The Income-tax Act of 1961 provides various tax exemptions for salaried individuals, in addition to deductions like LIC premiums and housing loan interest. While deductions lower your total taxable income, exemptions exclude certain types of income from taxation entirely. This enables employers to structure an employee’s Cost to Company (CTC) package in a tax-efficient manner.

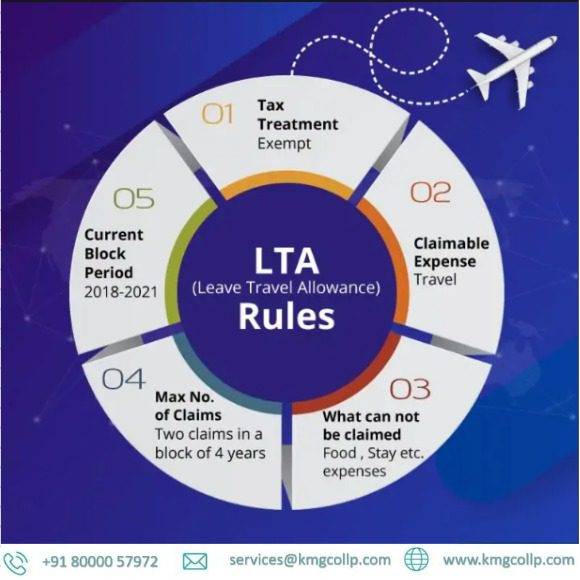

One commonly used exemption available to the salaried class under the law, and widely utilized by employers, is Leave Travel Allowance (LTA) or Leave Travel Concession (LTC). The LTA exemption also applies to LTA received from a former employer regarding travel after retirement of service or termination of service. LTA can be claimed for any two years within a block of four years. The current block year for claiming LTA is from 2022 to 2025.

What is Leave Travel Allowance (LTA)?

Leave Travel Allowance (LTA) or Leave Travel Concession is an allowance provided by an employer to their employee for traveling to any destination within India, whether it be during leave, after retirement, or following the termination of service. While it may seem straightforward, several factors must be considered before claiming an LTA exemption. Income tax provisions have established rules for claiming LTA exemption, which are outlined below.

Who Can Claim LTA?

Only individuals can claim LTA for travel expenses incurred for themselves and their family members, including their spouse, children, and wholly or mainly dependent siblings and parents.

Conditions for Claiming LTA:

Let’s review the conditions and requirements for claiming the exemption:

- Actual journey is necessary to claim the exemption.

- Only domestic travel within India is considered for exemption; international travel is not covered under LTA/LTC.

- The exemption for travel is available for the employee alone or with their family, where ‘family’ includes the employee’s spouse, children, and wholly or mainly dependent parents, siblings.

- Additionally, the exemption is not available for more than two children of an employee born after October 1, 1998. However, children born before this date are not subject to any restrictions. Moreover, in cases of multiple births on a second occasion after having one child, this restriction does not apply.

Amount of LTA/LTC Exemption

The exemption is applicable only to the actual travel costs incurred by the employee, such as airfare, rail fare, or bus fare. Expenses like local conveyance, sightseeing, hotel accommodation, food, etc., are not eligible for this exemption. Furthermore, the exemption is limited to the LTA provided by the employer.

For example, if the LTA granted by the employer is Rs 30,000, and the actual travel cost incurred by the employee is Rs 20,000, then only Rs 20,000 will be eligible for exemption, and the remaining Rs 10,000 will be included in the taxable salary income.

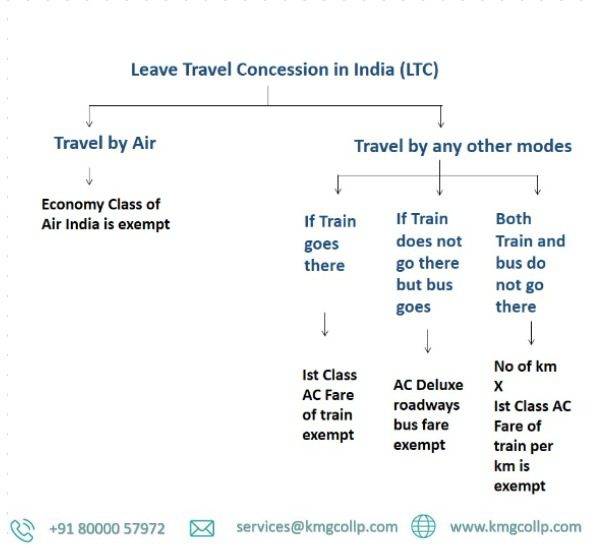

Exemption Regarding Various Modes of Transport

Sl. No. | Journey through (Mode of travel) | Limit under LTA |

1. | Air | Lower of the following amounts: – Actual Expenses or – Economy class air fare of the national carrier(Indian Airlines or Air India) by the shortest route to the place of destination. |

2. | Any other mode: | |

i) | Rail service is available | Lower of the following amounts: – Actual Expenses or – Air-conditioned first class rail fare by the shortest route to the place of destination |

ii) | Rail service is not available |

|

a) | No recognised public transport system | Lower of the following amounts: – Actual Expenses or – 1st class rail fare, for the distance of the journey by the shortest route, as if the journey had been performed by rail. |

b) | Recognised public transport system exists | Lower of the following amounts: – Actual Expenses or – 1st class or deluxe class fare by the shortest route to the place of destination |

Can LTA Exemption be Claimed on Every Vacation?

No, an LTA exemption is available for only two journeys performed in a block of four calendar years.

Block Year

A block year is distinct from a financial year and is determined by the Government for LTA exemption purposes. Each block comprises four years. The initial four-year block began in 1986. The list of block years includes 1986-1989, 1990-93, 1994-97, 1998-2001, 2002-05, 2006-09, 2010-13, and so forth. The current block applicable is 2022-25. The previous block was for the calendar years 2018-21.

