CPC Bangalore issued an income tax refund check that was returned undeliverable or not credited because of incorrect account information, an expired check, or other reasons.

Presently days Assessee who record their Annual expense form online gets their discount check gave by CPC Bangalore. Discounts are given by two modes:- .

- By depositing the refund amount into the Assessee’s bank account if the Assessee provided accurate bank information in his tax return.

- By sending an Income Tax Refund Cheque to the Assessee in the event that the Assessee’s Income Tax Return does not accurately reflect his bank account information.

In the case of physical checks, there is a possibility that the Assessee has relocated to a new address after submitting his or her tax return, at which point the CPC Bangalore refund check will be returned for non-delivery. Even though the Assessee’s address has not changed, it’s possible that they won’t be able to receive the refund order because no one was home on the day the check was delivered or because the postal service returned the refund check undeliverable because the house was locked.

Further on the off chance that Assessee has applied for ECS however has entered wrong record subtleties or record of which subtleties been placed is shut and ECS to such record been fizzled.

One question that arises in these situations is what the Assessee should do to request a reissue of the refund check, how to request credit to that account in his bank account, and how to notify the new address?

Procedure to apply for refund – reissue

Steps | Particulars |

Step 1 | Logon to ‘e-Filing’ Portal www.incometaxindiaefiling.gov.in |

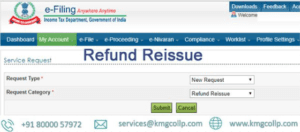

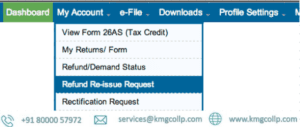

Step 2 | Click on ‘My Account’ menu and click ‘Service Request’ link. |

Step 3 | Select the ‘Request Type’ as ‘New Request’ and Select the ‘Request Category’ as ‘Refund Reissue’. Click ‘Submit’. |

Step 4 | Details such as PAN, Return Type, Assessment Year (A.Y), Acknowledgement No, Communication Reference Number, Reason for Refund Failure and Response are displayed. |

Step 5 | Click ‘Submit’ hyperlink located under ‘Response’ column. All the prevalidated bank accounts with status validated/validated and EVC enabled will be displayed. |

Step 6 | Select the bank account to which the tax refund is to be credited and click ‘Continue’. Details such as Bank Account Number, IFSC, Bank Name and Account Type are displayed for the taxpayer to cross verify the same. |

Step 7 | Click ‘OK’ in popup if the details are correct and the options for e-Verification appears in the dialogue box. Choose the appropriate mode of e-Verification, Generate and enter Electronic Verification Code (EVC)/Aadhaar OTP as applicable to proceed with the request submission. |

Step 8 | A success message will be displayed confirming the Refund Re-issue request submission. |

View Refund/ Demand Status

To view Refund/ Demand Status, please follow the below steps: Step

1 Login to e-Filing website with User ID, Password, Date of Birth / Date of Incorporation and Captcha. Step

2 Go to the ‘My Account’ ⇒ Click ‘Service Request’ ⇒ Select the ‘Request Type’ as ‘View Request’ and Select the ‘Request Category’ as ‘Refund Reissue’ Step

3 Click ‘Submit’

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.

Table of Contents

Toggle