What is an Appeal?

An appeal refers to a legal application submitted to a higher court, seeking the reversal of a decision made by a lower court. Appeals typically arise in cases of legal disputes where one party contests the decision.

What are Disputes?

Disputes occur when there is a disagreement regarding obligations imposed by tax laws (or any other laws). These obligations can be divided into two categories: tax-related and procedural. Tax officers verify a taxpayer’s compliance with these obligations through audits, anti-evasion measures, examinations, etc. Sometimes, there may be instances of actual or perceived non-compliance. If the difference in opinion between the taxpayer and the tax authorities persists, it leads to a dispute, which must be resolved.

The resolution process begins with a quasi-judicial process led by a departmental officer, resulting in an initial order, known by various names such as an assessment order, adjudication order, or order-in-original. Under the GST Act, the term “adjudicating authority” refers to any authority authorized to issue decisions or orders under the Act, excluding the Board, First Appellate Authority, and Appellate Tribunal. Hence, any decision or order issued under the GST Act is considered an “adjudication.” Examples of such decisions include cancellation of registration, best judgment assessments, refund claims, or the imposition of penalties.

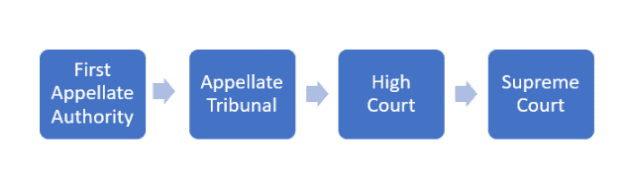

Steps of Appeals under GST

Here is the hierarchy of appeals under the GST framework:

Appeal Level | Orders Passed By | Appeal To | Relevant Sections |

1st | Adjudicating Authority | First Appellate Authority | Section 107 |

2nd | First Appellate Authority | Appellate Tribunal | Sections 109, 110 |

3rd | Appellate Tribunal | High Court | Sections 111-116 |

4th | High Court | Supreme Court | Sections 117-118 |

This framework helps resolve disputes arising under the GST law, ensuring a structured process for appealing decisions.

Should Every Appeal Be Made to Both CGST and SGST Authorities?

No, it is not necessary. According to the GST Act, both CGST and SGST/UTGST officers have the authority to issue orders. An order issued under CGST is also considered applicable to SGST. However, if a CGST officer has issued an order, any appeal, review, revision, or rectification related to that order must be addressed solely to the CGST officers. Likewise, for any order issued by an SGST officer, the corresponding appeal, review, revision, or rectification should be directed only to the relevant SGST officer.

Filing a GST Appeals

To initiate an appeal under GST to the Appellate Authority, you can follow the procedures outlined in this article.

Time Limit for Filing a GST Appeals

An appeal can be filed with the Appellate Authority within three months from the date the disputed order is communicated. Additionally, the Appellate Authority may allow a delay of up to one month if they find sufficient grounds for the delay.

General Rules for Filing GST Appeals

All appeals must be submitted using the prescribed forms along with the required fees. The fees will consist of the total amount of tax, interest, fines, fees, and penalties from the disputed order, as acknowledged by the appellant, plus 10% of the contested amount. If an officer or the Commissioner of GST is appealing, no fees will be charged.

Can an Authorized Representative Appear in Court?

Yes, an individual required to appear before a GST Officer, First Appellate Authority, or Appellate Tribunal can designate an authorized representative to attend on their behalf unless personal appearance is mandated by the Act. An authorized representative can be:

- A relative

- A regular employee

- A lawyer practicing in any court within India

- A chartered accountant, cost accountant, or company secretary with a valid certificate of practice

- A retired officer from the Tax Department of any State Government or the Excise Department, holding at least the rank of a Group-B gazetted officer

- A tax return preparer

Note that retired officers are not permitted to represent the concerned individual within one year of their retirement.

