The Food Safety and Standards Act, 2006 was implemented by the Government of India in order to regulate and prevent the food industry. The Food Safety and Standard Act of 2006 is a set of laws that govern the sale, manufacture, storage, distribution, and import of food products within the country.

According to Food Safety and Standard Authority of India (FSSAI) regulations, obtaining a food license is one of the most important steps in commencing a food business. You can begin your business freely and legally once you have obtained the food/FSSAI license. But that isn’t all. According to the FSS (Licensing and Registration) Regulations, 2011, it is also necessary to follow FSSAI requirements and file annual returns. In this article, we will discuss ‘All about FSSAI annual return’.

All food business operators (FBOs) with a food license and an annual turnover of Rs. 12 lakhs are required to file the annual return on time. If a person does not file his/her tax returns within the deadline, he or she may face severe penalties.

What are the advantages of annual FSSAI compliance?

Reputation-

Annual compliance by an entity that is registered in accordance with the FSSAI requirements would improve the company’s or entity’s overall reputation. The public will trust an entity that meets the requirements for annual compliance.

Increase Brand Value –

A company with an FSSAI license is more reputable in the eyes of customers. Aside from that, the entity’s value would be higher.

Get More Government Support –

Another advantage of this type of annual compliance is increased government support for entities that meet the requirements.

Types of FSSAI Annual Returns

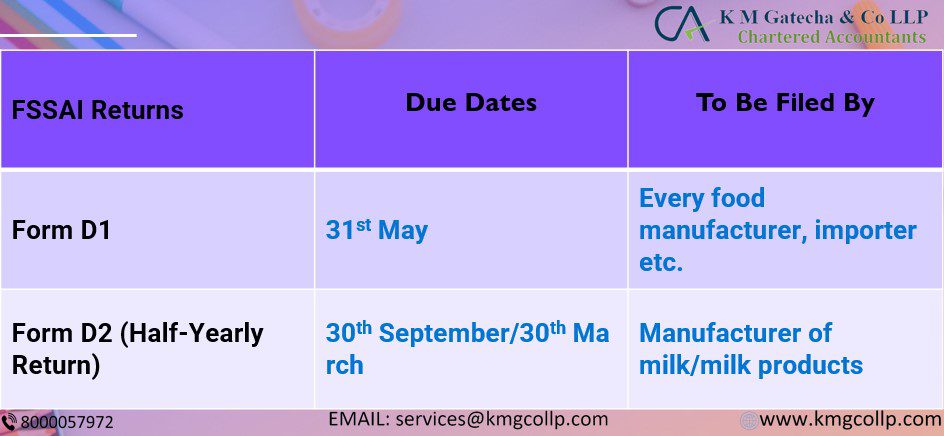

There are two types of FSSAI returns:

Form D1 of the FSSAI

Form D1 must be filed with the FSSAI licensing authority by all food importers, manufacturers, packers, labelers, re-labelers, and re-packers. The form D1 can be submitted online or in person, as directed by the food safety commissioner. Regardless of the type of production or food products sold in the previous financial year, all FBOs are required to file form D1.

Form D2 of the FSSAI

Form D2 is a semi-annual return that is not required of every food business operator. Instead, every FSSAI license holder involved in the manufacturing or importing of milk and/or milk products must file this.

Form D2, the FSSAI annual return, must be filed every six months. This return must be filed between the 1st of April and the 30th of September, and between the 1st of October and the 31st of March of each fiscal year.

Who Is Required to File the FSSAI Annual Return?

- Every FBO with a business turnover of at least Rs. 12 lakhs.

- Every business that sells, imports, exports, manufactures, distributes, stores, handles, or transports food must file an FSSAI annual return.

- Half-yearly returns must be filed by the business operator involved in the distribution and manufacturing of milk.

FSSAI Annual Returns are not required to be filed by some entities.

The following entities are excluded from filing an annual return with the FSSAI:

- Restaurants

- fast-food restaurants/joints

- Canteens

- Grocery Stores or supermarkets

Due Date for Filing FSSAI Annual Returns:

The FSSAI form D1 must be filed by FBOs on or before May 31 of each financial year.

The FSSAI form D2 is issued every six months. It must be filed by FBOs engaged in the manufacture of milk and milk products for the fiscal years 1 April to 30 September and 1 October to 31 March.

FSSAI Annual Returns Filing Procedure

The FSSAI returns, i.e., forms D1 and D2, can be filed online or offline by FBOs. FBOs can log into the FoSCoS portal, fill out the right form, and submit the FSSAI returns online. From the financial year 2020-21 onwards, annual returns will be submitted electronically.

The following is the offline procedure for filing annual returns:

- Take a printout of the form D1/form D2 specified in the Food Safety and Standards (Licensing and Registration of Food Businesses) Regulations, 2011 (‘Regulations’).

- Fill out the form to the best of your ability.

- After filling out the form’s information, FBOs can send it to the relevant food licensing body in their jurisdiction via registered mail or email.

The facts disclosed and mentioned in the FSSAI license should be supported by the information provided in the FSSAI returns. If there are any discrepancies in the details, the FBOs should amend the FSSAI license accordingly.

Penalty for Late filing of FSSAI Annual Return

According to Section 2.1.13 (3) of FSS (Licensing and Registration) Regulations, if FBOs do not file the FSSAI returns by the due date, they would be fined Rs.100 for each day the default continues, beginning on the following day of the due date.

How does K M Gatecha & CO LLP help its clients fill out their FSSAI annual returns?

Filling FSSAI annual returns is a time-consuming and complicated process where every eatery, grocery shop, food distributor, and restaurant must file for FSSAI annual return. All these FBOs files FSSAI Form D1 who indulge in manufacturing, whereas the FBOs dealing with the distribution of milk and milk products file FSSAI Form D2.

We at K M Gatecha & CO LLP have trained experts to help you throughout the process of Food license and annual return compliances. Our Experts will guide and assist you in the FSSAI Annual return process and also ensures that you file your return on time without facing any difficulty. For any queries related to FSSAI Annual return and related services, feel free to contact our experienced and trained professionals at K M Gatecha & CO LLP.

Frequently Asked Question:

The FSSAI annual return, Form D1 should be deposited on or before 31st May of each financial year to the Licensing Authority depending on the kinds of food products sold by the FBO in the prior financial year.

It is equally important to comply with the FSSAI compliances and the filing of annual returns. To file for the annual return is mandatory for all the food business operators who have acquired the food license and have an annual turnover of Rs 12lakh. The annual return should be filed within the prescribed time.

Form D1 must be filed with the FSSAI licensing authority by all food importers, manufacturers, packers, labelers, re-labelers, and re-packers. The form D1 can be submitted online or in person, as directed by the food safety commissioner. Regardless of the type of production or food products sold in the previous financial year, all FBOs are required to file form D1.

Disclaimer: The main goal of this article is to “assist investors in making informed financial decisions.” The above information is provided only for educational purposes. Readers are advised to exercise caution and seek professional counsel before relying on the above information. K M Gatecha & CO LLP is not liable for any loss or harm incurred by readers who take action based on the information provided in this article. “Please keep in mind that the opinions expressed in this Blog/Comments Section/Forum are clarifications intended for the readers’ reference and guidance as they investigate further on the topics/questions raised and make informed decisions. These are not intended to be investment advice or legal advice.”

Table of Contents

Toggle