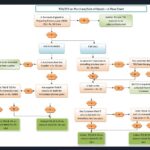

Any individual distressed with the request passed by an arbitrating authority can record an appeal under GST before the Principal Authority.

Who is Adjudicating Authority in appeal under GST?

Adjudicating Authority is the authority which passes an order or decision against which we appeal in GST.

Who is First Appellate Authority in Appeal under GST?

- The first appellate authority would be Commissioner (Appeals) where the adjudicating authority is Additional or Joint Commissioner

- (ii) The first appellate authority would be Joint Commissioner (Appeals) where the adjudicating authority is Deputy or Assistant Commissioner or Superintendent

Appealable Orders under GST appeal.

Following are the orders against which the aggrieved person may file an appeal in GST –

Enforcement Order

Assessment or Demand Order

Registration Order

Refund Order

Assessment Non-Demand Order

LUT Order

Filling of appeal under GST.

Along with the necessary documents, an GST appeal must be submitted on Form GST APL-01. When allure is documented, temporary affirmation will be given right away. However, the final acknowledgement with the GST appeal number must be submitted manually on Form GST APL-02, along with a copy of the order appealed against and a statement of the facts and grounds of appeal in GST, within seven days of the provisional acknowledgement’s issuance.

Time Limit for filling an appeal under GST.

The appeal must be filed within three months of the adjudicating authority’s communication of the order. However, if a justifiable reason for the delay and sufficient evidence are provided, the provision of condonation of delay in filing an GST appeal only allows for an additional month.

Appeal Fee for Appeal in GST.

No Appeal fee is levied as such

Requirement of Pre-deposit before filling an appeal in GST–

With the filing of appeal in GST, a specific amount has to be deposited as per below –

- i) In respect of the amount admitted – 100% of tax, interest, fine, fee and penalty

- ii) In respect of disputed amount – 10% of the tax in dispute, subject to maximum of twenty five crore rupees

However, in case of order with respect to detention or seizure, 25% of the penalty as specified in the order has to be paid.

Adjournment of hearing – The appellate authority may adjourn the hearing upto three times on showing of sufficient cause at any stage of hearing.

Time Limit to decide an appeal in GST.

Every appeal shall be decided within a period of one year from its filling, if it is possible to do so for the authority.

Want to add another ground of appeal at the time of hearing?

Additional ground of appeal is allowed, if the authority is satisfied that the omission of that ground was not willful or unreasonable.

Refund of Pre-Deposit in GST appeal

Where the pre-deposit is liable to be refunded in pursuance of appellate authority’s order, the taxpayer may file a refund application then the amount of pre-deposit shall be refunded along with interest from the date of payment of such amount till the date of refund.

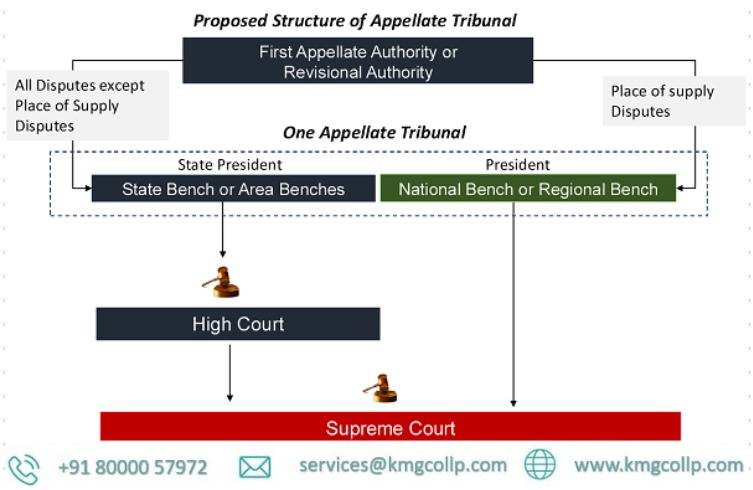

Not satisfied with the order of First Appellate Authority?

If the aggrieved person is not satisfied with the order of First Appellate Authority too, then he may go for an appeal before –

(i) National Appellate Tribunal

(ii) High Court

(iii) Supreme Court

Any person aggrieved by any order or decision passed under the GST Act (s) has the right to appeal to the Appellate Authority under Section 107. It must be an order or decision passed by an “adjudicating authority”. However, some decisions or orders (as provided for in Section 121) are not appealable.

A person unhappy with any decision or order passed against him under GST by an adjudicating authority can appeal to the First Appellate Authority . If they are not happy with the decision of the First Appellate Authority they can appeal to the National Appellate Tribunal, then to High Court and finally Supreme Court.

Owner of this information can be reached at K M GATECHA & CO LLP.

Important note: This does not lead to legal advice or legal opinion and is personal view and for information purpose only. It is prepared on the basis of facts available and applicable law.It is suggested to go through applicable provisions of law,latest regulations,judicial announcements, circulars, notifications and clarifications etc before taking any action based on above content.You agree here by that for any action taken on basis of above information in any manner writer or K M GATECHA & CO LLP is not responsible or liable for any omission,reliability,accuracy,completeness,errors or authenticity.This work by professional is just for knowledge purpose and does not constitute any kind of solicitation of work or advertisement.

-

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments -

Steps to register private limited company15/08/2024/

Steps to register private limited company15/08/2024/ -

Cancellation of registration under GST26/05/2024/

Cancellation of registration under GST26/05/2024/ -

-

Introduction to Transfer Pricing in India13/04/2024/

Introduction to Transfer Pricing in India13/04/2024/ -

-

-

Tax Liability of a NRI24/12/2023/

Tax Liability of a NRI24/12/2023/ -

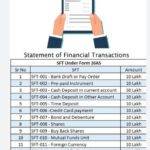

Everything about SFT18/12/2023/

Everything about SFT18/12/2023/ -

Documents to be maintained by NGo or trust17/12/2023/

Documents to be maintained by NGo or trust17/12/2023/ -

-

-

-

-

Taxation of Charitable/Religious Trust04/09/2023/

Taxation of Charitable/Religious Trust04/09/2023/ -

-

Application for Filing Clarification – GST09/06/2023/

Application for Filing Clarification – GST09/06/2023/ -

How to check GST application status09/06/2023/

How to check GST application status09/06/2023/ -

-

Gift tax under section 56(2)x03/06/2023/

Gift tax under section 56(2)x03/06/2023/ -

-

-

-

-

-

-

Old vs New income tax regime18/05/2023/

Old vs New income tax regime18/05/2023/ -

All about GSTR 10, GST Amnesty16/05/2023/

All about GSTR 10, GST Amnesty16/05/2023/ -

-

-

TDS on purchase of goods u/s 194Q17/01/2022/

TDS on purchase of goods u/s 194Q17/01/2022/ -

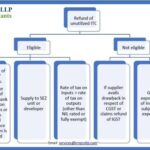

Situations of GST refund and process10/01/2022/

Situations of GST refund and process10/01/2022/ -

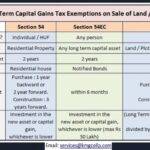

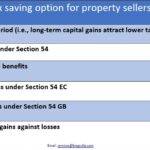

Tax on property sale in India05/01/2022/

Tax on property sale in India05/01/2022/ -

House Rent Deduction in Income Tax01/01/2022/

House Rent Deduction in Income Tax01/01/2022/ -

-

-

Table of Contents

Toggle