Carryover of Unclaimed LTA/LTC

If an employee hasn’t utilized the exemption for one or two journeys within any block of four years, they can carry over such exemption to the next block, provided they avail this benefit in the first calendar year of the immediately succeeding block.

Consider the following example for a better understanding:

– Where carryover exemption is claimed in the first calendar year of the immediately succeeding block

Particulars of journey | Block year 2014-17 | Block year 2018-21 |

April 2015 | Exemption claimed in April 2015 | NA |

June 2018 | NA | Exemption claimed in June 2018 (considered to be carried over from the previous block) |

March 2020 | NA | Exemption claimed in March 2020 |

January 2021 | NA | Exemption claimed in January 2021 |

- Where carryover exemption is not claimed in the first calendar year of the immediately succeeding block

Exe exemption to the next block, provided they avail this benefit in the first calendar year of the immediately succeeding block.

Consider the following example for a better understanding:

– Where carryover exemption is claimed in the first calendar year of the immediately succeeding block

Particulars of journey | Block year 2014-17 | Block year 2018-21 |

April 2015 | Exemption claimed in April 2015 | NA |

June 2018 | NA | Exemption claimed in June 2018 (considered to be carried over from the previous block) |

March 2020 | NA | Exemption claimed in March 2020 |

January 2021 | NA | Exemption claimed in January 2021 |

- Where carryover exemption is not claimed in the first calendar year of the immediately succeeding block

Procedure to Claim LTA

The procedure to claim LTA generally varies depending on the employer. Employers typically specify a deadline by which employees can claim LTA and may require employees to submit proof of travel, such as tickets, boarding passes, or invoices provided by travel agents, along with a mandatory declaration. While it’s not mandatory for employers to collect proof of travel, it’s advisable for employees to keep copies for their records and to submit them to the employer based on the company’s LTA policy or to tax authorities upon request.

Multi-Destination Journey

Income tax provisions provide exemption for travel costs incurred for leave to any place in India. Conditions regarding the mode of transport also specify the journey from the ‘origin’ to the ‘destination’ and the route, which must be the shortest available route.

Therefore, if an employee travels to different places during a single vacation, the exemption can only be claimed for the travel cost from the place of origin to the farthest destination in the vacation via the shortest possible route.

LTA Exemption for Vacation on Holidays

Some organizations strictly adhere to the wording of the income tax provision and only allow employees to claim LTA if they apply for leave and travel during that time. Such organizations may reject LTA claims for travel on official holidays or weekends.

FAQs of Leave Travel Concession Section (LTC/LTA) 10(5) of Income Tax Act, 1961

The latest block period of four years is from January 1, 2022, until December 31, 2025.

The amount of LTA/LTC exemption depends on the LTA/LTC component in your compensation package or CTC. You can provide proof of travel within the block period and claim up to the amount specified in your CTC.

You can claim LTA/LTC exemption for only one trip in one calendar year.

No, LTC is taxable in the case of the new tax regime and exempted if you choose to pay tax under the old tax regime by fulfilling the required criteria.

Exemption will be available for 2 journeys performed in a block of 4 calendar years.

Owner of this information can be reached at K M GATECHA & CO LLP.

Important note: This does not lead to legal advice or legal opinion and is personal view and for information purpose only. It is prepared on the basis of facts available and applicable law.It is suggested to go through applicable provisions of law,latest regulations,judicial announcements, circulars, notifications and clarifications etc before taking any action based on above content.You agree here by that for any action taken on basis of above information in any manner writer or K M GATECHA & CO LLP is not responsible or liable for any omission,reliability,accuracy,completeness,errors or authenticity.This work by professional is just for knowledge purpose and does not constitute any kind of solicitation of work or advertisement.

-

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments -

Steps to register private limited company15/08/2024/

Steps to register private limited company15/08/2024/ -

Cancellation of registration under GST26/05/2024/

Cancellation of registration under GST26/05/2024/ -

-

Introduction to Transfer Pricing in India13/04/2024/

Introduction to Transfer Pricing in India13/04/2024/ -

-

-

Tax Liability of a NRI24/12/2023/

Tax Liability of a NRI24/12/2023/ -

Everything about SFT18/12/2023/

Everything about SFT18/12/2023/ -

Documents to be maintained by NGo or trust17/12/2023/

Documents to be maintained by NGo or trust17/12/2023/ -

-

-

-

-

Taxation of Charitable/Religious Trust04/09/2023/

Taxation of Charitable/Religious Trust04/09/2023/ -

-

Application for Filing Clarification – GST09/06/2023/

Application for Filing Clarification – GST09/06/2023/ -

How to check GST application status09/06/2023/

How to check GST application status09/06/2023/ -

Gift tax under section 56(2)x03/06/2023/

Gift tax under section 56(2)x03/06/2023/ -

-

-

-

-

-

-

All about Appeal under GST20/05/2023/

All about Appeal under GST20/05/2023/ -

Old vs New income tax regime18/05/2023/

Old vs New income tax regime18/05/2023/ -

All about GSTR 10, GST Amnesty16/05/2023/

All about GSTR 10, GST Amnesty16/05/2023/ -

-

-

TDS on purchase of goods u/s 194Q17/01/2022/

TDS on purchase of goods u/s 194Q17/01/2022/ -

Situations of GST refund and process10/01/2022/

Situations of GST refund and process10/01/2022/ -

Tax on property sale in India05/01/2022/

Tax on property sale in India05/01/2022/ -

House Rent Deduction in Income Tax01/01/2022/

House Rent Deduction in Income Tax01/01/2022/ -

-

-

Table of Contents

Toggle