Contributions to various funds (e.g., provident fund, employee state insurance, superannuation funds, gratuity fund, or any other fund, etc.) are terms that all tax professionals are very familiar with. by employers and employees in accordance with the applicable law in a predetermined percentage. However, this appears to be a legally mandated requirement in the cases outlined below regarding employee welfare after retirement. However, there are still a lot of people who are unsure of how to proceed, as the Income Tax Act specifies which contributions are allowed as business expenses and which are not. As a result, the following question will be familiar to you after reading this article:

- Familiar about the terms (Provident Fund and Employee State Insurance)

- In which scenario these are mandatory?

- What will be the rate of deduction and deposit to the Government in a time bound manner?

- List of documents for registration under the Provident Fund and Employee State Insurance

- What is the Registration Process?

- And last and most important, what is the Income Tax perspective for an entity in relation to business expenditure?

- Now I will try to provide you a brief about all the above mentioned things.

First let us understand basic terms

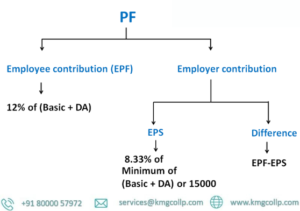

The Provident Fund (PF) is an investment fund that an employee and their employer jointly set up to provide long-term savings for an employee’s retirement. Additionally, it represents employee welfare benefits. Investments made in the provident fund came from: One is the “Employee’s Contribution,” which is a sum that will be taken out of the employee’s monthly pay. Another is the “Employer’s Contribution,” which is similar to a salary deduction in that the employer contributes a fixed amount in addition to the employee’s usual salary.

The Workers’ State Protection (ESI) Plan is a coordinated proportion of Social Protection epitomized in the Representatives’ State Protection Act and it is intended to achieve the undertaking of safeguarding ‘workers’ as characterized in the Workers’ State Protection Act, 1948 against the effect of rates of affliction, maternity, disablement and demise because of business injury and to give clinical consideration to guaranteed people and their families. Investments in the Employee State Insurance came from: One is the “Employee’s Contribution,” which is a sum that will be taken out of the employee’s monthly pay. Another is the “Employer’s Contribution,” which is similar to a salary deduction in that the employer contributes a fixed amount in addition to the employee’s usual salary.

Mandatory requirement in the following scenario

The Opportune Plan applies to each foundation where a foundation comprises of various divisions or has branches, whether arrange in similar spot or in better places, every such office or branches will be treated as parts of a similar foundation, which contains representatives at least 20 people and each such manager will be expected to be enlisted under the EPF on the public authority site known as “Worker Fortunate Asset Association”. All factories and other establishments are covered by the Employee State Insurance Scheme, which Hotels, restaurants, cinemas, newspapers, shops, and educational or medical establishments employing 10 or more people include road transportation. However, the threshold for establishment coverage remains at 20 in some states. Representatives of the previously mentioned classes of production lines and foundations, drawing compensation not more than Rs. Every such employer must be registered with the EPF on the government website known as the “Employees’ State Insurance Corporation” for a monthly fee of 21,000 rupees.

Rate of Percentage to be deducted and deposited

Opportune Asset: Representative’s commitment to EPF is 12% of compensation though Business’ commitment to EPF is 12% of pay. Basic pay plus Dearness Allowance and any other allowances (such as House Rent Allowance, City Compensatory Allowance, Meal Allowance, etc.) constitute salary for the purposes of PF calculation. shall not comprise.

Worker State Protection: Worker’s commitment to ESI is 0.75% of pay while Boss’ commitment to ESI is 3.25% of pay. Basic pay, Dearness Allowance, City Compensatory Allowance, House Rent Allowance, Incentives (including sales commission), Attendance and Overtime Payments, Meal Allowance, Uniform Allowance, and Any Other Special Allowances are all included in the salary for the purpose of ESI calculation.

Disclaimer: The rate of deduction may change from time to time; before relying on the rate above, please read the relevant act.

Due date for payment of contribution amount

Fortunate Asset/Worker State Protection commitment sum is to be saved before fifteenth of the month following the month in which derivations are made. This means that the January ESI contribution must be deposited by February 15 or earlier. However, if the situation calls for it, the government can extend the due date if it is in the public interest. Last year, for example, the covid pandemic required the government to extend the due date by two months.

Due date for return filing

Monthly returns must be submitted by the PF-registered entity. As a result, each month’s PF return filings must be completed by the 25th. The substance that has ESI enlistment need to document return half yearly. The ESI return filings for the time of April to September are to finished by twelfth November and for the period October to Spring are to be finished by the twelfth May.

