Statutory Audit Services

Call Us Today +91 80000 57972

At K M GATECHA & CO LLP we have statutory auditor having knowledge of auditing providing best statutstandards, business in ahmedabad.Basic objective of statutory audit is to provide qualitative,trustworthy and clear financial statement to the users of the financial statements that is the stakeholders of the company.Being statutory audit company in ahmedabad we not only believe in providing quality audit services through our external audit services in ahmedabad but also work to adding of value to financial statements by carrying out audit in accordance with statutory requirements.Statutory audits are the cornerstone of financial transparency and legal compliance for businesses. In Ahmedabad, K M GATECHA & CO LLP stands as a premier statutory audit company in Ahmedabad, offering services designed to ensure that your financial records are not only accurate but also aligned with regulatory requirements. Whether you’re a growing startup or an established organization, statutory audits are crucial for credibility and compliance.

Best Statutory Audit services in Ahmedabad

Statutory audit firm in Ahmedabad

What is meant by statutory audit?

A statutory audit, also called an external audit, is an audit mandated by a specific statute or law to ensure that an entity’s financial statements give an accurate picture of its situation and its profitability. Statutory audits are governed by the Companies Act 2013 and the Companies (Auditors and Auditors) Rules 2014.

The extent of statutory audits is largely determined by guidelines and regulations set by government. Being statutory audit firm in Ahmedabad our statutory auditor carefully review the financial statements and accounts of the organization to avoid inconsistencies or any possible misrepresentation and to ensure reliability.

The Companies Act 2013 makes it mandatory that the accounts of every company are audited by chartered accountants in practice. This auditor is called a business auditor and this activity is called a business audit. When carrying out a statutory audit, the provisions of the CARO must be observed. K M GATECHA & CO LLP developed a comprehensive audit plan and strictly adhered to it during the audit to identify key observations and recommendations to improve productivity while achieving results.

First of all, we determine the relevance of Ind-AS or not.

In general, Ind-AS applies to the following entities.

1) All listed companies.

2) Unlisted companies whose net assets are greater than or equal to Rs. 2.5 billion.

All parent companies, subsidiaries, associates and joint ventures of the companies in points 1 and 2 above. Once the IND AS applies, entities should be required to comply with the IND AS in all subsequent financial statements.

Why choose K M GATECHA & CO LLP as statutory audit firm in Ahmedabad?

We, K M GATECHA & CO LLP are a Statutory Audit Services Company, Tax Audit Services Company and Consultants in India with a dynamic team of Professionals and Statutory Auditors who understand the sole purpose of Audit Services.We have a comprehensive list of statutory audits to perform audit services which are too specific for each industry of manufacturing, trading, e-commerce, e-commerce as well as service companies in India.

Our auditors have in-depth subject matter knowledge and experience to provide the best auditing services. They understand various industries and the challenges faced by companies operating in these industries. We allocate audit partner in Ahmedabad based on client and industry profile to ensure audits are performed by people with in-depth knowledge of your industry. We keep them informed by investing heavily in their training and development. We organize weekly meetings with our partners and auditors to exchange ideas and challenges and improve our collective expertise.

A statutory audit is a mandatory examination of a company’s financial records and operations to ensure compliance with legal and regulatory frameworks. This process helps stakeholders, including investors, regulators, and board members, gain confidence in the company’s financial reporting.

Key Aspects of Statutory Audits:

- Mandated by Law: Conducted as per the Companies Act, 2013 and other relevant laws.

- Objective Evaluation: Ensures that financial statements are free from material misstatements.

- Transparency and Accountability: Promotes trust among stakeholders.

K M GATECHA & CO LLP: Your Trusted Partner for Statutory Audits

As a leading statutory audit company in Ahmedabad, we deliver audits tailored to meet your unique business requirements. Our team of seasoned professionals ensures your financial statements reflect accuracy, transparency, and compliance.

Key Features of Our Services:

- Customized Audit Plans: Tailored approaches for diverse industries, including:

- Manufacturing

- IT & Software

- E-commerce

- Real Estate

- Regulatory Expertise: We are well-versed in:

- The Companies Act

- Income Tax Act

- GST compliance

- Technology-Driven Solutions: Use of advanced tools for seamless auditing.

Why Choose K M GATECHA & CO LLP for Statutory Audit in Ahmedabad?

- Unmatched Expertise:

- Decades of experience in handling audits across sectors.

- Familiarity with local and international standards like IFRS and GAAP.

- Cost-Effective Solutions:

- Transparent pricing with no hidden charges.

- Flexible packages for businesses of all sizes.

- Dedicated Support:

- Ongoing advisory post-audit.

- Assistance with government and regulatory inquiries.

- Enhanced Business Insights:

- Identification of inefficiencies and risks.

