Every year, the finance minister announces income tax slabs in India. There are currently two different Income Tax regimes. Tax breaks are no longer available under the new regime. Tax breaks were available to taxpayers under the previous regime. In this article, we will discuss all about “New and old Income Tax Slabs FY 2021-22 (AY 2022-23) “.

Nirmala Sitharaman, the finance minister, announced the Union Budget for 2022 on February 1, 2022. The successive waves of Covid-19 have resulted in no change in income-tax rates for Assessment Year 2023-24. The current income tax slabs and rates are not being changed in the latest budget.

What exactly is an Income Tax Slab?

Individual taxpayers in India pay income tax based on a slab system. A slab system means that different tax rates are prescribed for different income ranges. It means that tax rates continue to rise as the taxpayer’s income rises. This type of taxation allows the country to have progressive and equitable tax systems. These income tax slabs are subject to change with each budget. These slab rates differ for different types of taxpayers. Income tax has three categories of “individual” taxpayers, including:

- Individuals (under the age of 60), both residents and non-residents

- Senior citizens who live locally (60 to 80 years of age)

- Residents who are super senior citizens (aged more than 80 years)

Income Tax Slab Rates for Fiscal Years 2021-22 (AY 2022-23)

- Income tax slab rate for Financial Year 2021-22 (Assessment year Years 2022-23), New Tax Regime – Why is it an option?

In this new regime, taxpayers have the OPTION of either:

- To pay income tax at lower rates under the New Tax regime in exchange for foregoing certain permissible exemptions and deductions available under income tax, or to continue paying taxes at the current tax rates.

- By remaining in the old regime and paying tax at the existing higher rate, the assessee can obtain rebates and exemptions.

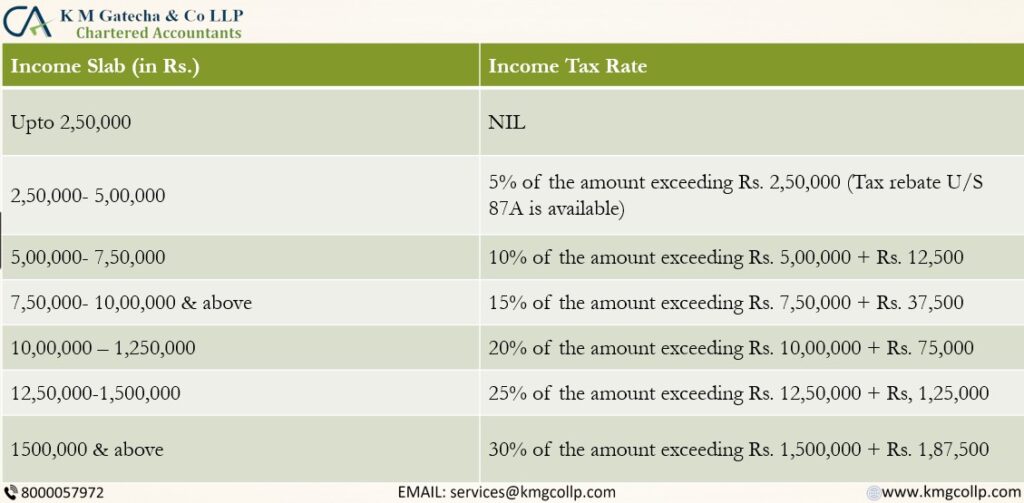

Income tax slab rate FY 2021-22 (AY 2022-23) – For the New Tax Regime

Note:

- The tax rates in the new tax regime are the same for all categories of individuals, namely individuals and HUF up to the age of 60, senior citizens between the ages of 60 and 80, and super senior citizens over the age of 80. As a result, the new tax regime will provide no benefit of increased basic exemption limit benefit to senior and super senior citizens.

- Individuals with a net taxable income of less than or equal to Rs. 5 lakhs will be eligible for tax relief under Section 87A of the Income Tax Act. In both the new and old tax regimes, such individuals will have no tax liability.

- The basic exemption limit for NRIs is Rs. 2.5 lakh, regardless of age.

- In all cases, a 4% health and education cess will be added to the income tax liability.

- In all categories, a surcharge is applied based on the tax rates mentioned above.

- If your total income exceeds Rs. 50,00,000, you will be subject to a 10% income tax.

- If your total income exceeds Rs. 1,00,00,000, you will be subject to a 15% income tax.

- If your total income exceeds Rs. 2,00,00,000, you will be subject to a 25% income tax.

- Where the total income exceeds Rs. 5,00,00,000, income tax is levied at a rate of 37%.

