Leave Encashment – Tax Exemption, Calculation & Formula With Example, Rules

Have you heard of the term ‘leave encashment’?

Leave encashment is a familiar concept among salaried individuals, allowing employees to convert their unused leave into income. It essentially means that even your unused leave days can bring you financial benefits.

Read on to learn more about the meaning and tax implications of leave encashment for employees.

Budget 2023 Update

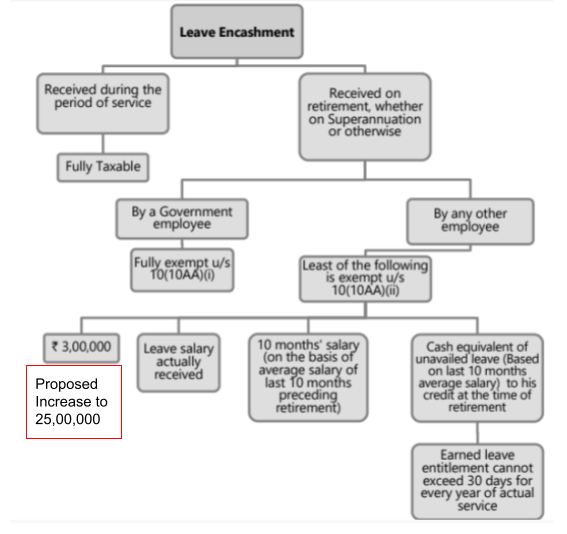

For non-government employees, leave encashment is exempt up to a specified limit. Previously set at Rs. 3 lakh since 2002, this limit has now been increased to Rs. 25 lakh, reflecting the general rise in salary income.

What is Leave Encashment?

As per labor law, every salaried person is entitled to a minimum number of paid leave days each year. However, it is not always necessary for an individual employee to use all the leave they are entitled to within the year. Many employers allow employees to carry forward their unused paid leave.

This practice often results in an accumulated balance of unused leave at the time of an employee’s retirement or resignation. Employers then compensate employees for their unused paid leave, a process known as leave encashment.

What are the Types of Leaves?

The types of leaves available to employees are specified in a company’s leave policy, which can vary between organizations. Here are the common types of leaves generally available to employees:

- Casual Leave:

- Typically available for 7 to 10 days.

- Can be used for personal reasons.

- Encashment policies for casual leave vary between companies.

- Earned Leave or Privilege Leave:

- Requires prior notice to the authority.

- Eligible for encashment after a specific period.

- Encashment policies differ between organizations.

- Medical Leave:

- For when employees are unable to perform their duties due to health conditions.

- Employees must inform the employer about these leaves.

- The maximum number of medical leave days varies by company.

- Holiday Leave:

- Granted by employers without salary deduction.

- The number of holiday leave days varies between companies.

- Maternity Leave:

- Available only for female employees.

- Ranges from 12 to 26 weeks during pregnancy.

- Employees can request an extension, but it is usually unpaid.

- Not eligible for encashment.

- Sabbaticals:

- For employees to upskill or expand their knowledge.

- Employees can enroll in courses, and the employer may reimburse these leaves.

Taxation of Leave Encashment

Leave Encashment Received During Service

Leave encashment received by employees during their service is fully taxable and is considered part of ‘Income from Salary’. However, employees can claim some tax benefits under Section 89 of the Income Tax Act. To claim this tax relief, you must fill out Form 10E. This form can be completed and submitted online on the income tax portal.

Leave Encashment Received at the Time of Retirement or Resignation

You can claim partial or complete exemption of leave encashment received at the time of retirement or resignation under the following conditions:

Leave encashment received by | Taxability |

State and Central Government employees | Fully tax-exempt |

Non-government employees | Partly exempt and partly taxable. The exemption is based on the calculation specified in Section 10(10AA)(ii). |

Legal heir of a deceased employee | Fully tax-exempt Leave encashment amount received by the Legal heir of a deceased employee is fully tax-exempt in the hands of the legal heirs. |

Leave Encashment Calculation

The formula for calculating the leave encashment exemption for non-government employees is:

The proposed limit increase from Rs 3 lakh to Rs 25 lakh has been incorporated.

