- Section 285BA of the Income Tax Act, 1961, governs the requirement for specified persons, assesses, prescribed officers, and authorities to furnish Statement of Financial Transactions (SFT).

- The concept of SFT was introduced in the Income Tax Law to monitor high-value transactions carried out by taxpayers.

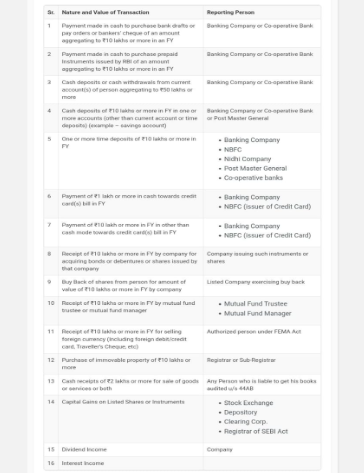

Transactions required to be reported

Due Date of Furnishing SFT

- The filing deadline for Statement of Financial Transactions (SFT) is on or before the 31st of May, immediately following the fiscal year.

- SFT needs to be submitted electronically in Form 61A.

- The designated recipients for the SFT are the Director or Joint Director of Income Tax Intelligence and Criminal Investigation.

- Failure to furnish the SFT will result in a penalty of ₹500 per day of default under section 271FA.

- Additionally, authorities reserve the right to direct individuals to file the SFT within 30 days from the date of notice served. Failure to comply may lead to a penalty of ₹1,000 per day of default.

Consequences of Inaccuracy

If a person discovers inaccuracies in the filed SFT and fails to inform and rectify them within 10 days, the Income Tax Authorities may impose a penalty of ₹50,000.

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.