The Income Tax Act of 1961 does not define the term “Expatriate Tax.” However, in general, an expatriate is someone who lives outside of his country of origin or in a country where he does not have citizenship. He may be residing in another country temporarily or permanently, depending on the terms of the deputation. In this article, we will learn “All about taxation of expatriate employees in India”. The term “deputation” refers to the temporary assignment of an employee to a position outside his cadre. The incidence of tax under the Income Tax Act of 1961 is determined by the following factors: The taxpayer’s residential status Provisions in effect during the Assessment Year to which the incomes relate Whether the accrual or receipt of such income has any connection to India.

Expats are classified into two types:

- Inbound Expatriate, a citizen of another country who lives and works in India.

Outbound Expatriate is someone of Indian origin who lives and works in another country. Expatriate work requirements vary depending on whether the term assignment or Consultation for a Business Visit (Short-term, mid-term, and long-term) assignment Permanent transfer.

Compliance for Inbound Expatriates while entering or exiting India:

All inbound expatriates (including minors over the age of 16) visiting India on a long-term visa for more than 180 days are required to register with the Foreign Regional Registration Office (FRRO) within 14 days of their arrival in India, if such a requirement has been raised as part of their visa endorsement. At the immigration checkpoint, such inbound expatriates must surrender their residential permits to the FRRO/FRO or the immigration officer.

The Income Tax Act also allows expatriates to obtain a “No Objection Certificate” by submitting Form 30A. Form 30A is an undertaking by the expatriate’s employer that any future tax liability incurred by the expatriate must be borne by the employer.

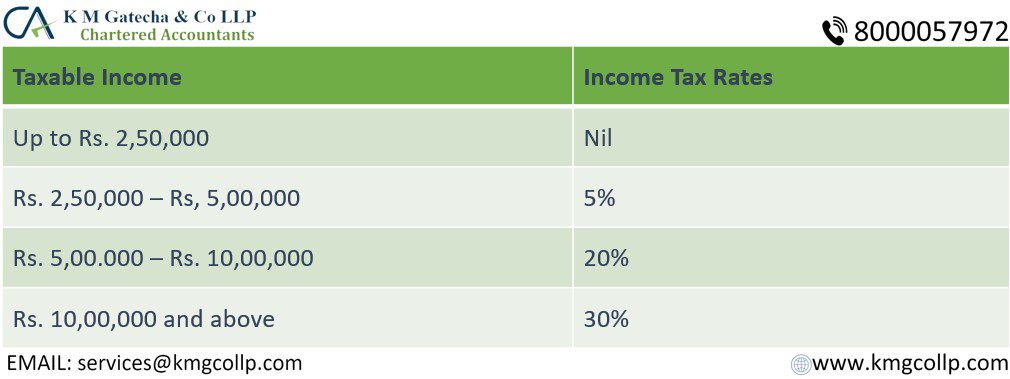

The income rates applicable to expatriates:

Residential Status:

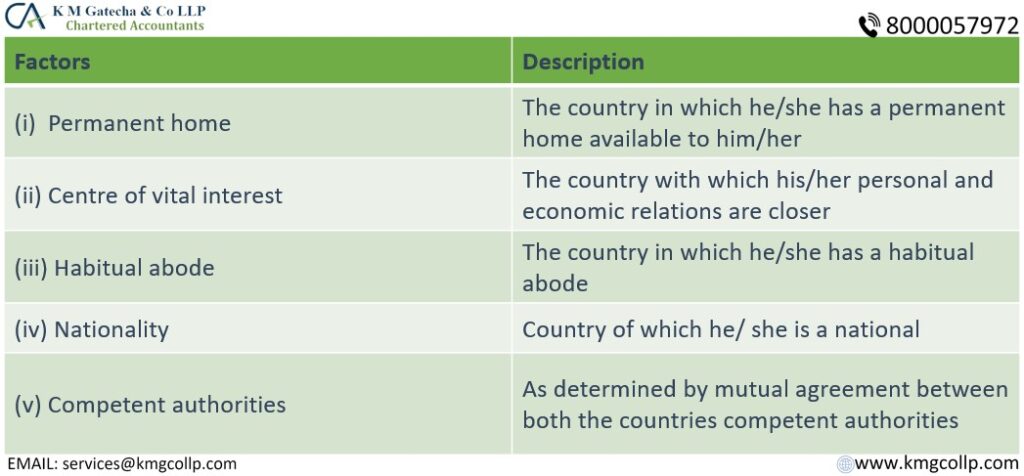

Residential Status: The residential status of an expat is determined by two perspectives: the Income Tax Act and the DTAA. According to the relevant taxation laws, the expat may be a resident of both countries in certain circumstances. This gives rise to the ‘Tie Breaker Rule.’ The following factors must be considered:

The fundamental rule of salary income taxation is that salary is taxable in the country where the employee is physically present while performing services.

Deemed Tax Residents: An Indian citizen is deemed to be a resident of India in the previous year if he is not required to pay tax in any other country or territory.