Appeals That Cannot Be Filed

The Board or the State Government may establish monetary limits for appeals based on recommendations from the Council to regulate the appeal process and minimize unnecessary litigation costs. However, not all decisions are eligible for appeal. The following decisions made by a GST officer cannot be contested:

- An order transferring proceedings from one officer to another

- An order to seize or retain books of accounts and other documents

- An order permitting prosecution under the Act

- An order allowing the payment of tax and other amounts in installments

If a person disagrees with a decision or order issued against them under GST by an adjudicating authority, they can appeal to the First Appellate Authority. Should they remain dissatisfied with the First Appellate Authority’s decision, they have the option to appeal to the National Appellate Tribunal, followed by the High Court, and ultimately, the Supreme Court.

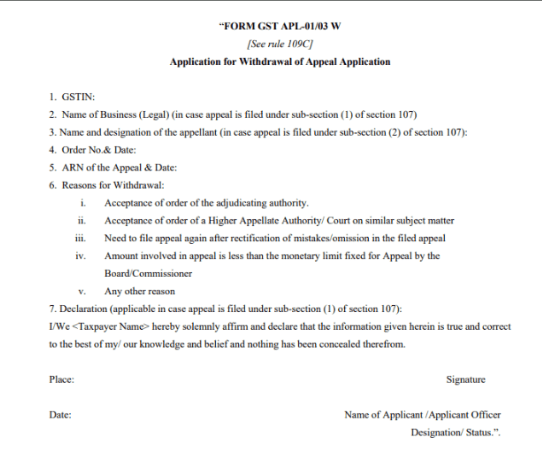

Withdrawal of a GST Appeals

During the 48th GST Council meeting, a decision was made to allow the withdrawal of a GST appeals that has already been filed. This initiative aims to decrease the litigation burden on appellate authorities. Consequently, a new Rule 109C was introduced in the CGST Rules through Notification No. 26/2022-Central Tax.

According to Rule 109C, the applicant may submit a request for the withdrawal of an appeal at any time before the issuance of a show-cause notice or order under Section 107(11), whichever occurs first. This applies to any appeal filed using Form GST APL-01 or Form GST APL-03. The request for withdrawal must be submitted using the new Form GST APL-01/03W.

It is crucial to mention that if the final acknowledgment in Form GST APL-02 has already been issued, the withdrawal of the appeal will necessitate the approval of the appellate authority. The appellate authority is required to make a decision on the application for withdrawal within seven days of receiving the request from the applicant. Additionally, any new appeal filed by the appellant after this withdrawal must adhere to the time limits established under Section 107.

FAQs

- What is the purpose of filing an appeal under GST?

Filing an appeal allows a taxpayer to challenge a decision made by a GST officer that they believe is incorrect or unjust. This process ensures that taxpayers have a means to seek redress and uphold their rights under the law. - How can I check the status of my GST appeal?

You can check the status of your GST appeals by visiting the official GST portal and navigating to the appeals section. You’ll need your acknowledgment number to track the progress. - Is there a specific format for submitting a GST appeal?

Yes, GST appeals must be filed using the prescribed forms (Form GST APL-01 or Form GST APL-03) along with the necessary fees. Ensure all required details are filled out correctly. - Can I represent myself in a GST appeal?

Yes, you have the right to represent yourself in a GST appeal. However, you may also choose to appoint an authorized representative, such as a lawyer or a chartered accountant, to assist you in the process. - What happens if I miss the deadline for filing an appeal?

If you miss the deadline, you may still request a delay condonation from the Appellate Authority. They may accept your appeal if you can provide valid reasons for the delay, but there is no guarantee of acceptance. - Are there any fees associated with filing a GST appeal?

Yes, there are fees associated with filing a GST appeal, which typically include the total amount of tax, interest, penalties, and an additional 10% of the disputed amount. - Can I appeal against an interim order made by a GST officer?

Generally, interim orders may not be subject to appeal. However, you should consult the specific provisions under the GST Act or seek legal advice for clarification. - What is the process for withdrawing a GST appeal?

You can withdraw a GST appeal by submitting an application using the new Form GST APL-01/03W before a show-cause notice or order is issued. If your appeal has received a final acknowledgment, approval from the appellate authority is required.

Table of Contents

Toggle