Hello Folks!!

Today, we are going to discuss about the taxation of capital gain in India.

What is Capital Gains Tax In India?

Any profit earned from the sale of a ‘capital asset’ is referred to as ‘income from capital gains’ and must be reported in taxes in the year that the asset is sold. This type of tax is called capital gains tax. There are two different kinds of capital gains, short-term capital gains and long-term capital gains.

Investing in real estate is highly desirable since it grants you ownership of a home. Other people may buy a house with the expectation of selling it in the future for a profit. It is essential to remember that a house is seen as a capital asset for tax purposes. Therefore, any profit or loss from the sale of a house may be taxed under the ‘Capital Gains’ heading. Moreover, capital gains or losses may arise from the sale of various types of capital assets.

Defining Capital Assets (All about taxation of capital gain in India)

Land, vehicles, real estate, building, automobiles, patents, trademarks, leased rights, equipment, and jewelry are some examples of capital assets. This includes having rights associated with or related to an Indian business. Additionally, it includes rights of management, control, or any other legal right.

The following do not come under the category of capital asset:

- Any stock, components, or materials, held for the purpose of conducting business or a profession.

- Personal goods such as furniture and clothes held for personal use

- Agricultural land in rural areas of India

- The Central Government issued 6½% gold bonds (1977), 7% gold bonds (1980), or National Defence gold bonds (1980).

- Special bearer bonds (1991)

- Bonds issued under the Gold Deposit Scheme (1999) or Certificates issued under the Gold Monetisation Scheme (2015) are backed by gold deposits.

Definition of Rural Area Starting from the 2014-15 tax year, any area which is outside the jurisdiction of a municipality or cantonment board, and has a population of more than 10,000 inhabitants, is considered a rural area, provided it is not located within a certain distance.

Distance (to be measured aerially) | Population (as per the last census). |

2 kms from local limit of municipality or cantonment board | If the population of the municipality/cantonment board is more than 10,000 but not more than 1 lakh |

6 kms from local limit of municipality or cantonment board | If the population of the municipality/cantonment board is more than 1 lakh but not more than 10 lakh |

8 kms from local limit of municipality or cantonment board | If the population of the municipality/cantonment board is more than 10 lakh |

Types of Capital Assets?

- Any asset held for a time frame of three years or less is considered a Short-term capital asset (STCA).

For immovable properties like land, building, and house property, the minimum time period required to be held to qualify as a long-term capital gain is 24 months from the financial year 2017-18. For example, if you sell house property after owning it for 24 months and after 31st March 2017, the income earned from it will be treated as a long-term capital gain.

The 24-month period mentioned above does not apply to items such as jewelry, debt-oriented mutual funds, etc. which are considered movable property.

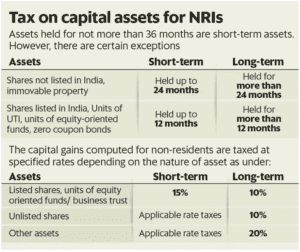

Certain assets are classified as short-term capital assets if they are held for less than 12 months, based on the date of transfer after July 10th, 2014 (no matter when they were bought). These assets include:

- Shares of a company that is listed on an approved stock exchange in India, either as equity or preference shares

- Securities such as debentures, bonds, and government-issued stocks that are listed on a validated stock exchange in India.

- Units of UTI, whether quoted or not

- Units of mutual funds focused on equity, whether quoted or not

- Units of equity-oriented mutual fund, whether quoted or not.

2. Any asset held for a period of over 36 months is considered a Long-term capital asset (LTCA). These assets will be recognized as long-term investments if they have been held for more than 36 months.

Beginning in the 2017-2018 financial year, any capital assets owned for two years or more, such as land, buildings, and houses, will be considered long-term capital assets.

If any of the assets listed below are held for longer than 12 months, they will be seen as long-term capital assets.

- Shares of a company listed on a recognized stock exchange in India that offer equity or preferential rights

- Securities such as debentures, bonds, and government securities listed on a reputable Indian stock exchange.

- Units of UTI, whether quoted or not

- Units of mutual funds focused on equity, whether quoted or not

- Units of equity oriented mutual fund, whether quoted or not

Classification of Inherited Capital Asset (All about taxation of capital gain in India)

If an asset is obtained through a gift, will, inheritance, or succession, the amount of time the asset was held by the previous owner is taken into account when determining if it is a short-term or long-term capital asset. In the case of bonus shares or rights shares, the period of possession begins from the date of the bonus or rights shares being allocated.

Tax Rates – Long-Term Capital Gains and Short-Term Capital Gains

Tax Type | Condition | Applicable Tax |

Long-term capital gains tax (LTCG) | Sale of: – Equity shares – units of equity oriented mutual fund | 10% over and above Rs 1 lakh

|

Others | 20% | |

Short-term capital gains tax (STCG) | When Securities Transaction Tax (STT) is not applicable | Normal slab rates |

When STT is applicable | 15%. |

Tax on Equity and Debt Mutual Funds

The profits earned from investments in debt and equity funds are handled differently. Any fund that has more than 65% of its total investments in stocks is referred to as an equity fund.

Funds | On or before 1 April 2023 | Effective 1 April 2023

| ||

Short-Term Gains | Long-Term Gains | Short-Term Gains | Long-Term Gains | |

Debt Funds | At tax slab rates of the individual | 10% without indexation or 20% with indexation whichever is lower | At tax slab rates of the individual | At tax slab rates of the individual |

Equity Funds | 15% | 10% over and above Rs 1 lakh without indexation | 15% | 10% over and above Rs 1 lakh without indexation

|

Tax Rules for Debt Mutual Funds

Due to the recent amendment to the Finance Bill 2023, any gains from debt mutual funds will be taxed according to the individual’s income tax slab rate, and be considered as short-term regardless of the length of time it is held. Before April 1st 2023, debt mutual funds had to be held for more than 36 months to be considered as a long-term capital asset. This means that in order to reap the benefits of long-term capital gains tax, investments must be kept for at least three years. If redeemed within this period, the capital gains will be added to the investor’s income and taxed accordingly.

Calculating Capital Gains

The way in which capital gains are calculated varies depending on the length of time an asset is held.

Terms You Need to Know:

The seller will receive a full amount of money as compensation for transferring their capital assets. Any capital gains resulting from this transaction must be taxed in the year of transfer, even if no money has been exchanged.

Cost of acquisition

The value for which the capital asset was acquired by the seller.

Cost of improvement

Expenses of a capital nature incurred in making any additions or alterations to the capital asset by the seller.

We hope you found this blog (All about taxation of capital gain in India) informative and helpful. For any queries, drop us an email at – [email protected]. Or, call us at – +91 80000 57972. Also, fill out the form to connect with our team.

Table of Contents

Toggle