Cash Deposit Limit in Savings Account as per Income Tax: A Comprehensive Guide

Cash Deposit Limit in Savings Account as per Income Tax: A Comprehensive Guide

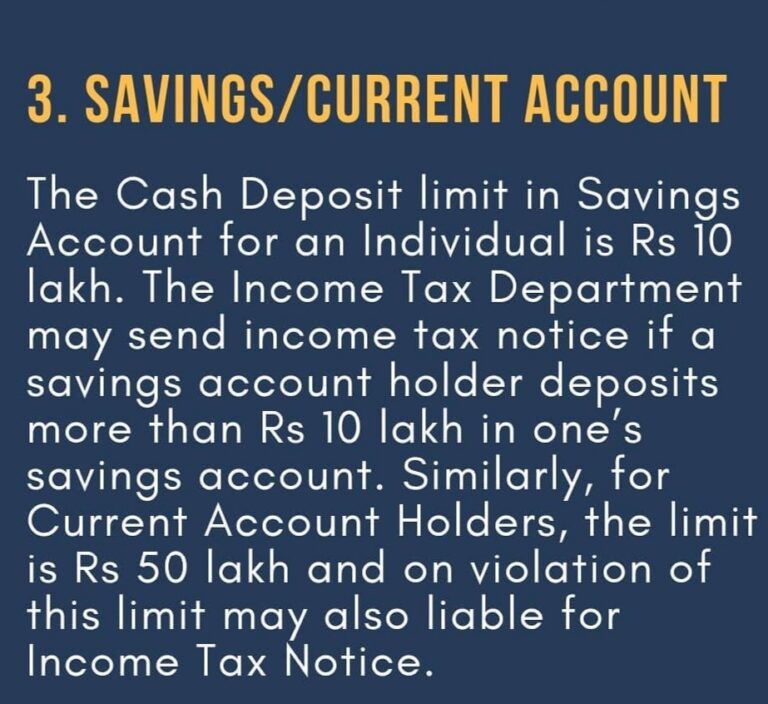

In this article we have discussed Cash deposit limit in bank account in a year as per income tax.The Cash Deposit limit as per income tax in a year in Savings Account for an Individual is Rs 10 lakh. The Income Tax Department may send income tax notice if a savings account holder deposits more than Rs 10 lakh in one’s savings account. Similarly, for Current Account Holders, the limit is Rs 50 lakh and on violation of this limit may also liable for Income Tax Notice.

Understanding cash deposit limits in savings accounts is critical for ensuring compliance with income tax regulations. This article breaks down these limits, their implications, and best practices for managing your finances effectively.

Cash Deposit Limit in Savings Account as per Income Tax: A Comprehensive Guide

- Current Regulations on Cash Deposit Limits

- Annual Deposit Limit:

According to income tax regulations, individuals depositing more than ₹10 lakh in a financial year in their savings account are subject to scrutiny. Banks report such transactions to the Income Tax Department under the Annual Information Return (AIR) framework. - Reporting Requirements:

Deposits exceeding specified limits necessitate reporting by banks to the tax authorities. This is done to monitor high-value transactions and prevent tax evasion.

- Daily Deposit Limits

While the focus is often on yearly limits, some banks may have daily cash deposit limits:

- PAN Requirement: Deposits exceeding ₹50,000 in a single day require the submission of PAN (Permanent Account Number).

- This measure ensures accountability for substantial cash transactions.

- Implications of Exceeding Limits

- Tax Scrutiny:

Deposits above the prescribed limits can trigger inquiries. Taxpayers may be asked to justify the source of funds. - Penalties:

Failing to justify large cash deposits can result in penalties under the Income Tax Act. This reinforces the need for proper documentation.

- Related Cash Transaction Limits

Understanding other related limits helps avoid accidental non-compliance:

- Current Accounts: Cash deposit limits for current accounts are higher, generally ₹50 lakh annually, but still monitored.

- Fixed Deposits: There is no direct cap on cash deposits for FD accounts, but any large transaction will likely be reported.

- Credit Card Payments: Cash payments toward credit card bills exceeding ₹1 lakh in a financial year may attract scrutiny.

- Tax Deducted at Source (TDS) on Cash Withdrawals

Section 194N of the Income Tax Act mandates TDS on cash withdrawals:

- If cash withdrawals exceed ₹1 crore in a financial year, TDS is applied at 2%.

- For non-filers of income tax returns, TDS rates are higher, starting at 2% for amounts exceeding ₹20 lakh.

- Legal Provisions and Relevant Sections

- Section 269SS: Prohibits accepting loans or deposits in cash exceeding ₹20,000.

- Section 269ST: Restricts receiving cash payments of ₹2 lakh or more from a single individual in a single day or in relation to a single transaction.

- Section 40A(3): Disallows tax deductions for expenses paid in cash exceeding ₹10,000.

- Best Practices for Account Holders

To remain compliant with income tax regulations:

- Maintain Documentation: Keep records of all cash transactions, including receipts and invoices.

- Use Digital Payments: Opt for online transfers to ensure transparency.

- Regularly File Returns: Declare all substantial cash transactions in your income tax filings.

- Recent Updates and Amendments

Tax laws evolve frequently. Recent changes include:

- Increased Monitoring: Banks and financial institutions now use AI to identify patterns of tax evasion.

- Threshold Adjustments: Limits for cash transactions and TDS have been periodically reviewed by the government.

- FAQs

- What is the maximum cash deposit allowed without PAN?

Deposits of up to ₹50,000 per day in a savings account can be made without PAN. - What happens if I make multiple small deposits?

Splitting deposits to evade reporting requirements is flagged by banks and reported to the authorities. - How should I respond to a notice from the Income Tax Department?

Provide valid documentation proving the source of funds. Seek professional advice if needed.

- Conclusion

Adhering to cash deposit limits in savings accounts is essential for avoiding tax scrutiny and penalties. By staying informed about the regulations and adopting transparent financial practices, you can ensure compliance with the Income Tax Act.

Owner of this information can be

reached at K M GATECHA & CO LLP – CA in Ahmedabad.

Important note: This does not lead to legal advice or

legal opinion and is personal view and for information purpose only. It is

prepared on the basis of facts available and applicable law.It is

suggested to go through applicable provisions of law,latest

regulations,judicial announcements, circulars, notifications and

clarifications etc before taking any action based on above content.You

agree here by that for any action taken on basis of above information in any

manner writer or K M GATECHA & CO LLP is not responsible

or liable for any omission,reliability,accuracy,completeness,errors or

authenticity.This work by professional is just for knowledge purpose and does

not constitute any kind of solicitation of work

or advertisement

Table of Contents

Toggle