Tax advisory services on Property Sale

Call Us Today +91 80000 57972

At K. M. Gatecha & Co. LLP, we offer our clients the complete array of Tax advisory services on Property Sale for their convenience. At K. M. Gatecha & Co. LLP, we believe in providing the best and efficient services to our clients. But first we believe in educating our clients of all the details that required for the different services to be availed. Different laws and taxes are applied for an Indian citizen and U.S. citizen and there are many aspects that are involved in capital gains on property sale therefore it is particularly important to understand these aspects before including it in Income Tax Returns of the financial year in which the property is sold.

Tax advisory services on Property Sale

Tax advisory services on Property Sale

The value of real estate has risen multi-fold in the past few years due to demand from local as well as NRI buyers. Thus, when a property owner sells a property in today’s market, he/she incurs a high value of Capital Gain Tax on property sale. This is because the person may have bought the property some years ago for a low value. Even in case of investment property, the person will be looking to move out to gain the profits from sale.

At K. M. Gatecha & Co. LLP, the team of experts aim to make the complete process of sale of property, hassle-free, efficient and optimize the tax liability that arises out of these transactions.

Therefore, by availing our services our clients reap the highest profits or returns out of their investments or properties.

There are many aspects that must be considered while taxable capital gain is calculated in Indian residents.

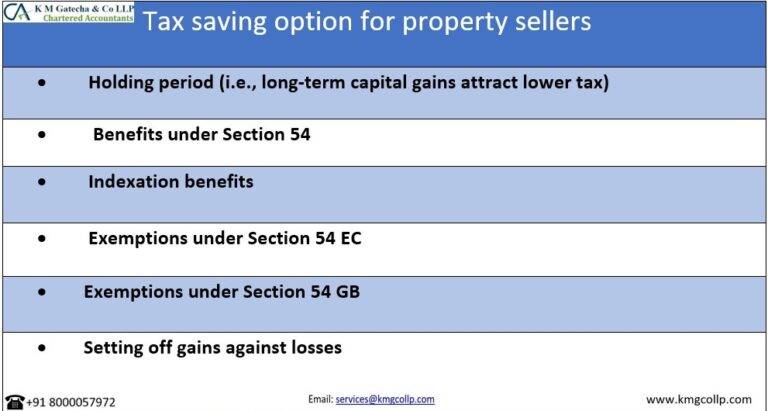

Some of the aspects are:

- Indexation of property:

- Indexation of property indicates how much the property should be worth if only inflation index is to be taken into consideration.

- Indexation is calculated as:

- Cost of purchase of property x CII (cost inflation index) of year of sale/ CII of year of purchase.

- So, by this method it is determined what is the capital gain on property that an individual or company has sold.

- So, if property was bought for INR 10,00,000 lakhs in F.Y. 2001-02 and sold in F.Y. 2020-21 then the index cost of house will be:

- 10, 00,000 x317/100 = 31, 70,000 INR.

- Indexation can only be taken into consideration in case of long-term capital gain (when property is held by owner for 3 years or more).

- Other expenses taken into consideration when calculating capital gain on property are as follows:

- Selling expenses:

- Stamp duty, property registration charges etc.

- Cost of acquisition:

- The original cost of property when bought or acquired.

- Indexation value of property.

- Selling expenses:

- So, calculation of profits would be on the following amount:

- Short term:

- Sale value of Property- selling expenses – cost of acquisition.

- Long term:

- Sale value of property- selling expenses – indexed cost of property acquisition.

- Other notable aspects of capital gain:

- You can avail of “roll over benefits” under section 54 of Income Tax Act if you buy another residential house 1 year prior or up to 3 years after the sale of a residential house. If the cost of new residential house is less than the capital gain from sale, then the difference amount will be taxed as per rate of tax.

- You can also avail of benefits of reinvestment by investing in certain notified bonds (up to 50 lakhs).

- If anyone is not able to reinvest the capital gain to avail exemption within the financial year, then amount of capital gain is to be deposited in a nationalized bank under the Capital Gains Accounts Scheme (CAGS) before the due date of filing of Income Tax return for the relevant year.

- The person who buys the property must deduct tax at source at 20% if the property is held by you for 3 years or more and at 30% if the period is less than 3 years.

