FORM INC 20A filing services

Call Us Today +91 80000 57972

We, at K M Gatecha & Co LLP, provide Form INC 20A filing services along with numerous other services such as accounting services, audit services, company registration services, GST filing, returns and refund services, Income Tax returns preparation and filing services to our clients in an efficient and hassle-free manner. We also believe in providing our clients with the complete knowledge about the service that they are looking to avail.

FORM INC 20A filing services

FORM INC 20A filing services

Form INC 20A filing services provided at K M Gatecha & Co LLP:

- Obtaining CIN number,

- DSC of director/s,

- Collection of documents,

- Filling e-form INC 20A,

- Submission of form INC 20A,

- Replying to any queries raised.

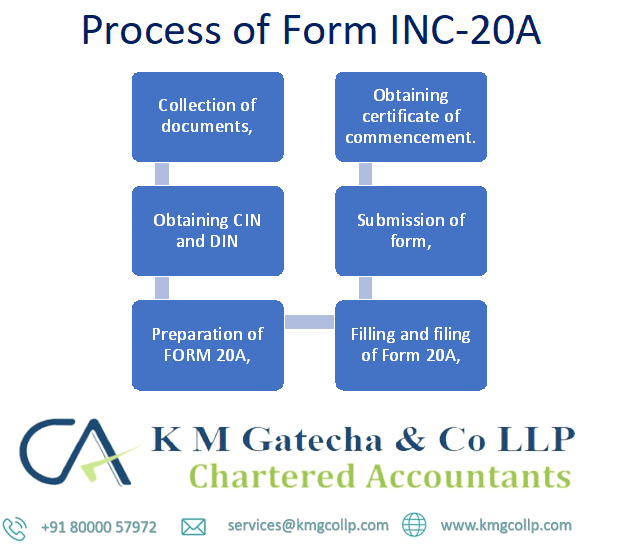

Process of FORM INC 20A:

- Collection of documents,

- Preparation of FORM 20A,

- Filling and filing of Form 20A,

- Submission of form,

- Obtaining certificate of commencement.

Eligibility criteria of Form INC 20A:

- Any company that has been incorporated after 2nd November 2018 has to file INC-20A as per due date prescribed by Ministry of corporate affairs,

- Company should have share capital.

Documents required for filing INC-20A:

- Bank statement of Company as proof of payment by shareholders for the value of shares as mentioned in the Memorandum of association,

- Digital signature of Director,

- Company Identity number (CIN),

- Director identity number (DIN) if the digital signature on e-form is of a director,

- PAN card if the signing person is a secretary,

- Certificate of practice number if the person is a company secretary in whole-time practice,

- Declaration of board resolution by the company director as per section 10A of Companies Act 2013,

- Certificate of commencement (to be obtained within 180 days of incorporation and filed with the registrar of companies).

Other requirements:

- Registration or approval for any objects which require registration or support from regulator such as Reserve bank of India or Securities and Exchange Board of India,

- The form has to be verified and certified by practicing Company Secretary, Chartered Accountant or Cost Accountant be being filed with the Registrar of Companies.

Benefits of filing Form INC 20A:

- Easier to borrow capital,

- Authentication of business,

- Avoidance of fines and penalties.

Penalties or fines for non-compliance for Form INC 20A:

- Companies that do not file form INC 20A for commencement of business will be penalised for INR 50,000/-,

- Every officer who is responsible for filing FORM INC 20A will be charged a penalty of INR 1000/- for every delayed day (maximum up to INR 1,00,000/-),

- ROC can remove the company from registry for non-compliance of filing Form INC 20A.

- Company will not be able to commence business without filing Form INC 20A.

FAQS on FORM INC 20A filing services

- INC-20A is a mandatory form which has to be filed by every company which has been incorporated on or after 2nd November,2018 with the Ministry of Corporate Affairs.

- It is only mandatory for companies which have a paid-up share capital by shareholders.

- The Form INC 20A is required by every company to commence business after incorporation.

- Without filing this form, the company cannot commence business.

No, a certified copy of the bank statement of the company is required as a proof of paid-up capital by shareholders which is to be tallied with the value of shares as mentioned in the Memorandum of association.

- Yes, a company can file Form INC 20A after the stipulated 180 days from date of incorporation by paying additional fees as prescribed by the Ministry of corporate affairs.

- Although the company will be liable to pay INR 50,000/- as penalty for delayed filing of Form INC 20A.

- According to rules set up by Ministry of Corporate affairs, a company cannot file any form without filing of Form INC 20A.

- The INC 20A status of a company can be checked on the MCA website through CIN number of the company.

Our Other Services

CA Firm in ahmedabad

Being the best ca firm in Ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Tax Consultant

We as the best tax consultant in Ahmedabad, india provide tax consultancy including direct and indirect tax consultancy.

Audit Firm in ahmedabad

We provide bank audits, stock audits, forensic audits, statutory audits, concurrent audits, tax audits, internal audits, information system audit services.

Accounting firm in ahmedabad

We provide bookkeeping, accounting, tally accounting, zero accounting, quick book accounting, Zoho accounting services.

GST Consultant

Our GST services include GST registration, GST payments, GST refunds services,e way bill consultant, GST return, GST classification, GST compliances, etc.

Chartered Accountant In Ahmedabad

We as the most-trusted chartered accountant in Ahmedabad provide all chartered accountant services under one roof.

Tax Accountant

We provide tax accounting services for effective tax planning and making tax provisions.

Income Tax Services In Ahmedabad

We provide income tax audits, income tax return filing, corporate income tax services, etc.