The income derived from selling a capital asset included in the block of assets on which depreciation has been permitted according to the Income Tax Act constitutes a capital gain.

The determination of capital gain or loss resulting from the sale of depreciable assets can be categorized into two categories:

- When certain assets are sold from the block of assets.

- When the entirety of assets within the block is transferred, And the block of assets ceases to exist

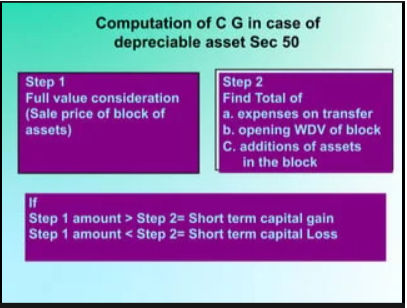

Calculating the capital gain when a part of the asset block is transferred.

Situation I

- When net sale consideration on such asset’s sale is reduced from the written down value (initial WDV + cost of assets acquired if any) of the block of the assets.

- The written-down value of the asset block reaches Nil, noting that the written-down value can be Nil but not negative.

- In that case, the profit from such a transfer of a capital asset will be classified as a short-term capital gain.

Computation of short-term capital gain:

Sale consideration

xxx

Less

Opening written down value of the block

xxx

Less

Actual cost of any asset acquired during the financial year

xxx

Short-term capital gain

xxx

Situation II

- When the net proceeds from the sale of the asset are reduced from the written down value (initial WDV + the cost of acquired assets, if applicable) of the asset block.

- And the written down value of the asset block is not zero.

- There is no capital gain from the asset transfer.

- Therefore, regular depreciation will be permitted.

Calculation of capital gain where all the assets of the block are transferred:

Situation III

- If the entire asset block is sold, and the selling price is lower than the written down value (initial WDV + cost of acquired assets, if any) of the asset block:

- It results in a short-term capital loss from the sale of the asset block.

- Additionally, no depreciation will be permitted from this asset block.

Computation of short-term capital loss:

Opening written down value of the block

xxx

Add

Actual cost of the asset acquired

xxx

Less

Sale consideration

xxx

Short-term capital loss

xxx

Situation IV

- If the entire asset block is sold, and the selling price exceeds the written down value (initial WDV + cost of acquired assets, if any) of the asset block:

- The proceeds from such a sale of the asset block constitute a short-term capital gain.

Computation of short-term capital gain:

Sale consideration

xxx

Less

Opening written down value of the block

xxx

Less

Actual cost of the asset acquired

xxx

Short-term capital gain

xxx

FAQs

- Is capital gain applicable on depreciable assets?

- The capital gain or loss from the transfer of depreciable assets is consistently treated as short-term capital gain or loss.

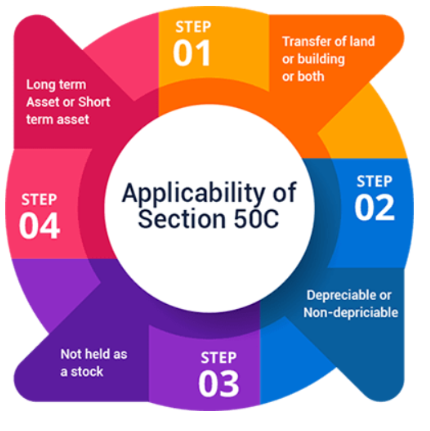

- Is Section 50C applicable on depreciable assets?

- Section 50C specifically pertains to land, buildings, or a combination of both. It utilizes the value determined by the Stamp Valuation Authority (SVA) – used for assessing stamp duty during property registration – as a reference point to ascertain whether the sale agreement undervalues the land or building.

- What is Section 50 of the Income Tax Act 1961?

- Section 50 outlines the statutory guidelines for computing capital gains related to depreciable assets. The Finance Act of 2022 introduced amendments to this section. The provisions within Section 50 of the Income Tax Act are interpreted in conjunction with the Income Tax rules of 1962.

- What is Section 50C of capital gains?

- Section 50C addresses the calculation of capital gains arising from the sale of land, buildings, or both, held as capital assets. According to this section, the sale consideration value cannot be lower than the stamp duty value evaluated by the Stamp Valuation Authority.

- What is the exception to Section 50C?

- Under such circumstances, the value adopted or appraised by the Stamp Valuation Authority will be considered the fair market value of the asset at the transfer date. Section 50C also includes a notable provision exempting cases where the transfer of the capital asset occurs between relatives.

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.

Table of Contents

Toggle