- If the sale price shown is less than the Stamp Duty Value (the value which is determined by the Stamp Duty Authority of India) then the difference amount may be calculated in capital gains on the property.

- Short term:

Aspects to be kept in mind for an U.S. Citizen:

- Sale of property in India is taxable in the United States if you are a U.S. Citizen.

- The capital gains are calculated as selling price- cost of acquisition.

- There are no indexation benefits available to U.S. Citizens in United States.

- If the property was your main home for 2 years within the last 5 years, then $250000 can be deducted from the capital gains. If you and your spouse both used the property as your main home, then $500000 can be deducted from capital gains. There is no such provision if it is less than 2-year period.

- If the above condition is not satisfied, then the property is classified as second home and the capital gains will be taxed as follows:

- If held for more than 1 year, then classified as long-term capital gain and taxed at the rate of 15%.

- If the period is less than 1 year, then it is taxed at normal rates applicable.

- An U.S. person may avail of the reinvestment benefits provided in India, but he may still be taxed in the U.S.

FAQS on Tax advisory services on Property Sale

- There are 2 types of capital gains:

- Short term:

- Gains/profits that are made within a period of 3 years or less.

- Long term:

- Gains/profits made in a period of 3 years or more.

- Short term:

- CII is an abbreviation of Cost Inflation Index which matches the inflation rates of the financial year compared to base year (base year is kept as 100)

- The Central Government notifies or fixes the Cost Inflation Index for each financial year.

- The indexation cost of property is defined as the calculated cost of property taking into consideration purchase of cost of acquisition of property and CII of purchase and sale year.

- If the property sold is commercial and the new property is residential then the reinvestment deduction is applicable only if you do not sell the residential property within 3 years of its purchase.

- In any other scenario the reinvestment deduction is not applicable.

- 20% tax and 3% cess for long term capital gains.

- Normal tax rates for short term capital gains.

- You can offset gains in India by availing of reinvestment deductibles, but you may be taxed in the U.S.

EXCELLENTTrustindex verifies that the original source of the review is Google. Best services you can get for your financial activities. Services provided is excellent. You can be rest assured sitting at your home as they professionally take care of the activities. Had the best experience.Trustindex verifies that the original source of the review is Google. Very good and fast service. With constant follow-up.Trustindex verifies that the original source of the review is Google. Recommend a CA for income tax-related work with quick and efficient service.Trustindex verifies that the original source of the review is Google. Excellent service from KM Gatecha firm, they resolved my case very promptly and I will definitely recommend them for any taxation services.Trustindex verifies that the original source of the review is Google. It's good platform with quality service assurance and timely closure with the personalized guidance. Thanks for support and all the best!Trustindex verifies that the original source of the review is Google. It was a great experience working with Milap. Dedicated, Accurate and wants to get work done on your behalf. I contacted him 7 hours ago to file tax on my behalf and all work is done in matters of hours. If you are looking for someone in India as NRI to work on your taxes he is the person who will do wonderful job. Thank you 🙏Trustindex verifies that the original source of the review is Google. Best chartered accountant in ahmedabad for comprehensive services related to private limited company registration,GST filing and registration,tax filing and audit services. Highly recommend for best and professional services.👍

Our Other Services

CA Firm in ahmedabad

Being the best ca firm in Ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Tax Consultant

We as the best tax consultant in Ahmedabad, india provide tax consultancy including direct and indirect tax consultancy.

Audit Firm in ahmedabad

We provide bank audits, stock audits, forensic audits, statutory audits, concurrent audits, tax audits, internal audits, information system audit services.

Accounting firm in ahmedabad

We provide bookkeeping, accounting, tally accounting, zero accounting, quick book accounting, Zoho accounting services.

GST Consultant

Our GST services include GST registration, GST payments, GST refunds services,e way bill consultant, GST return, GST classification, GST compliances, etc.

Chartered Accountant In Ahmedabad

We as the most-trusted chartered accountant in Ahmedabad provide all chartered accountant services under one roof.

Tax Accountant

We provide tax accounting services for effective tax planning and making tax provisions.

Income Tax Services In Ahmedabad

We provide income tax audits, income tax return filing, corporate income tax services, etc.