It is true that owning a property in a construction project has more benefits than purchasing a ready-to-move-in property. In this article, you will learn about the numerous rules relating to the ‘Capital gain tax on sale of under-construction property in India’. To begin with, because there is no immediate possession, the price of a property under construction is lower. The seller of a ready-to-move-in property charges a premium for immediate possession. Buyers have more time to save for a down payment on an under-construction property, and the price is also linked to special offers and reductions.

The Income Tax Act exempts long-term capital gains obtained from the sale of a capital asset if the sale proceeds are invested in a house property within the time limits set out in section 54F, which are two years from the date of transfer or one year before the date of transfer.

Section 54 And 54F

The major purpose of Sections 54 and 54F exemptions is to encourage individuals to build or acquire homes. One of the sub-clauses in each of these sections is that if the residence purchased with capital gains is to be built or is in the process of being built, the building must be completed within three years of the purchase. This applies to both a house you are building on a plot and a flat you’re buying that’s still being built when you buy it.

Due to this condition, many people have lost their capital gains exemption after three years and have had to pay the LTCG tax to the IRS because the house had not been built even after three years.

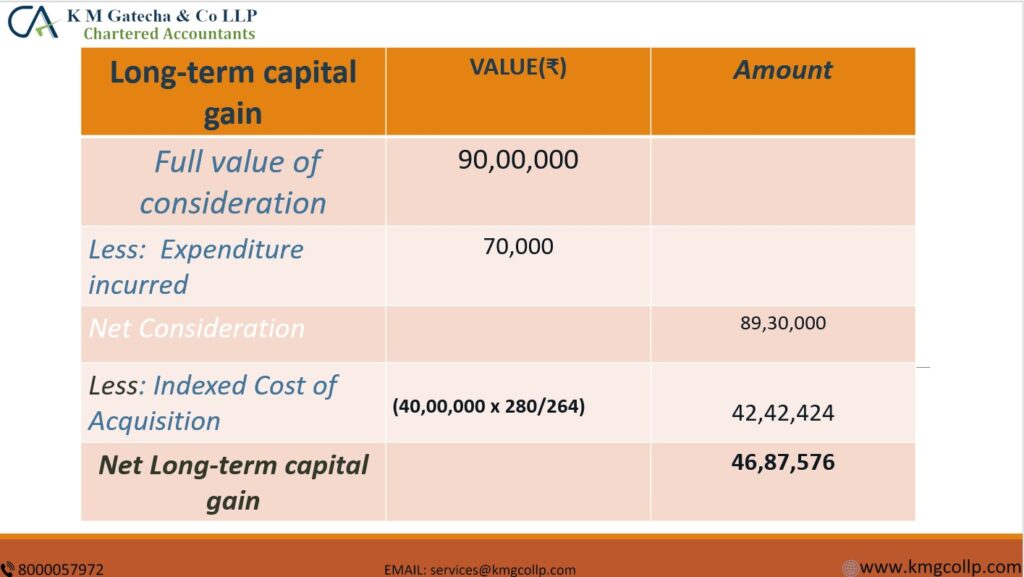

Calculation Of Capital Gains on Sale of Under-Construction Property

Mr. Deepak acquired an under-construction property for Rs. 40 lakhs on the 18th of June 2016. He received possession of the property from the builder on the 2nd of September 2017. Mr. Deepak then sold it on the 15th of February 2019 for Rs.90 lakhs. He incurred expenses of Rs. 70,000 on the transfer of property.

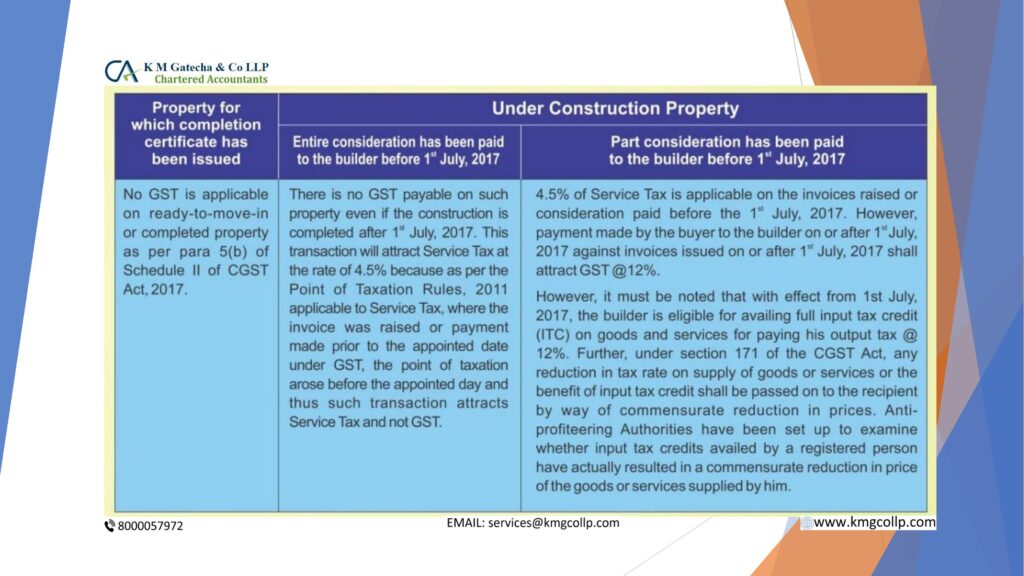

Clarification on whether GST applies to under construction and ready-to-move-in properties

According to GST Law, the construction of a complex, building, civil structure, or a part thereof, including a complex or building intended for sale to a buyer, wholly or partially, is a supply of service and subject to GST, unless the entire consideration is received after the competent authority issues the completion certificate, or after its first occupation, whichever comes first.

