Best ITR filing in ahmedabad

Call Us Today +91 80000 57972

K M GATECHA & CO LLP being best CA in ahmedabad helps for best ITR filing in ahmedabad.Our services are GST,income tax, accounting,audit,etc. Get the best ITR filing in Ahmedabad from KM GATECHA. Expert CA for ITR filing services & online tax filing for best income return tax filing. We provide not only consultancy services on itr filing but also consult for providing effective and ethical ways to save tax by making tax saving investments and tax planning. In the ITR filing services our experts are acknowledged as consultant for best ITR filing in Ahmedabad and also have sound knowledge and excellent experience to tackle all challenges in the income tax consultancy matters.

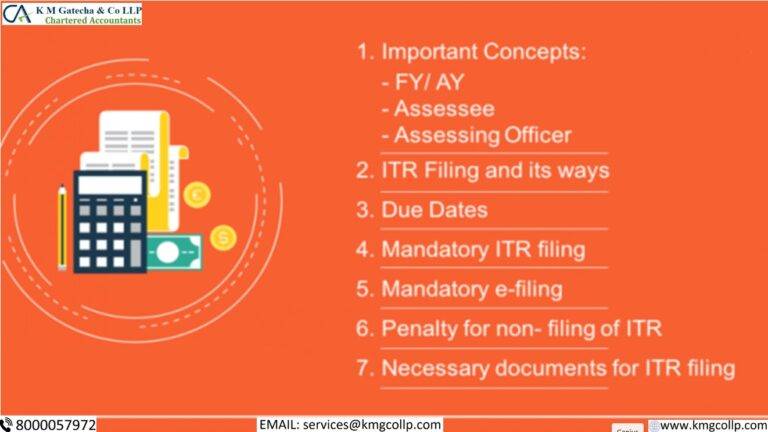

Must know about ITR filing

Best ITR filing in ahmedabad

Being a tax consultancy firm for best ITR filing in ahmedabad, Income Tax preparation, Income Tax accounting services,income tax consultancy and tax filing services we offer the following services:

Large multinationals corporate, small and mid-size corporate companies, and individuals avail itr filing services themselves of tax optimization services from our tax specialist. We help our clients in minimizing tax liabilities by several tax planning strategies and thus we provide tax filing compliance services with the tax planning strategies. We provide not only tax consultancy services on income tax consultancy related to personal, international taxation, ltd company tax, and corporate but also income tax filing service related to DTAA, transfer pricing, and other related tax filing services. We are also well known as income tax return consultant in Ahmedabad.

- Itr filing for self employed.

- Itr filing for NRI.

- Itr filing for senior citizen.

- Salary Itr filing

- Income tax consultancy

- Capital gain ITR filing

- Business ITR filing

- Freelancing ITR filing services

- 44AD ITR filing services

- Agriculture income ITR filing

- ITR filing for salaried

- ITR filing for house property and interest income

- ITR filing for private limited company

- ITR filing services for LLP/partnership firm

- ITR filing services for trust

- ITR filing services for society

- ITR filing services for company

- Income Tax Notice Reply Services

- NRI tax filing services

Being tax filing office our tax filing services has following operating process :

Our’s is 100% online process, clients can share thier data through email and our dedicated chartered accountant will handle your tax filing services.We have guaranteed income tax return filing consultant for process of timely tax filing services in ahmedabad.

1. Form 16/ documents and information collection which includes

collecting details and Documents. Such details depend on person’s occupation .

In addition to this financial transactions details which affect the Income Tax

Computation preparation is required. Basic Documents are PAN, Aadhar number,

Bank details/statement and Contact Information.

2. Verification and analysis of documents and information received which

includes tax Professional (C.A) Chartered Accountant will verify and analyses

each information and document in detail. Our analysis of Income and Tax for the

purpose of ITR Filing. Such Includes

1.Scrutinizing Bank entries from bank

statement and Cash Receipts with 26AS form of income tax.

2.Reconciling tax Credit with tax

deducted at source

3.Verifying deductions with provided

documents

4.Verification of all Income and

Capital Gain

3. Preparing computation of income and tax computation by our tax advisor. Tax professional will provide computation of income/profit and loss statement, income tax return filing form and tax computation.

4. Submission of online ITR form once client approves computation of income. Our tax expert CA will review final ITR form for filing and thus upload ITR form at e filing portal once required tax is paid.

5. Once ITR filing is done client will be provided with computation of income, income tax challan, ITR acknowledgment, 26As tax statement, profit and loss statement, balance sheet and required ITR filing documents.

Tax Compliances

We help in preparing best Income tax return filing i.e in income tax return filing with the Tax department with help of our income tax return filing consultant. We also help in the payment of self-assessment income taxes and advance tax compliance by providing tax challan of income tax.

TDS adjustments

TDS means tax deducted at source. In few income cases, TDS is deducted which needs to be adjusted against income shown in ITR,we take care of all tax deducted and accordingly adjust the income so that there is proper ITR filing and tax filings avoiding any difficulty in future to tax payers.

Tax planning

We also help in best tax planning for saving tax by advising for high returns investments or through other legible means.

International Taxation services.

We also provide services to foreign companies taxation services relating to International taxation relating to tax on foreign remittance, investment of foreign subsidiaries and its tax implications, formation of foreign companies, etc.

