TAX ON SALE OF PROPERTY RECEIVED AS GIFT

The taxability of gifts is a popular and frequently asked subject among taxpayers. In this article, you'll learn about the numerous rules relating to the ‘TAX ON SALE OF PROPERTY…

The taxability of gifts is a popular and frequently asked subject among taxpayers. In this article, you'll learn about the numerous rules relating to the ‘TAX ON SALE OF PROPERTY…

GST on Rental income : - In this article we will discuss about GST on rental income from commercial property. Any person/ individuals receiving income from the residential property like shop/factory…

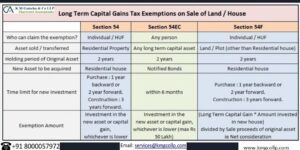

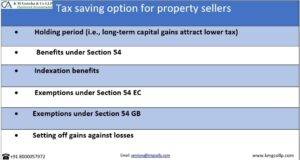

How to claim exemptions from Long Term Capital Gains Long Term Capital Gains are defined as profits on sale of assets (movable or immovable) which have been held for: 3…

Tax on property sale in India attract various taxes such as Gains, Cess and TDS which is to be calculated and paid while selling the property. These taxes are to…