Due date to file Income Tax Return for AY 2023-24|Income Tax Return Due date |Itr filing deadline

For the most part, taxpayers have until July 31, 2023, due date to file Income Tax Return (ITR) for Assessment Year (AY) 2023-24, which covers income earned during the fiscal year 2022-23.

However, the ITR filing due date is usually due by October 31, 2023, for taxpayers whose accounts must be audited under the Income Tax Act, such as businesses, limited liability companies, and some individuals.

Types of tax payers to ascertain due date to file Income tax return or ITR filing last date

In India, citizens are grouped into various sorts in light of their tendency of pay and the kind of element. The various categories of Indian taxpayers are as follows:

Individuals: Individual taxpayers are anyone who earns income in India and meets the criteria outlined in the Income Tax Act of 1961. Professionals, self-employed individuals, and salaried employees are all included in this.

Undivided Hindu Family (HUF): A HUF is a different element made by Hindu regulation and is viewed as a different citizen under the Personal Expense Act. The HUF can have its own source of income, which is taxable independently of the members’ income.

Companies: Companies are legal entities registered under the Companies Act, 2013, and are taxed as a separate entity under the Income Tax Act.

Partnership firms: Partnership firms are entities registered under the Partnership Act, 1932, and are taxed as a separate entity under the Income Tax Act.

Limited Liability Partnership (LLP): LLPs are entities registered under the Limited Liability Partnership Act, 2008, and are taxed as a separate entity under the Income Tax Act.

Association of Persons (AOPs) and Body of Individuals (BOIs): AOPs and BOIs are groups of individuals who come together for a common purpose and generate income. They are taxed as a separate entity under the Income Tax Act.

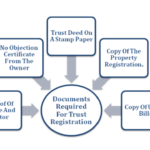

Trusts: Trusts are legal entities created for charitable or religious purposes, and their income is taxed separately under the Income Tax Act.

Because the tax laws, rules, and regulations that apply to each type of taxpayer may vary, it is essential to comprehend the classification of taxpayers.

Penalty for not filing ITR within due date to file income tax return.

The following are the penalties for non-filing or late-filing of ITR if not filed with income tax return due date:

If the ITR is not filed within the income tax return due date (i.e., July 31 for most taxpayers), but filed between August 1 and December 31 of the relevant Assessment Year (AY), the penalty amount is Rs. 5,000.

If the ITR filing deadline is missed i.e is filed after December 31 of the relevant AY, the penalty amount increases to Rs. 10,000.

However, if the total income of the taxpayer does not exceed Rs. 5 lakh, the penalty for filing itr after itr filing last date is limited to Rs. 1,000

In case of a delay in filing the ITR beyond ITR filing due date, interest under Section 234A, 234B, and 234C of the Income Tax Act may also be levied.

To avoid penalties and other negative outcomes, such as the disallowance of certain deductions and the loss of carry-forward benefits, it is essential to submit before ITR filing deadline or before ITR filing last date

Faqs on due date to file income tax return|Itr filing deadline

The Assessment Year 2023-24 will start from April 1, 2023, and end on March 31, 2024. The Income Tax Return (ITR) filing for the Assessment Year 2023-24 will commence after the end of the financial year 2022-23,

Under the new income tax regime, the amount of the rebate under Section 87A for FY 2023-24 (AY 2024-25) has been modified. A resident individual with taxable income up to Rs 7,00,000 will receive a Rs 25,000 tax relief. The former tax regime remains the same, i.e. 12,500 for income up to Rs 5,00,000.

Budget 2023 announced that individuals will not have to pay any tax if the taxable income does not exceed Rs 7 lakh in a financial year. The maximum limit of rebate available under section 87A of the Income-tax Act, 1961 has been increased to Rs 25,000 from Rs 12,500 in Budget 2023.

Know the itr filing last date for the financial year 2022-23. By India Today Information Desk: Income Tax Returns (ITRs) must be filed by July 31 for the FY 2022-23. April 1 will mark the start of the new assessment year 2023-24. Usually, the ITR filing due date is July 31.

Owner of this information can be reached at K M GATECHA & CO LLP.

Important note: This does not lead to legal advice or legal opinion and is personal view and for information purpose only. It is prepared on the basis of facts available and applicable law.It is suggested to go through applicable provisions of law,latest regulations,judicial announcements, circulars, notifications and clarifications etc before taking any action based on above content.You agree here by that for any action taken on basis of above information in any manner writer or K M GATECHA & CO LLP is not responsible or liable for any omission,reliability,accuracy,completeness,errors or authenticity.This work by professional is just for knowledge purpose and does not constitute any kind of solicitation of work or advertisement.

-

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments -

Steps to register private limited company15/08/2024/

Steps to register private limited company15/08/2024/ -

Cancellation of registration under GST26/05/2024/

Cancellation of registration under GST26/05/2024/ -

-

Introduction to Transfer Pricing in India13/04/2024/

Introduction to Transfer Pricing in India13/04/2024/ -

-

-

Tax Liability of a NRI24/12/2023/

Tax Liability of a NRI24/12/2023/ -

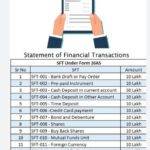

Everything about SFT18/12/2023/

Everything about SFT18/12/2023/ -

Documents to be maintained by NGo or trust17/12/2023/

Documents to be maintained by NGo or trust17/12/2023/ -

-

-

-

-

Taxation of Charitable/Religious Trust04/09/2023/

Taxation of Charitable/Religious Trust04/09/2023/ -

-

Application for Filing Clarification – GST09/06/2023/

Application for Filing Clarification – GST09/06/2023/ -

How to check GST application status09/06/2023/

How to check GST application status09/06/2023/ -

-

Gift tax under section 56(2)x03/06/2023/

Gift tax under section 56(2)x03/06/2023/ -

-

-

-

-

-

All about Appeal under GST20/05/2023/

All about Appeal under GST20/05/2023/ -

Old vs New income tax regime18/05/2023/

Old vs New income tax regime18/05/2023/ -

All about GSTR 10, GST Amnesty16/05/2023/

All about GSTR 10, GST Amnesty16/05/2023/ -

-

-

TDS on purchase of goods u/s 194Q17/01/2022/

TDS on purchase of goods u/s 194Q17/01/2022/ -

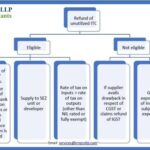

Situations of GST refund and process10/01/2022/

Situations of GST refund and process10/01/2022/ -

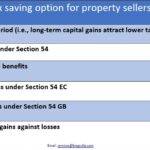

Tax on property sale in India05/01/2022/

Tax on property sale in India05/01/2022/ -

House Rent Deduction in Income Tax01/01/2022/

House Rent Deduction in Income Tax01/01/2022/ -

-

-

Table of Contents

Toggle