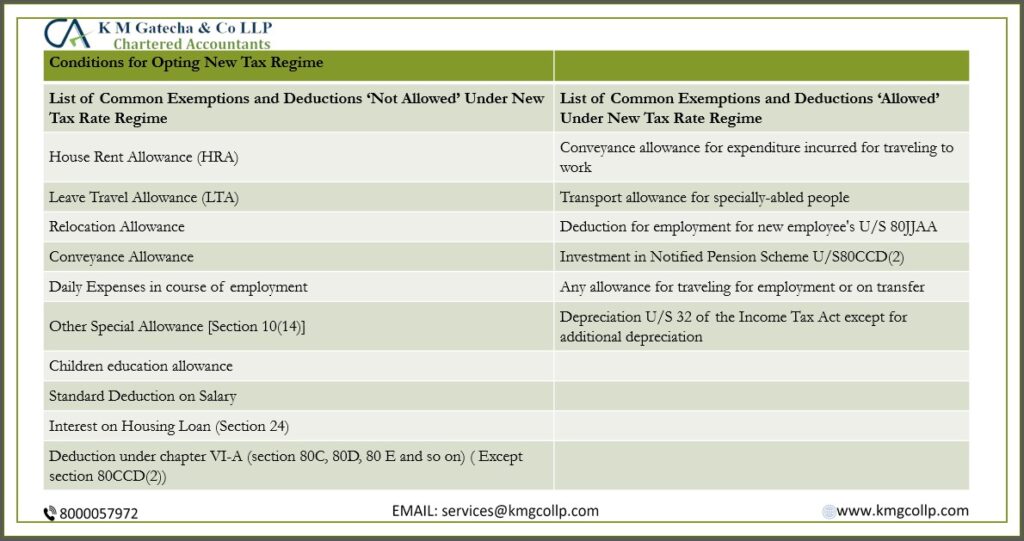

Conditions for Choosing a New Tax System

Taxpayers who choose lower rates under the new tax regime will lose certain deductions and exemptions available under the old tax regime. There are a total of 70 prohibited exemptions and deductions. Let’s take a look at the most commonly used exemptions and deductions-

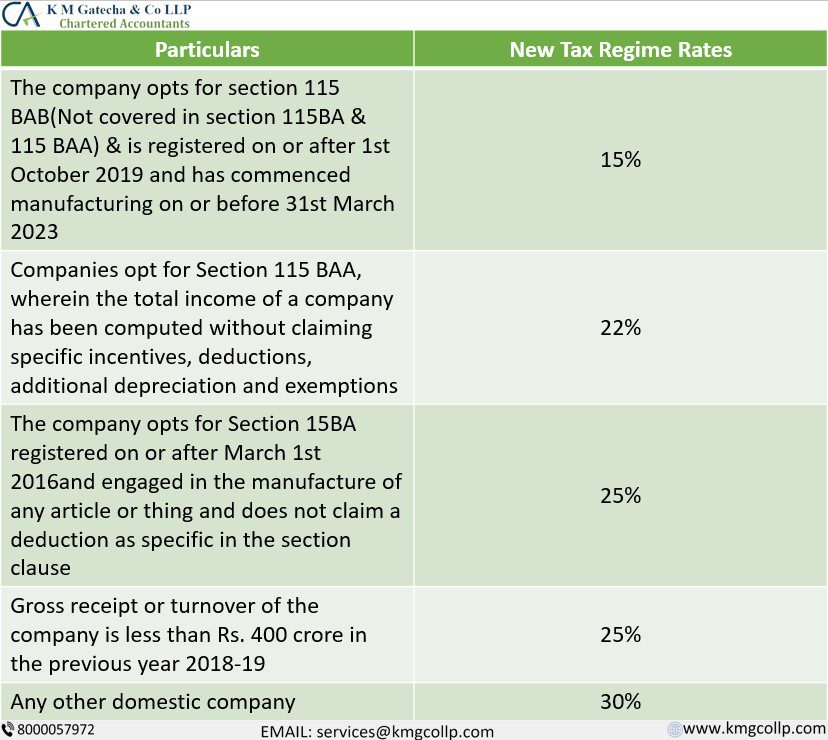

New Tax Slab Rates for Domestic Companies for FY 2021-22

Domestic Company Surcharge & Cess Application (AY 2021-22 & 2022-23)

The surcharge will be applied at the following rates unless the domestic company has chosen a special income tax slab for AY 2021-22:

If your total income is more than Rs. 1 crore but less than Rs. 10 crores, you will be taxed at 7%.

If your entire income surpasses Rs. 10 crores you would be taxed at 12%.

