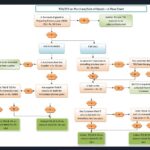

On payments made to non-residents,TDS on non resident payment must be deducted in accordance with Section 195 of the Indian Income Tax Act. To guarantee compliance with tax rules, the payer has to deduct TDS at the appropriate rates prior to making the payment.

- According to section 195 of the Income Tax Act of 1961, who is in charge of tax deductions?

Any person who owes money to a non-resident who is not a business or to a foreign corporation must deduct income tax at the current rates.

Form of Payment

Amounts chargeable under the terms of this Act include:

a) any interest (other than the interest mentioned in Sections 194LB, 194LC, and 194LD);

b) any other sum chargeable (other than income chargeable under the title “Salaries”);

- When Should TDS on non resident payment Be Deducted Under Section 195?

When the income is credited to the payee’s account or when the payment is made, whichever comes first. Credit to an “Interest payable account,” “Suspense account,” or any other name is considered a credit to the payee’s account for this purpose. In this context, “payment” may take the form of cash, a draft or check, or any other method. Tax deductions for interest paid by the government, a public sector bank, or a public financial institution can only be claimed when the interest is paid in cash, by check, draft, or any other method. [Finance Act 2020] The second provision of Section 195(1) that exempts dividends from TDS has been removed.

- Threshold limit for TDS on non resident payment

There is no limit on the threshold. Be that as it may, charge will be deducted on aggregate chargeable to burden. Therefore, no tax must be deducted if no amount is subject to tax in India.

- Other sums under Section 195-TDS on non resident payment

– Applicability: TDS to be deducted on any sum chargeable under the provisions of Income Tax Act, 1961 not being income chargeable under the head ‘Salaries’. (E.g. Payments such as interest, royalty, fees for technical services are liable for tax deduction u/s. 195 of the Act)

- Payer: Any person (both Resident and Non-resident)

- Payee: Non-residents / Foreign Company

- Threshold limit: NIL i.e. No Threshold limit.

- No TDS u/s. 195 on payment of Income chargeable under the head ‘Salaries’ or payments covered u/s. 194LB or 194LC or 194LD.

- TDS to be deducted at the time of payment or credit, whichever is earlier.

- In India, income that is assumed to accrue or rise

- According to Section 5(2)(b) of the Act, a non-resident’s total income also includes any income that the non-resident receives or is deemed to receive in India.

- To check whether the pay of the non-occupant is considered to build or emerge in India-We need to allude Area 9.

- The payer is obligated to withhold taxes in India if the income is deemed to accrue or arise in India.

Following shall be deemed to accrue or arise in India for TDS on non resident payment:

Section9(1)(ii)– Income which falls under the head “Salaries” ,if it is earned in India, i.e. when the services are rendered in India [Tax deductible u/s. 192]

Section9(1)(iii)– Salary payable by the Central Govt. to a citizen of India for services rendered outside India [Tax deductible u/s. 192]

Section9(1)(iv)– Dividend paid by an Indian company outside India

SECTION 9(1)(v) –INTEREST

A resident’s interest payments are considered to have accrued or arisen in India, unless the money is used for a business or profession outside of India or to make or earn money from outside India.

SECTION 9(1)(vi) –ROYALTY

Except when the royalty is paid for rights, property, information, or services used in a business or profession carried out outside of India or for the purpose of making or earning any income from any source outside of India, royalties paid by residents are considered to have accrued or arisen in India.

SECTION 9(1)(vii) –FEES FOR TECHNICAL SERVICES

Pay via charges for specialized administrations payable by an Occupant, with the exception of where the expenses are payable in regard of administrations used in a business or calling carried on by such individual external India or for the motivations behind making or procuring any pay from any source outside India.

SECTION 9(1)(viii) –SUM OF MONEY

Any money referred to in Section 2(24)(xviia) that is paid by a resident to a non-resident or foreign company on or after July 5, 2019, shall be deemed to accrue or arise in India.