List of documents required for registration under these fund

Provident Fund/ Employee State Insurance:

For registration under both funds, almost same documents are required. So, following is an illustrative list of documents for your reference:

- Shop and establishment Certificate/ GST Certificate/ License issued by the Government for factory/Articles of Association or Memorandum of Association

- Company incorporation certificate/LLP registration certificate/ Partnership Deed

- PAN Card of Proprietor/Partner/Director

- Digital Signature Certificate of Proprietor/Partner/Director etc.

- Aadhar Card of Proprietor/Partner/Director etc.

- Cancelled Cheque/Bank Statements of the entity

- PAN Card of the entity

- Lease or rent agreement (if applicable)

- Electricity Bill of the Registered Office (not older than 2 months)

- Contact number and e-mail address of the entity.

Besides the above requirements, any other specific documents can also be demanded by the authority as per the status of the organization or the situation of the case.

Registration process

Since online registration replaced manual registration, PF/ESIC registration has become a simple process. One can easily register in almost no time by following a few simple steps and verifying testimonials.

Provident Fund:

Now try to understand the process of PF registration

Step 1: The first step is registering an entity on EPFO portal. Visit the EPFO web portal for registering your entity. Select the option stating ‘Establishment Registration’ present on the home page of this unified portal.

Step 2: On clicking the ‘Establishment Registration’ option, the page will be redirected to the link https://registration.shramsuvidha.gov.in/user/register. Here on this link, there is a user manual available which you must download. This manual should be read thoroughly before registration if you are new to this process.

Step 3: After thoroughly reviewing this user manual, sign up on Unified Shram Suvidha Portal (USSP) of EPFO. The sign-up page of USSP will open when you click on the ‘Establishment Registration’ tab present on the home page. Then, click on the tab ‘Sign Up.’ On clicking the ‘Sign up button, you will be asked for your name, mobile number verification code, and email. Input all required details to create an account.

Step 4: Login to USSP and locate a tab stating ‘Registration For EPFO-ESIC v1.1’ situated on the screen’s left side. After this, choose an option displayed as ‘Apply for New Registration’ on the screen’s right side. You will find two options on clicking, namely, ‘Employees’ Provident Fund and Miscellaneous Provision Act 1952’ and ‘Employees’ State Insurance Act 1948.’ As an employer, you will have to select the option stating ‘Employees’ Provident Fund and Miscellaneous Provision Act 1952’ and then click the ‘Submit.’ On clicking the button stating ‘Submit,’ the page featuring ‘Registration Form for EPFO’ will be displayed. Here you need to input employment details, branch or division, contact persons, establishment details, activities and identifiers.

Step 5: Now the Last Step is attaching DSC: After filling out the above registration form and attaching all required documents, the employer’s Digital Signature Certificate needs to be uploaded and affixed on this form. The Unified Shram Suvidha Platform will email you to confirm that EPF registration has been successfully completed on uploading the DSC.

Employee State Insurance:

Now try to understand the process of ESIC registration

Step-1– The first step to get registered is to sign up in the ESIC portal. Signing up is easy as it is the first thing that pops up when any new employee opens the portal. Once you sign up with the required details, the first step is completed.

Step- 2– After signing up with the required details, the employee will receive a mail on his registered mail id, confirming the username and password provided. This username and password is very important, and it will help you open the portal as long as you are working under the organization.

Step-3– After the completion of signing up on the portal, the employee can log in with the username and password provided in the mail. Once you log in, a new page will open where the ‘registration form’ will appear for a ‘new employee’. This is the registration form that confirms your registration with ESIC. While filling up a form for ‘new registration’, the employee has to state the details of the organization along with the details of the employer. Once all the required information is provided, the employee has to click on the ‘submit button to complete the registration form’s filling.

Step-4– An employee is registered under the ESIC scheme only after the advance amount paid for the next six months. By clicking on the ‘payment ‘option and successfully following the payment procedure, the registration process will be completed.

Step-5– At this last step, the employee will receive the c-11 letter, which is the registered letter containing his unique registration number of 17 digits. This registration is generated by the ESIC system portal, which ensures that the employee is successfully registered for the ESIC scheme.

Therefore, let us comprehend these terms in relation to business expenses from the perspective of income tax.

