Lately, there has been considerable attention on a new provision introduced under Section 80G of the Income Tax Act, 1961, particularly concerning Form 10BD and Form 10BE. If you contribute to charitable organizations and wish to claim deductions under Section 80G, Form 10BE plays a key role. Here’s a detailed overview to help you understand what Form 10BE is and how it works.

Understanding Form 10BE in Income Tax

Form 10BE acts as a certification mechanism to ensure that the donations reported by charitable institutions align with the deduction claims made by taxpayers. After a charitable institution files Form 10BD (the donation statement), it must generate and provide Form 10BE to the donor. This certificate serves as official proof for the donor to validate their claim under Section 80G.

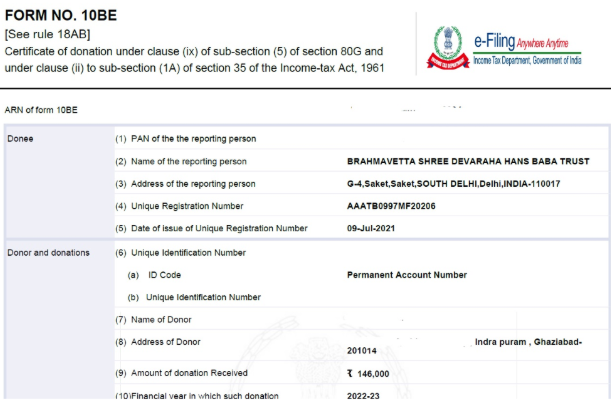

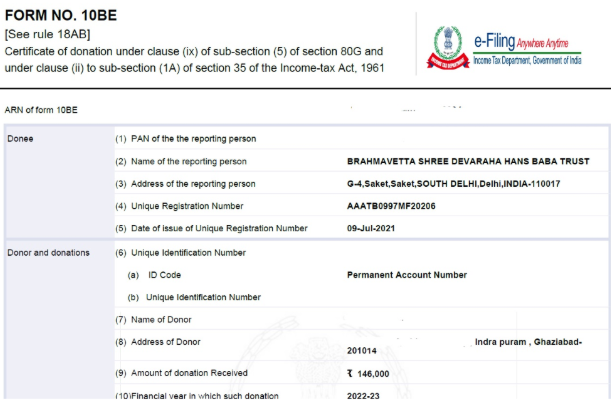

Form 10BE includes comprehensive details about both the donor and the donee institution. The information captured in the certificate includes:

- PAN of the donor

- Name of the charitable institution

- Address of the institution

- Name of the donor

- Date of institution’s approval

- Unique identification of the donor (Aadhaar, PAN, etc.)

- Address of the donor

- Financial year of donation

- Type of donation (Corpus fund, specific grant, others)

- Applicable deduction section (e.g., Section 80G(5)(vi), Section 35(1)(ii), Section 35(1)(iii), or Section 35(1)(iia))

- Total amount donated

A sample of Form 10BE, as issued by institutions registered under Section 80G, will resemble this format and include all the above details.

Due Date for Form 10BE

The due date for issuing Form 10BE aligns with the deadline for submitting Form 10BD. Charitable institutions are required to issue Form 10BE on or before May 31st of the financial year following the year in which the donation was received.

To meet this deadline, it is essential that institutions file Form 10BD in advance, allowing sufficient time for Form 10BE to be generated. Here’s an example to clarify the process:

Suppose a donor contributes ₹1 lakh in June 2024. This donation falls under the financial year 2024–2025. The charitable trust must file Form 10BD and issue Form 10BE on or before May 31st, 2025. When the donor files their Income Tax Return (ITR) for FY 2024–25, they must include the details mentioned in the donation certificate (Form 10BE).

Failing to issue Form 10BE by the prescribed deadline can lead to financial penalties. According to Section 234G of the Income Tax Act, a penalty of ₹200 per day of delay may be imposed on the charitable institution.

Filing Form 10BD for Issuing Form 10BE

Previously, donors could claim deductions under Section 80G simply by submitting a receipt issued by the NGO or charitable organization. However, with the updated regulation, donee institutions are now required to file Form 10BD and subsequently issue Form 10BE to validate the donor’s claim.