Any amount of money that is covered by Section 2(24)(xviia) is included in Income. Act section 56(2)(x).

Nonetheless, Endowment of any amount of cash from relative will not be responsible for keeping charge commitment u/s. 195.

SECTION 9(1)(i) – Income other than Interest / Royalty FTS / Salaries / Dividend

All income accruing or arising, whether directly or indirectly, through or from

Business connection in India

Property in India

Asset or source of income in India

Transfer of a Capital asset situated in India

EXPLANATION TO SECTION 9

To clear up any ambiguity, it is stated that for the purposes of this section, a non-resident’s income is included in the non-resident’s total income regardless of whether the non-resident’s income arose in India under clauses (v) [Interest], (vi) [Royalty], or (vii) [Fees for technical services] of subsection (1).

The non-resident has a place of residence, a place of business, or a connection to a business in India; or then again

The non-occupant has delivered administrations in India.

Keeping charge commitment u/s. 195

if the payment is made to a foreign company or non-resident The provisions of Section 195 of the Act will apply to all transactions subject to taxation under Section 9 of the Act.

According to Segment 195 (1)- Duty is expected to be deducted at the hour of installment or credit, whichever is prior at the rates in force.

In addition, TDS u/s. On an accrual basis, 195 must also be withheld when making provision because the payee has been identified and the amount can be determined.

RATES IN FORCE –Section 2(37A)(iii)

Rate or Rates in force means-The rates of income tax specified in the

Finance Act of the relevant previous year, or

DTAA (Double Taxation Avoidance Agreement) Section 90(2)-The provisions of the Act or the DTAA, whichever is more beneficial to the assessee shall be applied.

Surcharge and Education Cess – Not required to be added separately if the rates mentioned in DTAA are applied.

RATES IN FORCE –Finance Act, 2020

Some Important rates mentioned in the Finance Act, 2020 for the purpose of withholding tax u/s.195 are as under:

Dividend–20%

Royalty–10%

Fees for technical services–10%

Interest (other than 194LB / 194LC / 194LD) –20%

The above rates shall be increased by education cess @4% and applicable surcharge to corporate / non-corporate assessee. Rates mentioned in DTAA should be applied if they are more beneficial.

PERMANENT ESTABLISHMENT

Tax must be deducted by anyone who is responsible for paying technical services royalty or fees to a non-resident or foreign company with a Permanent Establishment (PE) in India. 195 of the Demonstration at the pace of expense at appropriate rates.

Therefore, for payments to Indian PEs of foreign companies:

If the sum is greater than Rs. 1 crore: 40% + 4% Cess + 2% Extra charge (42.432%)

Assuming sum surpasses Rs.10 Crores: 40%, 4% levy, and 5% surcharge

LOWER / NIL DEDUCTION CERTIFICATE–Application By Payer u/s. 195(2)

The Payer must make the application.

When? When the payer believes that the recipient would not be subject to income tax on the entirety of the payment, the Assessing Officer will determine the appropriate portion of the payment from which tax must be deducted. 195 of the Demonstration.

Additionally, a U.S. Nil Deduction Certificate can be obtained. 195(2) through the payer.

NIL DEDUCTION CERTIFICATE—Application by Payee in accordance with 195(3)

The beneficiary of pay (Payee) can apply to the Evaluating Official for getting installment without derivation of duty at source.

For instance, in the event of the transfer of a capital asset, if the payee wishes to claim exemption pursuant to 54 or 54F, he may request payment without source deduction from the Assessing Officer.

NIL / LOWER DEDUCTION CERTIFICATE u/s. 197 -FORM 13

The recipient of income can apply to the Assessing Officer for Lower Deduction Certificate u/s. 197 of the Act.

Application to be made in prescribed Form No.13

Lower Rate to be determined keeping in view the estimated total income, total income of previous 3 years, taxes paid for the current year.