We should be aware, from an income tax perspective, of when the amount that has been deducted from the fixed monthly salary of the employee and the employer’s own contribution, which is deposited to the government in accordance with norms as defined in the Act, will be permitted as a business expense and when it will not be permitted as a business expense. Therefore, in order to fully comprehend these, we must discuss the following sections:

- Section 43B(b) of the 1961 Income Tax Act: In accordance with this section, certain deductions can only be made on actual payments. One of these deductions is that any amount that an assessee owes as an employer in the form of a contribution to a provident fund, superannuation fund, gratuity fund, or other fund for the welfare of employees can be deducted only from the income referred to in Section 28 of the previous year in which such payment is actually made, regardless of the year in which the assessee was liable to

Provided, however, that any amount actually paid by the assessee on or before the applicable due date for furnishing the return of income under subsection (1) of section 139 for the year prior to which the liability to pay such sum was incurred and the evidence of such payment is provided by the assessee with such return is subject to the provisions of this section.

- The Income Tax Act of 1961, Section 36(1)(Va): According to segment 36 of, in which there is a rundown of different derivations, and one of them is, any aggregate got by the assessee from any of his representatives to which the arrangements of sub-provision (x) of condition (24) of area 2 apply, in the event that such total is attributed by the assessee to the worker’s record in the pertinent asset or assets at the very latest the due date.

Section 1’s first explanation: For the motivations behind this provision, “due date” signifies the date by which the assessee is expected as a business to credit a representative’s commitment to the worker’s record in the applicable asset under any Demonstration, rule, request or notice gave thereunder or under any standing request, grant, agreement of administration etc.

Clarification 2 of the above segment: For the evacuation of questions, it is thusly explained that the arrangements of area 43B will not make a difference and will be considered never to have been applied for the reasons for deciding the “due date” under this provision.

After reading the two preceding sections, we discuss their relevance, pointing out that there are two types of contributions: those made by employees and those made by employers, respectively. In addition, the due date and actual date of payment for such contributions must be examined in order to determine whether or not they are permissible in relation to business expenses.

Therefore, if the contribution is made by the employer, the first section, Section 43B, applies. This means that the employer’s contribution to various funds can be deducted if it is paid before the return’s due date, as specified in sub-section (1) of Section 139 of the Income Tax Act of 1961.

Let’s look at an example: let’s say the employer has to pay its own contribution for the month of January 2022, and the deadline to file a return is September 30, 2022. Now, the entity must pay its own contribution by September 30, 2022, in order to claim this expense as a deduction.

However, this is not the same as claiming a deduction for an employee’s contribution to multiple funds. According to the second section above, if an organization wants to deduct an employee’s share, it must pay before the fund’s due date in accordance with an Act, rule, order, or notification issued thereunder, a standing order, award, or other contract of service.

Let’s look at an example: let’s say the entity has to pay employee contributions for the month of January 2022 after collecting them from employees. According to the relevant statute or act, the due date for these contributions is February 15, 2022. Now, in order for the entity to be able to deduct this expense, it must pay the employee contribution by the due date, which is the 15th of February 2022, as specified in the statute or act.

Notwithstanding, I have seen such countless cases that a similar arrangement of segment 43B is applied if there should be an occurrence of Worker’s commitment, which is at first sight off-base.

Conclusion.

In the entire article I attempted to make sense of the main point is that when Worker’s Commitment is permitted as business consumption and when the Business’ commitment is permitted as business use in regard of Annual Duty Act, 1961.

We have come to the conclusion that the employer’s contribution will be eligible for a deduction under the Income Tax Act of 1961 and section 43B if paid by an entity prior to the due date for filing a return. Also, the same rule won’t apply to employee contributions; instead, employee contributions can be deducted if they are paid by an entity prior to the act’s due date, not the Income Tax Act‘s due date for filing returns.

FAQs

What is Employee Provident Fund scheme?

Employees Provident Fund and Miscellaneous Provisions Act, 1952 is a Social Security Act passed by the Government of India. It includes Social Security Schemes namely Provident Fund, Pension and Insurance to industrial employees.

What is Provident Fund Act?

Provident Fund is a mandatory saving by an employee during the years of his employment. Further, the Provident Fund Act aids to provide terminal benefits in case of occurrence of accidents or mishaps or an unforeseen event.

What is a provident fund & a superannuation fund?

The purpose of this Act is to provide retirement and old age benefits such as Provident Fund, Superannuation Pension, Deposit Linked Insurance etc. with the intent to protect the interest of workers recruited in factories and other establishments. Provident Fund is a mandatory saving by an employee during the years of his employment.

Can a private Provident Fund be exempted from a statutory pension scheme?

This is possible only if the majority of the employees of such an establishment agree to such an exemption. Further, the benefits extended by the private Provident Fund or The Pension Scheme should mandatorily be equal to or more than the ones provided by the statutory scheme.

Table of Contents

Toggle