Introduction:

Over the past decades, the growing concern over climate change, energy independence, and securities of energy supply have accelerated the path to the decarbonization of the transport sector. this article aims to present an overview of the Tax benefits on the purchase of electric vehicles in India. Looking to accelerate the use of electric vehicles in India, the Indian government has recently added a new section to give tax benefits to Electric vehicle buyers. As per India’s Income Tax rules, cars for personal use are classified as luxury products and thus salaried professionals do not get any tax benefits on car loans. However, electrical vehicle (EV) customers can avail of tax reliefs on their loans under a recently added section known as 80EEB of the income tax act. As we all know that electric vehicles play the role in the social and political aspects of climate change mitigation, as well as a renewable energy-based economy.

Tax benefits on Electric Vehicle:

If an individual purchases an electrical vehicle (EV) on loan, then he can avail of tax benefits under section 80EEB of the Income-tax Act, whether you use the vehicle for personal or business purposes. In other words, a total tax exemption of up to Rs 1,50,000 can be availed when paying off the electrical vehicle (EV) loan under section 80EEB. This tax exemption is available for both 4-wheeler and 2-wheeler electrical vehicle (EV) purchases.

Under Section 80EEB, persons opting to buy an electrical vehicle (EV) on loan will be eligible for tax deductions of Rs 1.5 lakh on interest paid on the loan amount. This tax benefit makes choosing an electrical vehicle (EV) as the next vehicle purchase an attractive proposition for salaried professionals.

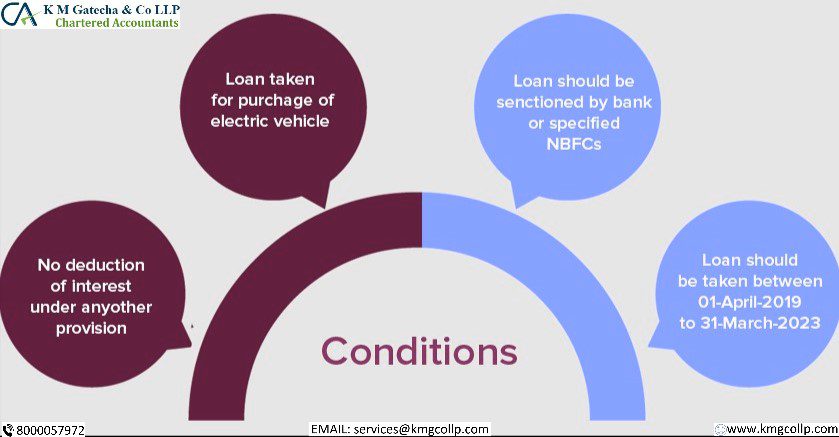

Conditions that apply to Section 80EEB for Electric Vehicle (EV) Tax deduction

- A loan must be taken by an individual from any financial institution or a non-banking financial company for the purpose of purchase of an electric vehicle.

- the loan must be sanctioned by the financial institution or specified NBFC (non-banking financial company) during the period beginning on the 1st day of April 2019 and ending on the 31st day of March 2023.

- Individuals can only avail the tax relief only one time. If you are a company, partnership firm, HUF, or any other kind of taxpayer, you won’t be eligible for any tax benefits under section 80EEB.

Not just the Income Tax benefit, the government has moved the GST council to lower rate the GST rate on the electrical vehicle (EV) from 12% to 5%.

As per the budget 2019, customs duty on certain parts of electrical vehicles (EV) is exempted to promote e-mobility and accelerate the use of electric vehicles in India.

Conclusion: This article is a response to the high demand of people, scholars, industries, as well as the financial institution that nowadays want to have knowledge about:

- The current trend of electric vehicle technologies,

- Tax benefits on Electric Vehicle,

- 80EEB of the income tax act,

Frequently Asked Questions:

an individual purchases an electrical vehicle (EV) on loan, then he can avail of tax benefits under section 80EEB of the Income-tax Act, whether you use the vehicle for personal or business purposes. In other words, a total tax exemption of up to Rs 1,50,000 can be availed when paying off the electrical vehicle (EV) loan under section 80EEB. This tax exemption is available for both 4-wheeler and 2-wheeler electrical vehicle (EV) purchases.

the government has moved the GST council to lower rate the GST rate on the electrical vehicle (EV) from 12% to 5% to promote e-mobility and accelerate the use of electric vehicles in India.

total tax exemption of up to Rs 1,50,000 can be availed when paying off the electrical vehicle (EV) loan under section 80EEB. This tax exemption is available for both 4-wheeler and 2-wheeler electrical vehicle (EV) purchases.

Table of Contents

Toggle