Additionally, the institution’s funds must fall under any of the following sections:

- Section 35(1A)(i) of the Income Tax Act

- Section 80G(5)(viii) of the Income Tax Act

How to File Form 10BD

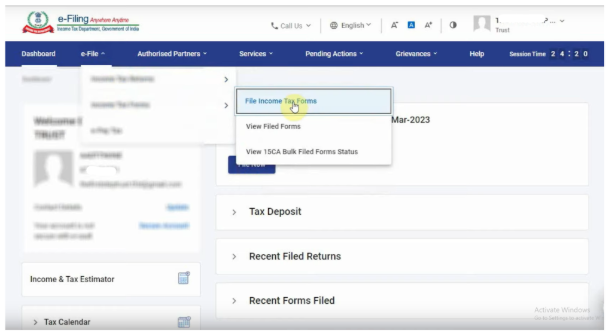

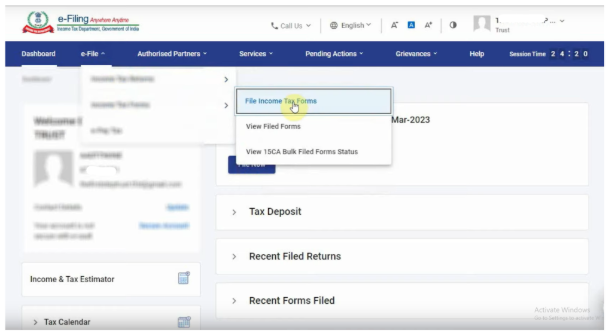

- Log in to the Income Tax e-filing portal.

- Go to the ‘e-File’ tab.

- Click on ‘File Income Tax Forms’.

- Select Form 10BD from the list and proceed with filing.

Enter all required information in each section, including “Basic Information,” “Donor and Donation Details,” and “Verification.”

Once completed, save the file in CSV format and click the “Preview” button. After e-verification, submit the form.

Once Form 10BD is successfully submitted, Form 10BE can be easily obtained.

How To Download Form 10BE From Income Tax Site?

The process of downloading Form 10BE is straightforward. You can effortlessly get it from the official Income Tax Department website.

Here’s how:

Go to the official Income Tax Department portal and log in using your valid credentials.

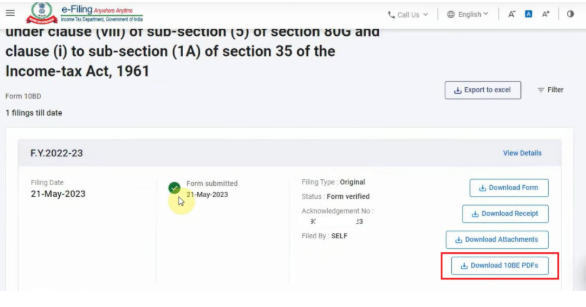

From the “e-file” tab, choose “Income tax forms”.

Next, from the drop-down menu, click on “View filed forms”.

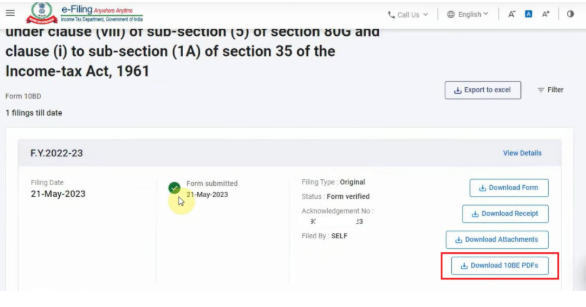

A new page will open displaying all the forms filed so far.

Locate the Form 10BD section and click on the “View all” option.

Finally, click on “Download 10BE PDF” to download the certificate. Please note, this option becomes available 24 hours after filing Form 10BD online.

Conclusion

From the above information, it’s clear that to claim a deduction under Section 80G for donations made during a financial year, the charitable institution must issue Form 10BE. According to the new regulations, obtaining the donation certificate or Form 10BE after filing Form 10BD is essential to claim deductions.

Need Help?

FAQ’s

1. What documents are needed to file Form 15CA?

To download Form 10BE, log in to the Income Tax portal and navigate to:

e-file > Income Tax Forms > View Filed Forms > Click on Form 10BD > Download 10BE PDFs.

Which document is required to claim a deduction under Section 80G?

Form 10BE, issued by the registered trust or institution, is mandatory to claim a deduction under Section 80G.

What is Form 10BE for a trust?

Form 10BE is a certificate issued by a registered Trust or Institution, confirming a donation received. It enables the donor to claim a deduction under Section 80G. This form is issued after the Trust files Form 10BD—a statement of donations received.

Is there any penalty for non-issuance of Form 10BE?

Yes, a penalty of ₹200 per day is levied for each day the failure to issue Form 10BE continues.

What is the due date for issuing a certificate in Form 10BE?

Form 10BE must be issued to donors by May 31st following the financial year in which the donation was received.