Tax to be deducted by the payer at the rate mentioned in Lower Deduction Certificate issued by the AO .

FAQs of TDS on non resident payment section 195

Without PAN, what is the rate for Section 195 TDS? If the payees’ Permanent Account Number (PAN) is unavailable, the tax deduction for all financial transactions subject to TDS will be increased by 20%. This is additionally appropriate to all non-occupants in regard of installments/settlements responsible to TDS

Section 195 of the Income Tax Act of 1961 addresses the deduction of TDS from payments to non-resident aliens. 1.4. Limit of Threshold: Under Section 195, there is no threshold for the TDS deduction from payments to non-resident aliens. The payer is required to deduct TDS pursuant to Section 195 if the income of NRIs is subject to Indian taxes.

NRIs should pay TDS under Section 195 in the range of 10% to 30%

A TDS certificate, also known as a Certificate of Tax Deduction or Form 16A, can be issued to the NRI seller after the buyer has completed the Section 195 process of TDS deposition. The buyer must then submit the Form 27Q i.e TDS returns preparation to file the TDS return electronically.

Owner of this information can be reached at K M GATECHA & CO LLP.

Important note: This does not lead to legal advice or legal opinion and is personal view and for information purpose only. It is prepared on the basis of facts available and applicable law.It is suggested to go through applicable provisions of law,latest regulations,judicial announcements, circulars, notifications and clarifications etc before taking any action based on above content.You agree here by that for any action taken on basis of above information in any manner writer or K M GATECHA & CO LLP is not responsible or liable for any omission,reliability,accuracy,completeness,errors or authenticity.This work by professional is just for knowledge purpose and does not constitute any kind of solicitation of work or advertisement.

-

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments -

Steps to register private limited company15/08/2024/

Steps to register private limited company15/08/2024/ -

Cancellation of registration under GST26/05/2024/

Cancellation of registration under GST26/05/2024/ -

-

Introduction to Transfer Pricing in India13/04/2024/

Introduction to Transfer Pricing in India13/04/2024/ -

-

-

Tax Liability of a NRI24/12/2023/

Tax Liability of a NRI24/12/2023/ -

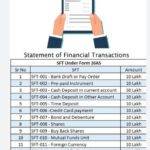

Everything about SFT18/12/2023/

Everything about SFT18/12/2023/ -

Documents to be maintained by NGo or trust17/12/2023/

Documents to be maintained by NGo or trust17/12/2023/ -

-

-

-

-

Taxation of Charitable/Religious Trust04/09/2023/

Taxation of Charitable/Religious Trust04/09/2023/ -

-

Application for Filing Clarification – GST09/06/2023/

Application for Filing Clarification – GST09/06/2023/ -

How to check GST application status 202309/06/2023/

How to check GST application status 202309/06/2023/ -

-

Gift tax under section 56(2)x03/06/2023/

Gift tax under section 56(2)x03/06/2023/ -

-

-

-

-

-

All about Appeal under GST20/05/2023/

All about Appeal under GST20/05/2023/ -

Old vs New income tax regime18/05/2023/

Old vs New income tax regime18/05/2023/ -

All about GSTR 10, GST Amnesty16/05/2023/

All about GSTR 10, GST Amnesty16/05/2023/ -

-

-

TDS on purchase of goods u/s 194Q17/01/2022/

TDS on purchase of goods u/s 194Q17/01/2022/ -

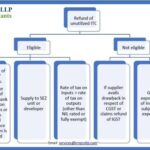

Situations of GST refund and process10/01/2022/

Situations of GST refund and process10/01/2022/ -

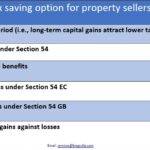

Tax on property sale in India05/01/2022/

Tax on property sale in India05/01/2022/ -

House Rent Deduction in Income Tax01/01/2022/

House Rent Deduction in Income Tax01/01/2022/ -

-

-

Table of Contents

Toggle