Particulars | Amount (Rs) |

Leave encashment received (A) | XXXX |

Less: Exemption under Section 10(10AA) – (B) Least of the following: | XXXX |

i) Amount notified by the Government** Rs 25,00,000 (C) ii) Actual leave encashment amount (D) iii) Average salary* of last 10 months (E) iv) Salary per day *unutilised leave (considering maximum 30 days leave per year) for every year of completed service (F) | 25,00,000 XXXX XXXX XXXX |

Leave encashment taxable – (A) – (B) | XXXX |

Salary for this purpose includes basic salary, dearness allowance, and commission based on a fixed percentage of turnover secured by the employee.

Specified Amount Limit

The specified amount of Rs 25,00,000 is the total exemption allowed, regardless of the frequency of leave encashment received by the employee from various employers. For instance, if an employee has already utilized Rs 5,00,000 at the time of their first resignation, they are only entitled to use the remaining Rs 20,00,000 for exemption computation in subsequent instances. Thus, an employee is allowed a total exemption of Rs 25,00,000 for leave encashed from all employers.

Notes:

- If leave encashment is received from two or more employers in the same previous year, the maximum exemption amount is capped at Rs 25,00,000.

- Exemption under section 10(10AA) is available to an assessee regardless of the tax regime under which they pay taxes.

Leave Encashment Exemption Illustration

To understand leave encashment exemption, let’s look at an example:

The proposed limit increase from Rs 3 lakh to Rs 25 lakh has been incorporated.

Example:

Mr. XYZ is retiring after 15 years of service.

- Mr. XYZ was entitled to 35 days of paid leave per year from his employer, amounting to a total of 525 days of leave over his entire service period (35 days/year * 15 years).

- Mr. XYZ has already utilized 200 days of paid leave, leaving him with 325 days of unutilized leave.

- At the time of retirement, Mr. XYZ’s basic salary plus dearness allowance (DA) was Rs 33,000 per month.

- Mr. XYZ received Rs 3,57,500 as leave encashment, calculated based on 325 days * Rs 1,100 per day (where Rs 1,100 is the daily salary, i.e., Rs 33,000/30 days).

Using the leave encashment exemption formula, Mr. XYZ’s exemption would be the minimum of the following:

- Actual Leave Encashment Received: Rs 3,57,500

- Leave Salary for the Earned Leave Period: Based on 10 months’ average salary prior to retirement

- Maximum Limit: Rs 25 lakh

- Cash Equivalent of Leave: Amount equivalent to 325 days’ leave

Given the new proposed limit of Rs 25 lakh, Mr. XYZ’s entire leave encashment of Rs 3,57,500 would be exempt from tax, as it is well within the Rs 25 lakh limit.

Particulars | Amount (in Rs) |

Leave encashment received | 3,57,500 (325 days* Rs 1,100) |

Less: Exempt | 2,75,000 |

Least of the following: 1. Amount notified by the Government 2. Actual leave encashment 3. Average salary for 10 months= Rs 33,000 * 10 months 4. Rs 1,100 * (30 days * 15 completed years of service minus 200 days of utilised leave) | 25,00,000 3,57,500 3,30,000 2,75,000 |

Leave encashment taxable as ‘income from salary | 82,500 |

Based on the employer’s leave encashment policy and an individual’s income, tax planning can be optimized by deciding whether it is more beneficial to encash leave annually or to receive a lump sum at the time of retirement or resignation.

One should also consider the impact of inflation before making this decision.

FAQ’s

Is leave encashment taxable?

Yes, leave encashment is subject to taxation. However, the specific taxation conditions vary depending on the sector and the employer.

Are leave encashment and leave salary the same?

Leave salary is a portion of leave encashment that accumulates over time and is later redeemed for cash.

Is there a change in the leave encashment limit in 2023?

Yes, one of the exemption criteria limits for non-government employees has been raised from Rs 3 lakh to Rs 25 lakh.

Can I use the entire limit of Rs.25,00,000 for leave encashment if I have availed of the exemption earlier?

No, the limit of Rs. 25,00,000 applies over the lifetime. Whenever you claim the exemption over the years, the limit of Rs. 25,00,000 will be reduced by the amount exempted earlier. The total amount exempted shall not exceed Rs. 25,00,000.

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.

Table of Contents

Toggle