properly and in prompt manner.

CHANGE IN REGISTERED OFFICE ADDRESS OF BUSINESS

CHANGE IN REGISTERED OFFICE ADDRESS OF BUSINESS

The services provided by K M Gatecha & Co LLP are:

- Guidance on the pre and post process of changing address,

- Collection of documents,

- Filling of forms,

- Filing the forms and registering the request with the respective Registrar of Companies,

- Following up with status of application.

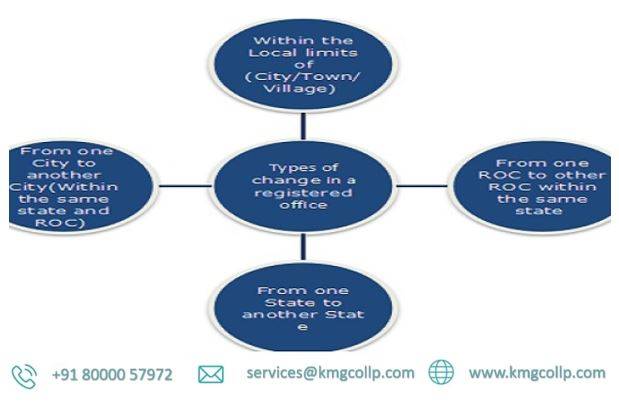

Different classifications under change in registered address:

- Within the same city,

- Outside the city but under the same ROC,

- Outside the city but under different ROC,

- To another state.

Compliances related to change of address

Before Change of Address:

- Common compliances/process of change of address for all classifications:

- A Board meeting is to be conducted by the company and a resolution is to be pass for calling the Extraordinary General Meeting (EGM),

- In EGM a Special Resolution is to be passed.

- Additional Compliances:

- For within same city:

- The company needs to file Form INC-22 with the ROC within 15 days of passing the Board Resolution.

- Outside city but same ROC:

- Form INC-22 and MGT-14 must be filed within 30days of passing of Special Resolution.

- Outside city and different ROC:

- Form INC-23 must be filed to the Regional Director for approval,

- Form MGT-14 is to be filed within 30 days of Special Resolution,

- Notice of change of address needs to be published, one month before filing of application, in a daily English newspaper and principal language newspaper,

- Individual notice is to be served to each depositor, debenture holder and creditor one month before filing,

- Confirmation Notice is to be acquired from Regional Director and the same must be filed with the ROC in Form INC-22 within 60 days from receipt of confirmation.

- Other State

- All requirements from above,

- Approval given by Central Government is to be filed in Form INC-28 with ROCs of both states (old and new registered office).

- For within same city:

Compliance after Change of Address

- Issuance of general notice in form of advertisement in newspaper to inform all members and stakeholder about the change of address,

- Printing of new MOA,

- Changing the office address outside all premises of business,

- Change of address in all printed stationary (letterheads, invoices etc.),

- Update address with all banks and financial institutions related to the company,

- Update of address in TAN and PAN,

- Update the address in all utility service providers to the company,

- Update the address with government authorities such as Customs, Central Excise, Service Tax and Sales Tax.

Basic documents Required (for change of office within same city):

- NOC from property owner, if office is on leased or rented land,

- Rent/lease agreement,

- Proof of address (any utility bills not older than 2 months.

Additional Documents:

- For outside city but under same ROC:

- Copy of the special resolution.

- For outside city but different ROC (to be filed with Form INC-23:

- Board resolution for changing the address,

- Declaration by any two directors or key managerial personnel authorized by the Board, stating that the company has not defaulted in paying its dues to its workers and has obtained creditors’ consent for shifting the office,

- Acknowledge copy of intimation made to the Chief Secretary of the state.

- For another state:

- Copy of MOA with proposed alterations,

- Copy of minutes of meeting of EGM,

- List of all debenture holder and creditors with statement of balance,

- Declaration signed by at least 2 directors and the Company secretary, stating that list of creditors given is complete,

- Declaration that no employee will be retrenched.

FAQS on CHANGE IN REGISTERED OFFICE ADDRESS OF BUSINESS

Only if a contrary provision in present in company’s article, passing a resolution is mandatory for change of address.

No, registered and corporate offices can have different address.

Yes, more than 1 company can have the same registered office address.

The purpose of a registered offices is to function as the official address and point of contact between Government agencies and the company.

Our Other Services

CA Firm in ahmedabad

Being the best ca firm in Ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Tax Consultant

We as the best tax consultant in Ahmedabad, india provide tax consultancy including direct and indirect tax consultancy.

Audit Firm in ahmedabad

We provide bank audits, stock audits, forensic audits, statutory audits, concurrent audits, tax audits, internal audits, information system audit services.

Accounting firm in ahmedabad

We provide bookkeeping, accounting, tally accounting, zero accounting, quick book accounting, Zoho accounting services.

GST Consultant

Our GST services include GST registration, GST payments, GST refunds services,e way bill consultant, GST return, GST classification, GST compliances, etc.

Chartered Accountant In Ahmedabad

We as the most-trusted chartered accountant in Ahmedabad provide all chartered accountant services under one roof.

Tax Accountant

We provide tax accounting services for effective tax planning and making tax provisions.

Income Tax Services In Ahmedabad

We provide income tax audits, income tax return filing, corporate income tax services, etc.