- Sale of the building is an activity or consideration which is neither a supply of goods nor a supply of services (Para 5 of schedule Ill of the CGST Act, 2017).

- As a result of the foregoing circumstances, the sale of ready-to-move-in or completed property is exempt from GST. GST is payable only on the under-construction property as talked about underneath.

Rate of GST on Sale of Under-Construction Property

The effective rate of GST payable on the purchase of an under-construction residence or commercial property from a builder involving the transfer of property in land or undivided share of land to the buyer is 12% with full Input Tax Credit (ITC). [GST of 18 percent is charged on 2/3rds of the property price; 1/3rd of the price is assumed to be the value of land, or an undivided share of land delivered to the buyer.]

Frequently Asked Questions

Section 54 applies to long-term capital gains on the sale of a primary residence, whereas Section 54F applies to long-term capital gains on the sale of any asset other than a primary residence.

The Income Tax Appellate Tribunal (ITAT) in Delhi recently granted a multiple-year exemption u/s 54F for an under-construction house. It has been ruled that taxpayers can invest capital gains for the second or third time in the same new home.

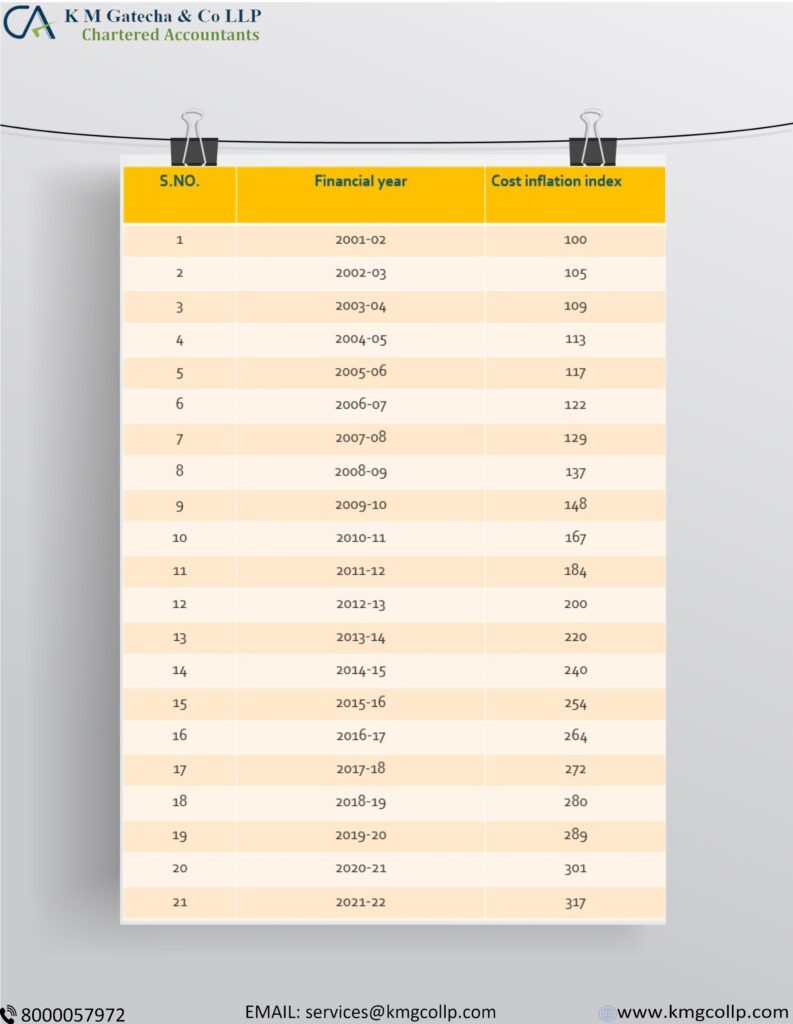

Index for the year of sale/Index for the year of acquisition) x cost is the formula for calculating indexed cost. For example, if a property was bought in 1991-92 for Rs 20 lakh and sold in 2009-10 for Rs 80 lakh, the indexed cost would be (582/199) x 20 = Rs 58.49 lakh.

Disclaimer: The main goal of this article is to “assist investors in making informed financial decisions.” The above information is provided only for educational purposes. Readers are advised to exercise caution and seek professional counsel before relying on the above information. K M Gatecha & CO LLP is not liable for any loss or harm incurred by readers who take action based on the information provided in this article. “Please keep in mind that the opinions expressed in this Blog/Comments Section/Forum are clarifications intended for the readers’ reference and guidance as they investigate further on the topics/questions raised and make informed decisions. These are not intended to be investment advice or legal advice.”

Table of Contents

Toggle