- Recommendations for operational improvements.

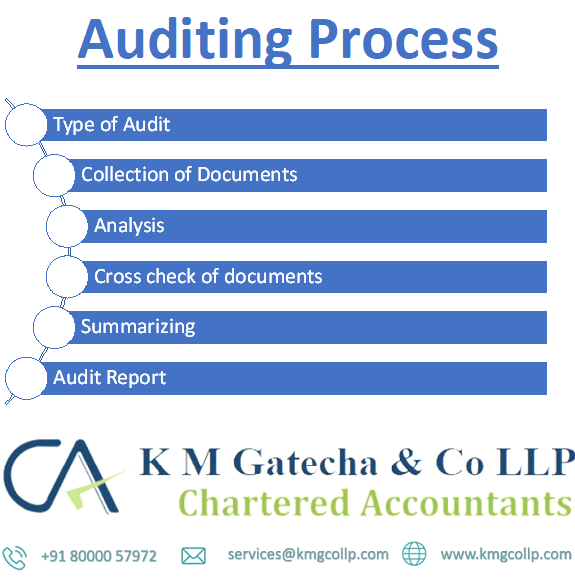

The Audit Process

Our audit process is comprehensive and structured to deliver actionable insights:

- Initial Consultation:

- Understand the client’s business and objectives.

- Discuss specific regulatory requirements.

- Planning & Risk Assessment:

- Develop a risk-based audit plan.

- Identify critical focus areas.

- Fieldwork:

- Analyze financial records, internal controls, and compliance.

- Conduct interviews with key personnel.

- Reporting:

- Deliver a detailed audit report.

- Highlight observations and recommendations.

Benefits of Statutory Audits for Your Business

Statutory audits are more than a compliance exercise; they’re a strategic tool for growth. Here’s how they benefit your business:

- Regulatory Compliance:

- Avoid penalties and ensure adherence to legal requirements.

- Investor Confidence:

- Build trust with investors through transparent financial reporting.

- Risk Mitigation:

- Detect fraud, inefficiencies, and operational risks.

- Operational Insights:

- Enhance financial controls and optimize processes.

Legal review of the company’s or government financial records and financial statements. Analysis of financial records and statement of the company and its examinations is called audit.K M GATECHA & CO LLP is known for Best Statutory Audit services in Ahmedabad.

A company’s financial statements must provide the required clarity and quality and create an atmosphere of trust in the minds of readers.We statutory audit firm in ahmedabad have Statutory Auditor in Ahmedabad who have a deep understanding of regulatory requirements, business challenges and technical knowledge of local and international accounting and auditing standards to provide best statutory audit services in Ahmedabad. We believe that through our external best audit services in Ahmedabad, audits are conducted in a free and fair manner in accordance with regulatory requirements, thereby adding value by increasing the transparency of a company’s financial statements.

Ready to ensure your business meets all statutory

requirements while gaining valuable insights? Contact K M GATECHA & CO LLP for top-tier statutory audit services in Ahmedabad.Ensure compliance, enhance trust, and unlock growth with our expert statutory audit services. Book your consultation now!

Faqs on statutory audit services

There are several types of audits. Audits can be internal or external. However, while internal audit reports and findings are shared within company management, external audit findings must be shared with external entities such as government agencies.

An auditor is an external audit that must be performed on a company’s financial statements and records by an external entity. Since legal audits are mandated by law or statute, they should be performed by professionals who understand the principles and ethics of the governing body.

Auditors will review bank statements, ledgers, accounting records and other financial documents filed for tax purposes.

There are several types of statutory audit, either through the Companies Act 2013 and the Companies (Auditors and Auditors) Rules 2014 or through other legal frameworks. Some of these statutory audits are-

1) The Securities and Exchange Board of India prescribes audits of stock brokers and credit rating agencies.

2) The National Health Mission requires a concurrent internal audit.

3) The Telecom Regulatory Authority of India has ordered an audit of billing and metering.

Statutory audits are important to businesses for the following reasons –

Compliance with the law – Under the Companies Act 2013 and the Companies (Auditors and Auditors) Rules 2014, the law allows all businesses to undertake a legal audit of their deposits and financial documents. The government can impose heavy fines for non-compliance.

Authenticity – Having a forensic audit is important for businesses as it increases the authenticity of financial reports as they are verified by experienced and qualified auditors

.

Minimize Fraud Risk – By performing a forensic audit, the risk of fraud in an organization can be reduced as it is able to detect all discrepancies and redundancies in financial statements.

- Companies above a specific turnover threshold.

- Public limited companies, private limited companies, and LLPs as mandated by law.

Depending on the complexity, audits typically take 2–6 weeks.

Financial statements, trial balances, tax returns, and details of internal controls.