Taxation of individuals in India is primarily based on their residential status in the relevant tax year. The taxability of an individual in India depends upon his residential status in India for any particular financial year. The residential status of different types of persons is determined differently. Similarly, the residential status of the taxpayer is to be determined each year concerning the “previous year.” The residential status of the taxpayer may change from year to year. What is essential is the status during the previous year and not in the assessment year. In this article, we will discuss all about “Residential Status as per Income Tax Act, 1961 “in India.

Types of Residential Status as per Income Tax Act, 1961

For income tax in India, the income tax laws in India classify taxable persons as:

- A resident

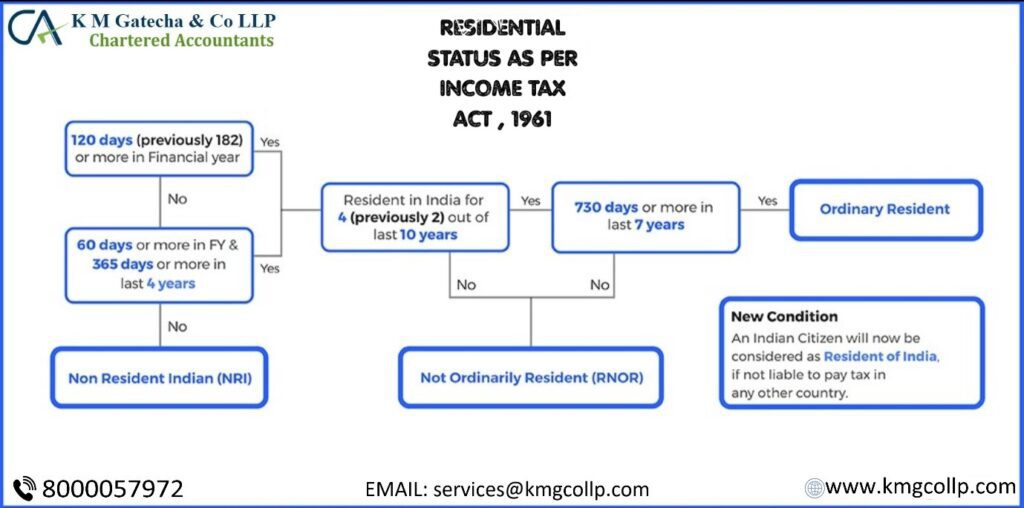

A person shall be deemed resident in India if he/she is in India in a tax year for:

- Must stay in India for a period of 182 days or more during the previous year.

- Must stay in India for a period of 60 days or more during the previous year and 365 days or more during the 4 years immediately preceding the previous year.

- A resident not ordinarily resident (RNOR)

Resident but Not Ordinary Resident (RNOR) status is given to those people who have been Non-Resident in India during 9 out of 10 financial years preceding that year, or people who have been in India during 7 previous years preceding that year for a period of total 729 days or less.

- A non-resident (NR)

Any taxpayer who is neither a resident nor a resident not ordinarily resident is classified as a non-resident.

The taxability differs for each of the above categories of taxpayers. Before we get into taxability,

let us first understand how a taxpayer becomes a resident, an RNOR, or an Non-resident.

Residential status of HUF (Hindu Undivided Family)

A Hindu undivided family (HUF) is said to be resident in India if the control and management of its affairs are wholly or partially situated in India.

A Hindu undivided family (HUF) is non-resident in India if the regulation and management of its affairs are entirely situated out of India. The residential status of the Karta of the Hindu undivided family during the previous year is not relevant in order to determine whether a Hindu undivided family is a resident or non-resident.

Residential status of the company

An Indian company (which is incorporated under Indian Law or is deemed as a company under any law of the country) is always resident in India. Even if an Indian company is regulated from a place located outside India. A foreign company (with effect from the assessment year 2022-) is resident in India if its place of effective management (POEM), during the relevant previous year, is in India. A foreign company (whose turnover/gross receipt in the previous year is Rs. 50 crores or less) is always a non-resident in India.

In the case of every Other Person

In the case of every other person, who has control and regulation or management entirely in India during the relevant previous year is a resident. Any other person, who has regulation or management entirely outside India during the relevant previous year is a non-resident.

In order to provide more clarity on the applicability of this provision, Under the Income Tax Act, the residential status of an individual is considered or classified based on the period of stay of taxpayers in India. The basis on the period of stay, residential status is further classified into further three categories (Residents and Ordinarily Resident (ROR), Residents but not Ordinarily Residents (RNOR) cumulatively referred to as residents; and Non-Residents (NR), based on which the income is taxable in India.

Frequently Asked Questions

According to the Income Tax Act, 1961, the residential status of an individual is one of the important criteria in determining the tax implications. The residential status of an individual can be considered Resident and Ordinarily Resident (ROR), Resident but Not Ordinarily Resident (RNOR), and Non-Resident (NR).

Taxation of individuals in India is primarily based on their residential status in the relevant tax year. The taxability of an individual in India depends upon his residential status in India for any particular financial year.

The residential status of an individual can widely be classified into three types such as, Resident, Non-Resident, and Deemed Resident. The Resident is further considered as Resident Ordinary Resident and Non-Ordinary Resident.

Table of Contents

Toggle