Firms with excess income will also be eligible for marginal relief if the surcharge exceeds their excess income. Consider the following scenario:

The surcharge is not payable if the surcharge increases the tax payable by Rs. 1 lakh but the excess income exceeding Rs. 1 Crore is less than Rs. 1 lakh.

Education & Health Cess is applied to the tax due after the 4% surcharge has been added.

Income Tax Rates for Partnership Firms in the Old and New Regimes for FY 2021-22 and AY 2022-23

A partnership firm, such as a Limited Liability Partnership (LLP), is subject to a 30% tax rate. In addition, if your total income surpasses Rs.1 crore, you’ll have to pay a tax surcharge of 12%.

Note that the new tax structure does not include any concession rates for LLPs/firms.

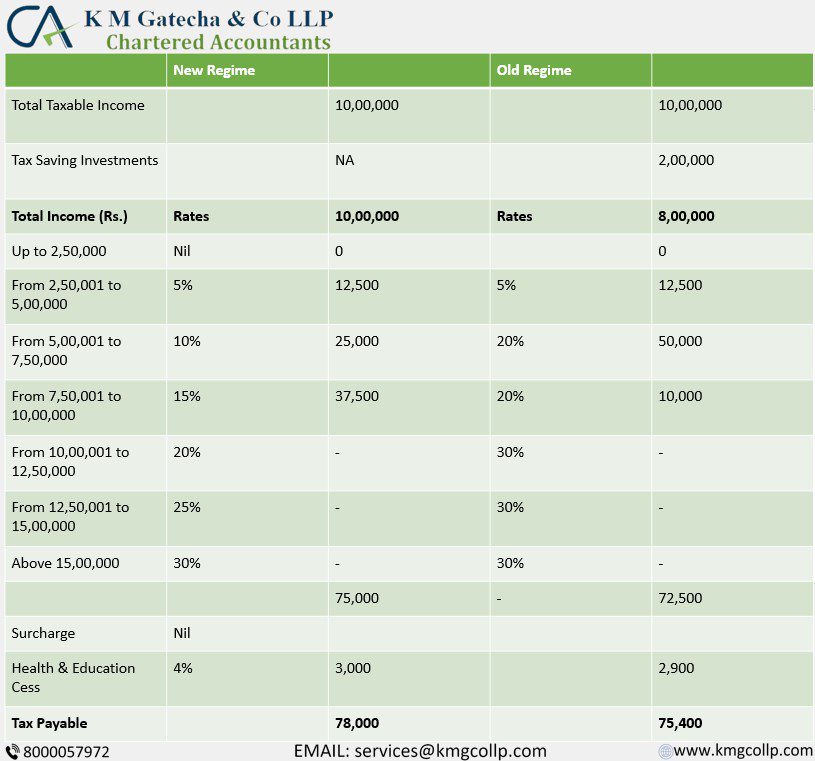

Which Is Better: The Old or the New Tax System?

Middle-class taxpayers with taxable income up to Rs. 15 lakhs may benefit from the new tax regime. For high-income earners, a previous system is a preferable option.

The new tax system features seven reduced income tax brackets, which benefit taxpayers with minimal investment income. The new tax slab rates will benefit everybody who pays taxes without claiming any tax exemptions. For example, under the prior tax regime, a taxpayer with a total income of up to Rs. 12 lakhs before deductions would have a larger tax due if his or her investments were less than Rs.1.9 lakh. Individuals who invest less in tax-avoidance plans should benefit from the new system.

Frequently Asked Questions:

If an individual’s annual income is less than Rs. 2.5 lakh, filing an ITR is not required. However, it is recommended that you file a ‘Nil Return’ solely for the record because you can use it as proof of income in a variety of situations.

Any residential Indian whose annual income is below Rs. 5 lakhs can claim a maximum deduction up to Rs. 12,500 under Section 87A of the IT Act.

Finance Minister Nirmala Sitharaman said in her Union Budget address for 2022 that there will be no changes to tax brackets for the fiscal year 2022-23. Furthermore, the income tax rates for the fiscal year 2022-23 have not been changed.

Disclaimer: The main goal of this article is to “assist investors in making informed financial decisions.” The above information is provided only for educational purposes. Readers are advised to exercise caution and seek professional counsel before relying on the above information. K M Gatecha & CO LLP is not liable for any loss or harm incurred by readers who take action based on the information provided in this article. “Please keep in mind that the opinions expressed in this Blog/Comments Section/Forum are clarifications intended for the readers’ reference and guidance as they investigate further on the topics/questions raised and make informed decisions. These are not intended to be investment advice or legal advice.”

Table of Contents

Toggle