EPF return filing services in Ahmedabad

Call Us Today +91 80000 57972

In order to encourage the practice of saving among employees and to help them in their retirement, a social security program of Provident Fund was implemented. Both the employer and the employee are obliged to make a monthly contribution to the PF, and the employee can only access the money deposited in the PF during their time of employment, apart from a few exceptions. Employers with PF registration must submit their PF returns every month by the 25th. In this discussion, the different forms that are used for PF return filing will be examined in detail. Employers can easily submit their PF returns through the Unified portal.

Form 2

Form 2 must be submitted as a declaration and nomination under the Flagship scheme of the Employment Provident Fund and the Employment Family Pension Scheme. It is mandatory for employees joining the establishment to submit this form along with Form 5. Form 2 is divided into 2 different parts.

Part A

Part A of Form 2 is concerned with nominating who will receive the EPF account balance if the account holder passes away. This part of the form requires the following information to be provided:

- Name

- Address

- Relationship with the subscriber

- Age

- Sum of the money that is to be paid to the nominee

- Guardian Details ( In case the nominee is a minor)

This Part has to be signed or needs to have a thumb impression to be made at the end of the section.

Part B

The information about the nominee stated in Part A must also be included in Part B. Furthermore, the details of those who are qualified for the children/widow pension should be provided.

This part must be properly signed or a thumbprint must be placed at the end of this section.

Form 5

Form 5 is a report that is compiled on a monthly basis and provides information on all employees who have newly joined the company’s provident fund program. This report must include the following particulars:

- Organization’s Name

- Address of the Organization

- Code of the organization

- Account number of the Employee

- Name of the employee

- Middle Name (Husband/Father)

- Date of birth of the employee

- Date of joining

- Track record of the work.

The form is to be filed and stamped by the employer with the date of filing mentioned on it.

Form 10

This is a monthly report that contains information regarding the employees who have left the program in that particular month. Form 10 includes the following details.

- Account Number

- Name of the employee

- Name of the father or the husband

- Date of leaving the service

- Reason for leaving service.

Form 10 must be filed and stamped by the employer with the filing date of the form.

Form 12A

This Form 12 A is a report that provides information about the money that was deposited into an employee’s account during a certain month.

Annual PF Return Filing

The annual PF returns must be submitted by April 30th of each year and the forms used for filing must be completed.

- Form 3A

- Form 6A

Form 6A

Form 6A is an annual summary of contributions made by each member of the organization. It must include the following information:

- Account number

- Name of the members of the subscriber

- Wages, retaining allowance if there is any, and the D.A that includes the cash value of the food concession that is paid during the currency period.

- The amount of contribution that is deducted from the wages.

- Employer’s contribution (Both EPF and Pension)

- Refund of the advances

- Rate of the higher voluntary contribution (If there is any)

- Remarks

Besides this, the following details should also be included in the amount remitted column:

- The month of the contribution

- The remitted contribution that includes the refund of the advances

- EDLI Contribution

- Pension Fund Contribution

- Administrative charges

- Aggregate contributors.

FAQS on EPF return filing services

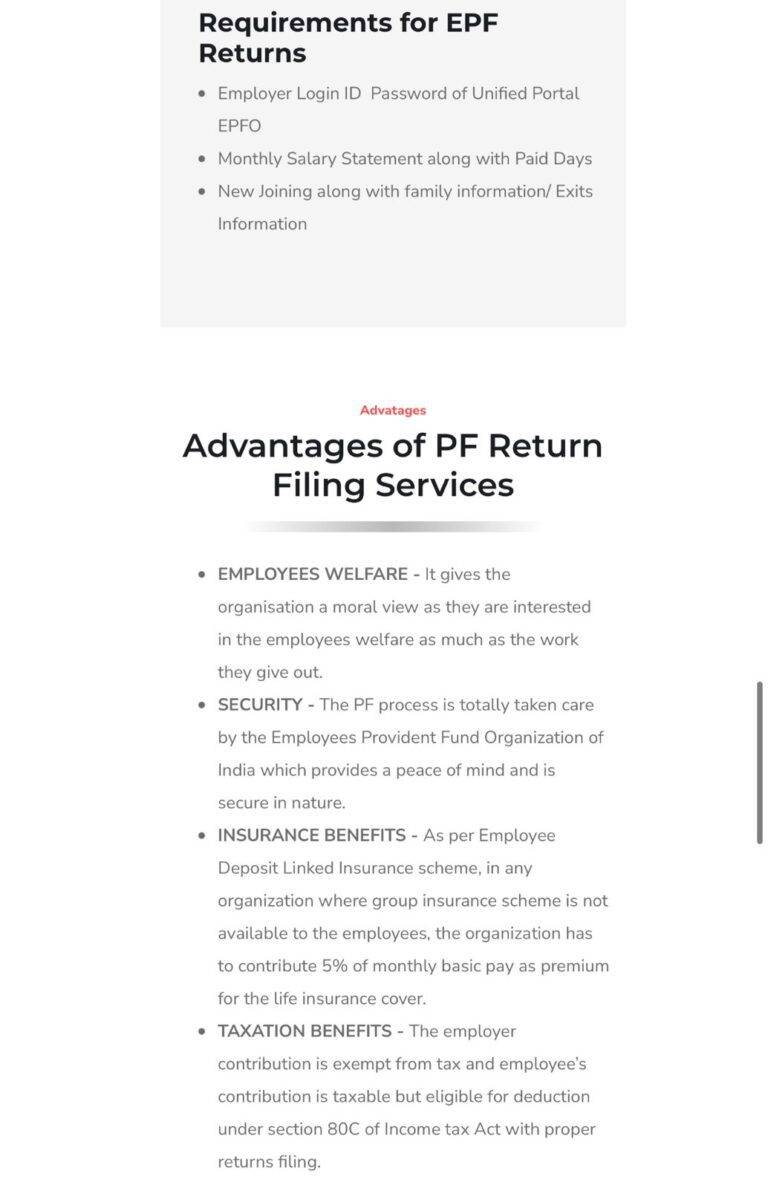

Both the employer and the employee must put aside 12% of the employee’s basic salary into the EPF account.

Transmission is the process of transferring the ownership of shares from one person to another, without the involvement of the company’s registrar or transfer agent. In this process, the transferor is the one who transfers the shares and the transferee is the one who receives the shares.

All employers who have acquired PF registration need to file PF returns every month. These returns should be submitted to the unified portal by the 15th of the month.

If the individual has more than one EPF member ID, and the EPF account of those IDs have not been moved to the most recent EPF account, then the person must get the PF transferred into the present EPF account.

The first group of people involved in the share transfer process are the shareholders. The shareholders are the individuals or entities that have ownership in the company. They are the ones who control the shares and decide who to transfer them to.

The second group of people involved in the share transfer process are the company’s directors. The directors are responsible for overseeing the transfer process and ensuring that all of the necessary steps are taken to complete the transfer.

The third group of people involved in the share transfer process are the brokers. The brokers are the people who facilitate the transfer from one party to another. They work with the shareholders and the company’s directors to make sure that the transfer is completed in a timely and efficient manner.

It is not possible to immediately withdraw the balance from your EPF account after leaving your job. If you choose to take out money from your PF account before 5 years have passed, you will be taxed on the amount.

The transfer of Provident Fund can only be done offline if the transfer is from one exempted establishment to another exempted establishment. For all other cases, it must be done online.