Hello Folks!!

Today, we are going to discuss about the applicability of Income tax to NRI.

So, Let’s begin!

In India, the amount of taxes an individual is liable to pay is determined by their residential status. According to the Income Tax Act 1961, there are three categories of residential status.

- Resident (ROR)

- Resident but Not Ordinarily Resident (RNOR)

- Non-Resident (NR)

Non Resident Indian (NRI) – (applicability of Income tax to NRI)

The Income 1 Tax Act 1961 does not explicitly state who a Non-Resident Indian (NRI) is but rather provides criteria for being considered a resident of India. Consequently, anyone who does not fulfill those criteria is considered an NRI.

Under Section 6(1) of the Income Tax Act, an Individual can be considered a resident of India if they meet one of the following conditions:

- If he/she stays in India for a period of 182 days or more in a financial year, or he/she is in India for a period of 60 days.

- If he/she resides in India for 365 days or more in any given fiscal year and has stayed in India for a total of 4 years in the period prior to the most recent year.

If someone is an Indian citizen working abroad or a crew member, only the first condition is applicable to them. This implies that a person is considered a resident if they have been in India for at least 182 days.

Finance Act Amendment 2020 (Applicability of income tax to NRI)

The Finance Act of 2020 has amended the residency criteria for taxation to include Indian citizens and Persons of Indian Origin who come to India. These individuals are now classified as RNOR subject to the following conditions:

- The total income excluding foreign income is at least Rs 15 lakh.

- The individual had resided in India for a period of between 120 and 182 days during the preceding year,

- The person has spent 365 or more days in India during the last four years before the previous year.

Before this amendment, these people were considered non-residents. Now, they may be labeled as RNOR, resulting in the loss of certain DTAA benefits, an expanded scope of taxable income, and the elimination of particular exemptions.

It should also be noted that, under the aforementioned amendment, a person living for more than 182 days will be considered a resident regardless of their income from the previous year.

Tax liability for NRI (applicability of Income tax to NRI)

Non-Resident Indians (NRIs) in India are only subject to taxation on income earned within the country. There is no requirement to pay taxes on any international earnings. If the same income has been taxed both in India and another country, the NRI may be eligible for relief under the Double Taxation Avoidance Agreement (DTAA) if India has a signed agreement with the other nation to avoid paying taxes twice.

Incomes liable to tax in India:

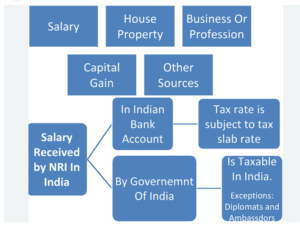

Salary Income:

Any salary obtained in India or income for services provided in India will be regulated by Indian tax regulations. This means that if a Non-Resident Indian (NRI) is paid for a job done in India, the salary will be taxed regardless of where the payment is received. The applicable tax rate will be based on the scale for the relevant fiscal year.

If the Indian Government remits any salary or income to an Indian citizen for services performed outside India, it will still be regarded as income earned in India and taxed appropriately even if the individual is classified as a ‘Non-resident’ according to residency regulations.

House property income:

Income from the rental of a house located in India that is owned by a non-resident Indian (NRI) is taxable. The determination of the taxable house property income will be the same as that of a resident. Additionally, NRIs can claim the standard deduction of 30%, deductions for property taxes paid, and interest on a home loan. Furthermore, Section 80C deductions for principal repayment, stamp duty, and registration fees can be taken. Finally, the house property income will be taxed at the individual slab rate applicable.

Income from Other Sources:

Income from other sources, such as the interest earned on savings accounts and fixed deposits held in Indian banks, will be taxed in the hands of Non-Resident Indians (NRIs). Interest earned on Non-Resident External (NRE) and Foreign Currency Non-Resident (FCNR) accounts, however, is not subject to taxation in India. However, all the interest earned from a Non-Resident Ordinary (NRO) account, which is opened by an NRI to handle their income earned in India, is fully taxable.

Capital gains income:

Any capital assets that are based in India, such as houses, shares, bonds, and gold, will be subject to taxation. Non-Resident Indians(NRI) will also be responsible for capital gains taxes if they transfer any of these Indian-based assets, and the regulations are the same as those for residents.

Income from business & profession:

Any profit earned by a Non-Resident Indian from an enterprise based or managed in India will be considered as income earned and thus subject to taxation in India.

Double taxation relief:

If Non-Resident Indian (NRI) income is subject to taxation in both India and the NRI’s country of residence, then tax relief may be available through a Double Tax Avoidance Agreement (DTAA) between the two countries. There are two ways in which tax relief under a DTAA can be claimed.

(i) Exemption method and

(ii) Tax credit method.

We hope you found this blog – applicability of income tax to NRI informative and helpful. For any queries, drop us an email at – [email protected]. Or, call us at – +91 80000 57972. You can also fill out the form, our executive will contact you as soon as possible.

Table of Contents

Toggle