How to Check GST Application Status: A Step-by-Step Guide

Are you waiting for your GST (Goods and Services Tax) application approval and wondering how to track its status? Knowing where your application stands is crucial for managing your business operations effectively. In this article, we’ll walk you through the process of checking your GST application status quickly and efficiently.

Why Check Your GST Application Status?

Once you’ve applied for GST registration, staying informed about your application status ensures that you’re prepared for the next steps. Whether it’s for filing GST returns, collecting GST from customers, or compliance with government norms, timely updates can save you from unnecessary delays.

A. FAQs on Track Application Status

Q.1: Can I see where my Registration Application stands?

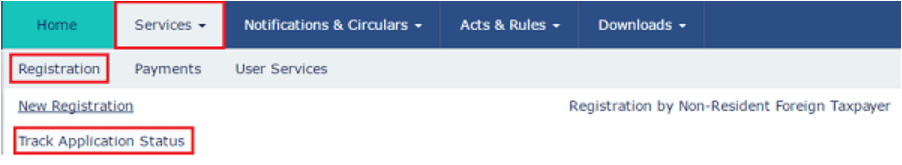

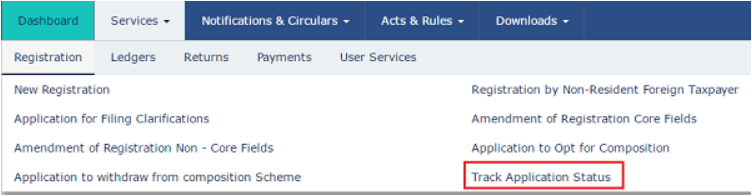

Yes, you can monitor the status by utilizing the GST Portal’s Registration > Services > Track Application Status service.

Q.2: What kinds of application statuses exist?

Enlistment

- ARN Generated – TRN Status at the time the Registration Application was submitted.

- Pending Processing: The Registration Application was submitted successfully.

- When the creation of the challan is initiated (in the case of a casual taxable person), the status of the GSTIN is considered provisional until the registration application is approved.

- Pending Validation: Advertisement Ads by after the Registration Application is submitted until an ARN is generated.

- Validation Error: If the validation is unsuccessful, an error will occur when the Registration Application is submitted until an ARN is generated.

Corrections to Center Fields

- Amendment Application of Registration successfully filed and ARN generated in Pending for Processing.

- Forthcoming for Approval – On accommodation of the Change Application until ARN is produced.

- Approval Blunder – in the event that the approval comes up short, on accommodation of the Alteration Application until ARN is created.

- Track Application Status > Pre Login

I pay my taxes. How might I follow my GST enlistment status of utilization that I have submitted without logging to the GST Gateway?

You will be provided with an Application Reference Number (ARN) after submitting the registration application. This ARN can be used to monitor your application’s GST registration status. Follow these steps to view your ARN’s status without logging into the GST Portal:

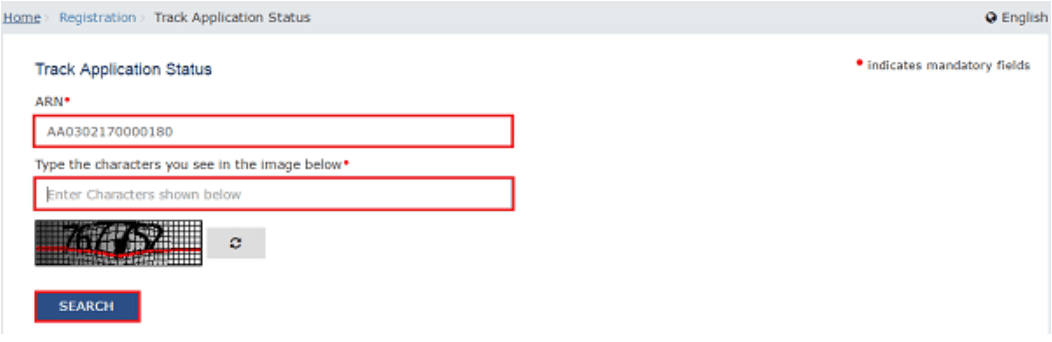

- Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

- Click the Services > Registration > Track Application Status command.

