As the Income Tax Return filing deadline nears, you might be wondering if you can switch between the old and new tax regimes while filing your returns. The answer is YES. The new tax regime was introduced in Budget 2020 and later updated in Budget 2023. To learn more and understand the process, check out our article.

Old Tax Regime

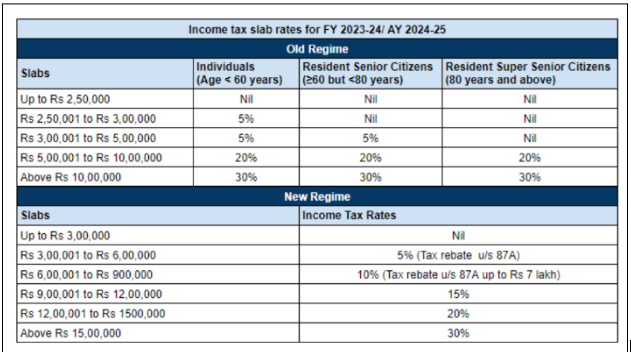

The old tax regime allows taxpayers to claim exemptions and deductions on various expenses like investments, insurance premiums, and housing loans under Section 80 and others. It benefits those with higher investments and deductible expenses.

New Tax Regime

The new tax regime was introduced in the 2020 budget and updated in the 2023 budget. It offers lower tax rates and raises the basic exemption limit from ₹2,50,000 to ₹3,00,000. However, this regime allows only a few deductions, such as section 80CCD(2) for individuals and section 80JJA for businesses.

You can find the tax slabs for both the new and old tax regimes in the image below.

Changing Your Tax Regime While Filing Income Tax Return

With the introduction of the new tax regime, it has become the default option for tax calculations. If you don’t actively choose a tax regime, your taxes will automatically be calculated under this new regime. However, you have the option to switch back to the old tax regime before the deadline for filing your Income Tax Return (ITR) for the relevant Assessment Year (AY).

It’s important to note that you can change your tax regime every year. However, if you earn income from a business or profession, you can only switch between the two regimes once during your lifetime.

How to Change Your Tax Regime While Filing Income Tax Return

Changing your tax regime is easy. When filling out ITR-1 or ITR-2 forms, you will see a question: “Do you wish to opt out of the new tax regime (the default option is ‘No’)?”. If you select ‘No’, you will file your return under the new tax regime. If you select ‘Yes’, you will switch to the old tax regime.

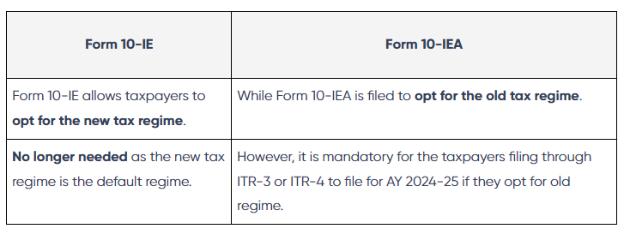

For ITR-3 and ITR-4 forms, if you want to switch from the new tax regime to the old one, you need to file Form 10-IEA before the due date, which is July 31, 2024.

Form 10-IE vs. Form 10-IEA

If you’re unsure about which form to file for Assessment Year 2024-25—Form 10-IE or Form 10-IEA—here’s a clear explanation of the differences between the two.

If you’re unsure about which form to file for Assessment Year 2024-25—Form 10-IE or Form 10-IEA—here’s a clear explanation of the differences between the two.

Things to Remember When Switching Tax Regimes

Switching between tax regimes is an important decision. When you change your tax regime, your tax liability and basic exemption limit will also change. Before making this switch, keep these points in mind:

- Understand Your Tax Regime: It’s essential to fully understand the different tax regimes before choosing one. Look at the available deductions, exemptions, and tax rates to maximize your savings.

- Evaluate Your Tax Liability: Determine how much tax you will need to pay based on your income and available deductions. You can use our income tax calculator to help you with this.

- Impact on Investments and Savings: Consider how changing regimes will affect your investments, savings, and overall financial plan. Be aware that some investments may not qualify for deductions under the new tax regime.

- Keep Your Documents Ready: Ensure you have all the necessary documents to prove your income sources, deductions, and exemptions when filing your tax returns.

- Plan for the Future: Think about your future financial goals and whether changing regimes will impact them. Consider significant life events and long-term investments to ensure your tax planning aligns with your chosen regime.

Conclusion

You can switch between tax regimes, but it’s crucial to think about your tax planning, long-term goals, and investments before doing so. We make it easy to file your taxes quickly and can help you choose the best tax regime for your situation.

Table of Contents

Toggle