The Central Board of Direct Taxes introduced Rule 17AA through Income Tax Notification No. 94/2022 dated August 10, 2022. This rule outlines the specific books of account and other necessary documents that must be maintained by every fund, institution, trust, university, educational institution, hospital, medical institution, or non-governmental organization, as mandated by section 12A(1)(b)(i) or under clause (a) of the tenth proviso to section 10(23C).

- Ledger books and other records can be maintained in written, digital, or electronic formats, including printouts derived from electronically stored data, or any other electromagnetic data storage device. Additionally, they can be kept at any location in India determined by the management.

- Non-governmental organizations must uphold books of accounts and other documents at their registered office as resolved. These records should be maintained in the required format, location, and manner.

- However adopting a resolution, it’s mandatory to notify the jurisdictional AO in writing within 7 days, providing the complete address of the alternative location.

- Books of accounts and other documents need to be preserved and maintained for a minimum of 10 years after the relevant Assessment Year.

- Non-governmental organizations need to consider that Rule 17AA, introduced by the Finance Act of 2022, imposes the obligation of maintaining and preserving books of accounts and other records on all funds, organizations, trusts, colleges, educational institutions, hospitals, and healthcare facilities. Apart from books of accounts, additional records encompass details about projects and institutions, income from various sources, income applications, accumulated or reserved income, investments or deposits, received voluntary contributions, corpus received, documented loans and borrowings, records of specific individuals, etc.

-

Books of Accounts are required be maintained by NGO

The following books of accounts are required to be maintained by a trust, institution, or non-governmental organization registered under Section 10(23C) or Section 12A:

- Ledger, cash book, journal.

- Original bills and receipts pertaining to NGO expenses.

- Bills or counterfoils of receipts issued by the NGO/Assessee.

- Any other book necessary to accurately present the state of affairs and elucidate the conducted transactions.

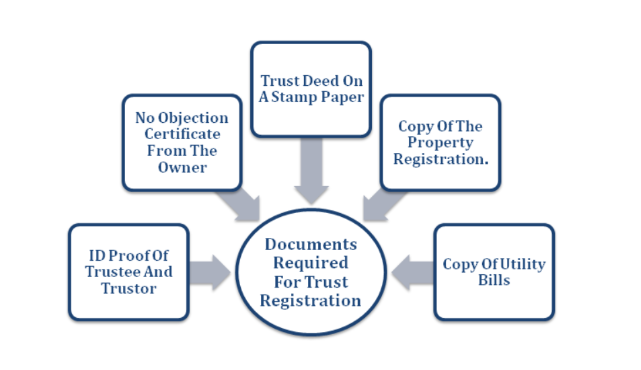

Other associated documents are necessary to be maintained by a trust, institution, or non-governmental organization registered under Section 10(23C) or Section 12A.

- Documents and related records detailing all projects and institutions administered by the entity, containing their names, addresses, and objectives.

- Any other records pertaining to the entity’s income during the preceding year, encompassing details of voluntary contributions, income from trust-held property, and any other income.

- Documents and related records concerning the utilization of income.

- Records regarding the utilization of accumulated income.

- Documents and related records of voluntary contributions specifically designated to constitute part of the corpus.

- Documents regarding provisions under 80G(2)(b).

- Records related to contributions received for the renovation or repair of religious institutions as notified under specific sections.

- Documents and related records of loans and borrowings.

- Documents and related records of properties owned by the NGO/Assessee.

- Records of specified or related individuals as specified under Section 13(3) for the NGO.

Conclusion

– Above said income tax provision is introduced to mandate the maintenance of books of accounts by specified individuals engaged in business or profession, as per the regulations outlined in Income Tax Act Section 44AA along with Rule 6F or related rules.

– As per the Central Board of Direct Taxes’ notification of New Rule 17AA, the mentioned accounts, books, and associated documents are obligatory for NGOs or Trusts to maintain in the specified format, manner, and at the designated location of the NGO’s office.

– It’s essential to note that, except for Trusts or NGOs with donation income below Rs 250,000 in a financial year, there’s no distinction made between smaller or larger entities concerning the maintenance of these books of accounts and other records per Rule 17AA. Charitable trusts and NGOs, regardless of size, are expected to retain a substantial array of documentation, encompassing project records, received donations (in time or funds), details of loans and investments, and more.

– Smaller trusts and NGOs are likely to face challenges in complying with the comprehensive record-keeping requirements of Rule 17AA, resulting in increased compliance costs and potential difficulties in adherence.

– Despite being regulatory necessities, these records don’t mandate the use of expensive software. Even simple tools like Excel spreadsheets suffice for record-keeping. However, adherence to these rules is imperative.

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.

Table of Contents

Toggle