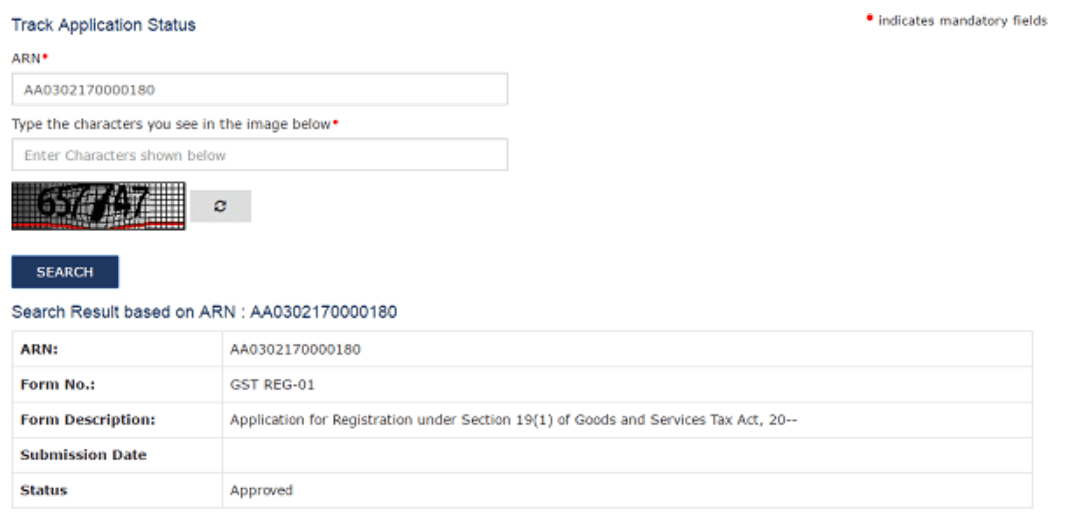

- In the ARN field, enter the ARN received on your e-mail address when you submitted the registration application.

- In the Type the characters you see in the image below field, enter the captcha text.

- Click the SEARCH button.

The Application status is displayed.

C.Track Application Status > Post Login

I pay my taxes. After logging in to the GST Portal, how can I see where my submitted GST application stands?

You will receive an Application Reference Number (ARN) upon application submission. This ARN can be used to track your application’s status. After logging into the GST Portal, follow these steps to view your ARN’s status:

- Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

- Login to the GST Portal with valid credentials.

- Click the Services > Registration > Track Application Status command.

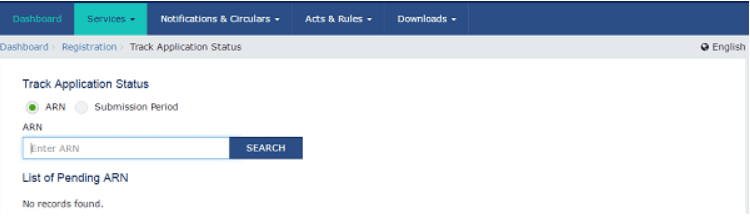

In Case of ARN:

- a) In the ARN field, enter the ARN received on your e-mail address when you submitted the registration application.

- b) Click the SEARCH button.

The Application status is displayed.

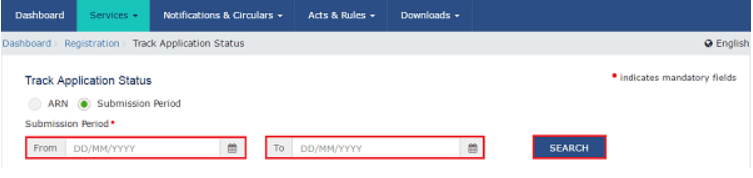

In Case of Submission Period:

- a) Select the Submission Period of the application using the calendar.

- b) Click the SEARCH button.

The Application status is displayed.

To be update with screenshot

- Track Application Status > Login using TRN

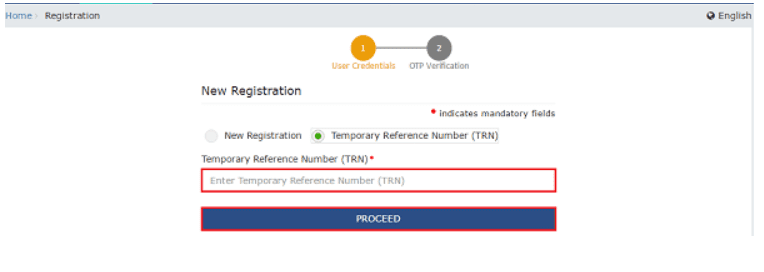

I am a taxpayer. How can I track status of GST registration application that I have submitted after logging to the GST Portal using TRN?