Our team keeps themselves updated on new income tax laws and tax regulations, leading to tax planning for minimizing both current and future tax liabilities and thus results in tax saving. Throughout the year we offer our client tax expertise and knowledge. Our extensive coverage of Income Tax filing services led to the various tag marks to our firm like Best ITR filing in Ahmedabad, Best income tax consultant in Ahmedabad, CA in Ahmedabad, Best Income Tax Planning Consultant in Ahmedabad, tax accountant in ahmedabad, Tax return accountant in ahmedabad, taxation accountant in ahmedabad, etc.

Types of income tax forms

- ITR 1 (Sahaj):This form is for people who are residents (as opposed to non-typical occupants), have total income up to Rs. 50 lakhs, income from salaries, one home, various sources (interest, etc.), and farming income up to Rs. 5,000. This form is not intended for:

- has resources (keeping in mind the value of one factor) located outside of India; or

- receives income from any source outside of India; or

- possesses a directorship in a firm; or

- held any unlisted value shares at any time in the preceding year; or

- possesses many residential properties, each of whose income is subject to taxation under the “Pay from House Property” heading; or

- has pay in the concept of:- has pay under the heading “Pay from Other Sources”

having won the lottery;

Owning and caring for race horses;

pay that is available at a special rate under Sections 115BBDA or 115BBE; or - having losses carried over or to offset the losses

- ITR 2 : This ITR is for individuals and HUFs without business income.

- ITR 3: This form is intended for use by individuals and HUFs reporting business income.

- ITR-4 (Sugam): According to the provisions of the Income Tax Act of 1961, ITR-4 is applicable to individuals, HUFs, and corporations that are resident and have total income up to Rs. 50 Lacs but do not maintain books of accounts. This does not apply to those who:

- has assets (remembering financial interest for an element) outside of India; or

- has pay from any source outside of India; or

- is a director in any organization; or

- held any unlisted value share at any time in the previous year; or

- claims more than one home, the pay of which is chargeable under the head “Pay from House Property”; or

- has pay under the head “Pay from Other Sources” in the concept of:- prizes from lotteries; action of purchasing and keeping up horse race; or

- action of selling; has any loss that has already occurred or that is scheduled to occur under any head of pay; or

- is assessable for the full amount of the salary or any portion of on which tds is deducted.

- ITR 5: This form is for individuals who are not individuals, HUFs, corporations, or individuals submitting returns in Form ITR 7.

- ITR 6: This form is for companies that are exempt from income tax under Section 11 but are not organizations.

- ITR 7: This structure is for individuals and businesses who must file returns in accordance with the Income Tax Act of 1961, specifically Sections 139(4A), 139(4B), 139(4C), and 139(4D).

Useful Links

Best ITR Filing In Ahmedabad

Best Itr filing in ahmedabad

What our ITR filing services include?

Itr filing can benefit when taking loan, filing itr can also help in visa, your correct networth can be known, filing itr can also help in claiming loss, proof of income, etc. One can take help of CA for itr filing.

ITR filing means providing correct information related to income and tax to income tax department. One can take help of ITR filing CA (chartered accountant). We are considered as one of the best CA for ITR filing in Ahmedabad, India.

Self-employed can file income tax return using ITR-4. In ITR 4 certainpercentage of receipt is considered as income and tax is paid on that,rather claiming cost against income and paying tax on balance income. K M GATECHA & CO LLP is a know for best itr filing services in Ahmedabad.ITR-4 can be downloaded from income tax website download section.

Itr filing due date in India is usually 31st July.

Income upto Rs.2,50,000 is tax free in India.

As per current income tax law we can file ITR only once in a year.

ITR 1 is applicable for retired person to declare income from pension.ITR 1 can also be used by person filing income of salary and income from other sources. K M GATECHA & CO LLP can help for ITR filing in Ahmedabad.

ITR filing is a form which is submitted to income tax department containing details of income and tax payable on income in a financial year. For correct filing of income tax returns help of chartered accountant can be taken for income tax filing. We are recognized as best CA for tax fling.

Every HUF or individual has to file ITR if his/her total income (including income of any person in respect of which he/she is assessable) without giving effect to section of income tax act 10(38), 10A, 10B or 10BA or 154 or 54B or 54D or 54EC or 54F or 54G or 54GA or 54GB Chapter VIA (i.e., deduction under section 80C to section 80U), exceeds the exemption limit.One can take help of CA file tax return.

Our Other Services

CA Firm in ahmedabad

Being the best ca firm in Ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Income Tax Return filing Consultant in Ahmedabad

We as the best tax consultant in Ahmedabad, india provide tax consultancy including direct and indirect tax consultancy.

Audit Firm in ahmedabad

We provide bank audits, stock audits, forensic audits, statutory audits, concurrent audits, tax audits, internal audits, information system audit services.

Accounting firm in ahmedabad

We provide bookkeeping, accounting, tally accounting, zero accounting, quick book accounting, Zoho accounting services.

GST Consultant

Our GST services include GST registration, GST payments, GST refunds services,e way bill consultant, GST return, GST classification, GST compliances, etc.

Chartered Accountant In Ahmedabad

We as the most-trusted chartered accountant in Ahmedabad provide all chartered accountant services under one roof.

Income tax return consultant in Ahmedabad

We provide tax accounting services for effective tax planning and making tax provisions.

Income Tax Services In Ahmedabad

We provide income tax audits, income tax return filing, corporate income tax services, etc.