6. Do I need to file Form 15CB before submitting Form 15CA (Part C)?

Yes. If you’re filing Part C of Form 15CA, you must first file and e-verify Form 15CB. The Acknowledgement Number of Form 15CB is necessary to pre-fill the relevant details in Form 15CA.

7. How is Form 15CA e-verified?

How can I download Form 10BE from the Income Tax Portal?Form 15CA can be e-verified using either a Digital Signature Certificate (DSC) or an Electronic Verification Code (EVC). However, if a DSC is registered, it must be used for verification.

Lately, there has been considerable attention on a new provision introduced under Section 80G of the Income Tax Act, 1961, particularly concerning Form 10BD and Form 10BE. If you contribute to charitable organizations and wish to claim deductions under Section 80G, Form 10BE plays a key role. Here’s a detailed overview to help you understand what Form 10BE is and how it works.

Understanding Form 10BE in Income Tax

Form 10BE acts as a certification mechanism to ensure that the donations reported by charitable institutions align with the deduction claims made by taxpayers. After a charitable institution files Form 10BD (the donation statement), it must generate and provide Form 10BE to the donor. This certificate serves as official proof for the donor to validate their claim under Section 80G.

Form 10BE includes comprehensive details about both the donor and the donee institution. The information captured in the certificate includes:

- PAN of the donor

- Name of the charitable institution

- Address of the institution

- Name of the donor

- Date of institution’s approval

- Unique identification of the donor (Aadhaar, PAN, etc.)

- Address of the donor

- Financial year of donation

- Type of donation (Corpus fund, specific grant, others)

- Applicable deduction section (e.g., Section 80G(5)(vi), Section 35(1)(ii), Section 35(1)(iii), or Section 35(1)(iia))

- Total amount donated

A sample of Form 10BE, as issued by institutions registered under Section 80G, will resemble this format and include all the above details.

Due Date for Form 10BE

The due date for issuing Form 10BE aligns with the deadline for submitting Form 10BD. Charitable institutions are required to issue Form 10BE on or before May 31st of the financial year following the year in which the donation was received.

To meet this deadline, it is essential that institutions file Form 10BD in advance, allowing sufficient time for Form 10BE to be generated. Here’s an example to clarify the process:

Suppose a donor contributes ₹1 lakh in June 2024. This donation falls under the financial year 2024–2025. The charitable trust must file Form 10BD and issue Form 10BE on or before May 31st, 2025. When the donor files their Income Tax Return (ITR) for FY 2024–25, they must include the details mentioned in the donation certificate (Form 10BE).

Failing to issue Form 10BE by the prescribed deadline can lead to financial penalties. According to Section 234G of the Income Tax Act, a penalty of ₹200 per day of delay may be imposed on the charitable institution.

Filing Form 10BD for Issuing Form 10BE

Previously, donors could claim deductions under Section 80G simply by submitting a receipt issued by the NGO or charitable organization. However, with the updated regulation, donee institutions are now required to file Form 10BD and subsequently issue Form 10BE to validate the donor’s claim.

Additionally, the institution’s funds must fall under any of the following sections:

- Section 35(1A)(i) of the Income Tax Act

- Section 80G(5)(viii) of the Income Tax Act

How to File Form 10BD

- Log in to the Income Tax e-filing portal.

- Go to the ‘e-File’ tab.

- Click on ‘File Income Tax Forms’.

- Select Form 10BD from the list and proceed with filing.

Enter all required information in each section, including “Basic Information,” “Donor and Donation Details,” and “Verification.”

Once completed, save the file in CSV format and click the “Preview” button. After e-verification, submit the form.

Once Form 10BD is successfully submitted, Form 10BE can be easily obtained.

How To Download Form 10BE From Income Tax Site?

The process of downloading Form 10BE is straightforward. You can effortlessly get it from the official Income Tax Department website.

Here’s how:

Go to the official Income Tax Department portal and log in using your valid credentials.

From the “e-file” tab, choose “Income tax forms”.

Next, from the drop-down menu, click on “View filed forms”.

A new page will open displaying all the forms filed so far.

Locate the Form 10BD section and click on the “View all” option.

Finally, click on “Download 10BE PDF” to download the certificate. Please note, this option becomes available 24 hours after filing Form 10BD online.

Conclusion

From the above information, it’s clear that to claim a deduction under Section 80G for donations made during a financial year, the charitable institution must issue Form 10BE. According to the new regulations, obtaining the donation certificate or Form 10BE after filing Form 10BD is essential to claim deductions.

Table of Contents

Toggle