To track status of registration application after logging to the GST Portal using Temporary Reference Number (TRN), perform the following steps.

- Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

- Click the REGISTER NOW link.

- Select the Temporary Reference Number (TRN) option.

- In the Temporary Reference Number (TRN) field, enter the TRN received.

- Click the PROCEED button.

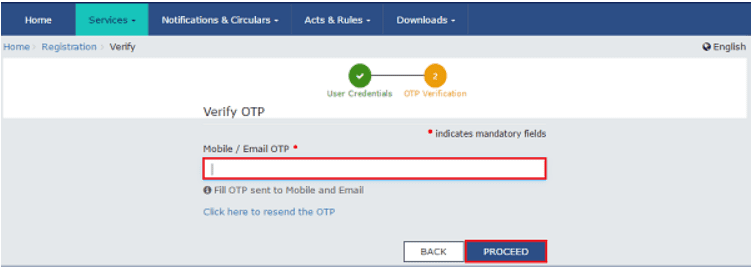

- In the Mobile / Email OTP field, enter the OTP you received on your mobile number and email address. OTP is valid only for 10 minutes.

Note:

OTP sent to mobile number and email address are same.

In case OTP is invalid, try again by clicking the Click here to resend the OTP link. You will receive the OTP on your registered mobile number or email ID again. Enter the newly received OTP again.

- Click the PROCEED button.

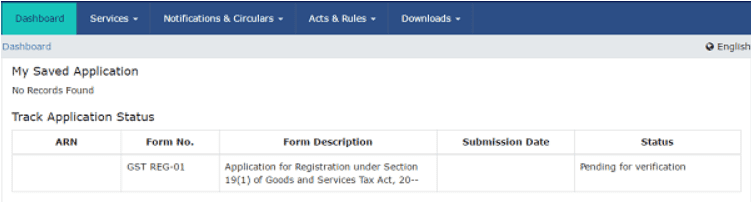

- The My Saved Application page is displayed. You can check the current status of the application under Status column.

Status | Status description |

Draft | When the Application Form is saved but not submitted at the GST Portal |

Active | On the generation of the TRN, Status of TRN becomes Active or Status of GSTIN on approval of application |

Expired | Status of TRN on expiry of 15 days and application form not submitted at the GST Portal |

ARN Generated | Status of TRN on submission of the application form at the GST Portal |

Inactive | Status of the Provisional GSTIN in case of Casual Dealer or Non-Resident Taxable Person on rejection of the application/ Post expiry of the validity period of 90 days |

Provisional | Status of GSTIN, when create challan is initiated (in case of casual taxpayer) till registration form is approved |

Pending for Validation | On submission of the application form until ARN is generated at the GST Portal |

Validation Error | In case the validation fails, on submission of the application form until ARN is generated |

Pending for Processing | Application Form successfully filed at the GST Portal |

Pending for Clarification | Notice is issued for seeking clarification by the Tax Official |

Pending for Order | Application Form resubmitted by the Applicant with the Response/ clarifications to the notice |

Approved | When the Registration Application is approved by the Tax Official |

Rejected | When the Registration Application is rejected by the Tax Official |

Common Issues While Checking GST Application Status

While the process is straightforward, you might face some issues. Here’s how to resolve them:

- Incorrect ARN or SRN: Double-check the number you’ve entered.

- Server Downtime: If the portal is not loading, try accessing it during non-peak hours.

- Pending Documents: Ensure you’ve uploaded all required documents to avoid delays.

The approval process usually takes 7 working days. However, delays can occur if additional clarifications or documents are required.

Yes, if your application status is ‘Pending for Clarification,’ you can make changes and re-submit.

If your application is rejected, you’ll receive a detailed explanation. You can correct the issues and reapply

Owner of this information can be reached at K M GATECHA & CO LLP.

Important note: This does not lead to legal advice or legal opinion and is personal view and for information purpose only. It is prepared on the basis of facts available and applicable law.It is suggested to go through applicable provisions of law,latest regulations,judicial announcements, circulars, notifications and clarifications etc before taking any action based on above content.You agree here by that for any action taken on basis of above information in any manner writer or K M GATECHA & CO LLP is not responsible or liable for any omission,reliability,accuracy,completeness,errors or authenticity.This work by professional is just for knowledge purpose and does not constitute any kind of solicitation of work or advertisement.

Table of Contents

Toggle