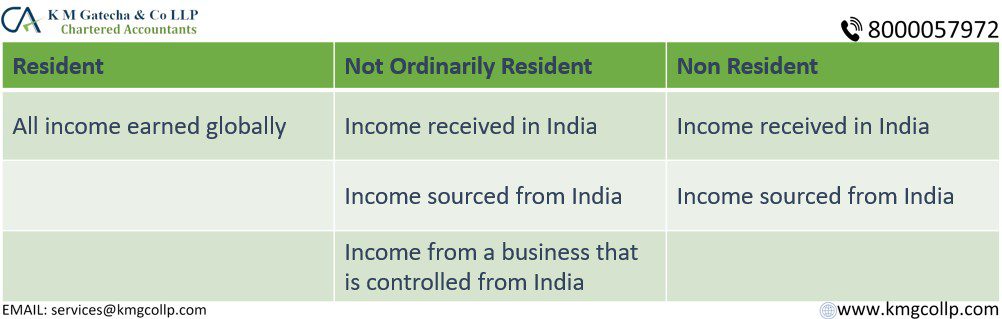

Scope of Income:

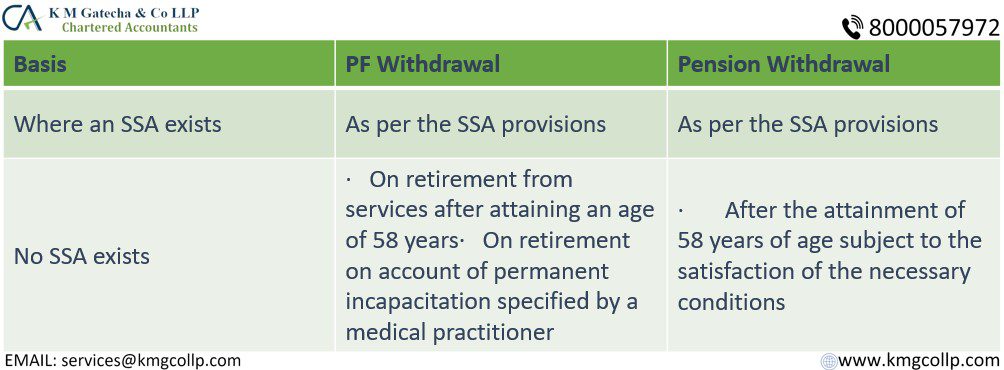

Provident Fund and SSA:

Provident Fund and SSA: Under the PF scheme, both the employer and the employee will contribute 12% of their monthly pay (as defined in the EPF and MP Act). The employer’s contribution will be 8.33 percent of monthly pay, with the remaining 3.67 percent going to the Provident Fund. For fiscal years 2020-21, the interest rate on EPF contributions is 8.5 percent. Salary will include all earnings, whether in India or abroad.

If an international worker is from a country with which India has signed a Social Security Agreement (SSA) and has a Certificate of Coverage from his home country, he does not need to contribute to social security in India as long as he provides the COC to the PF authorities.

Per Diem Allowance/Daily Allowance: To compensate employees for the lifestyle changes they must endure while on assignment in foreign countries, a daily allowance is paid in addition to their salary. According to the Income Tax Rules, any ordinary daily allowance paid while on tour is exempt if incurred for the purpose of daily living expenses.

Employees Stock Option Plan (ESOP): In the case of ESOP, shares issued under the plan are taxable in the hands of the employees at the time they are exercised.

The taxability of expatriates, in general, is an intriguing topic that has seen numerous changes in recent years. Significant efforts have been made to provide greater clarity on the taxability of such individuals and other foreign nationals.

Frequently Asked Questions: -

Irrespective of the residential status of the expatriate employee, the amount received by him as salary, for services rendered in India shall be liable to tax in India being income accruing or arising in India, and also be subject to TDS regardless of the place where the salary is actually received.

An expatriate, or ex-pat, is an individual living and/or working in a country other than his or her country of citizenship, often temporarily and for work reasons. An expatriate can also be an individual who has relinquished citizenship in their home country to become a citizen of another.

What Does Resident Mean? For the record and to clarify, you don’t have to give up your citizenship to live in another country, and moving to another country, as a retiree, etc., has nothing to do with expatriation. Expatriation isn’t about where you live. It’s about where you’re a citizen and whose passport you carry.

Disclaimer: The main goal of this article is to “assist investors in making informed financial decisions.” The above information is provided only for educational purposes. Readers are advised to exercise caution and seek professional counsel before relying on the above information. K M Gatecha & CO LLP is not liable for any loss or harm incurred by readers who take action based on the information provided in this article. “Please keep in mind that the opinions expressed in this Blog/Comments Section/Forum are clarifications intended for the readers’ reference and guidance as they investigate further on the topics/questions raised and make informed decisions. These are not intended to be investment advice or legal advice.”

Table of Contents

Toggle