CERTIFICATE OF ORIGIN SERVICES

Call Us Today +91 80000 57972

We, at K M Gatecha & Co LLP, provide Certificate of Origin services along with numerous other services such as accounting services, audit services, company registration services, GST filing, returns and refund services, Income Tax returns preparation and filing services to our clients in an efficient and hassle-free manner. We also believe in providing our clients with the complete knowledge about the service that they are looking to avail.

CERTIFICATE OF ORIGIN SERVICES

Certificate of Origin services provided at K M Gatecha & Co LLP:

- Ascertaining documents required,

- Collection of documents,

- Collection of required details,

- Filling and filing of CO form,

- Declaration drafting and submission,

- Submitting application,

- Issuance of Certificate of Origin.

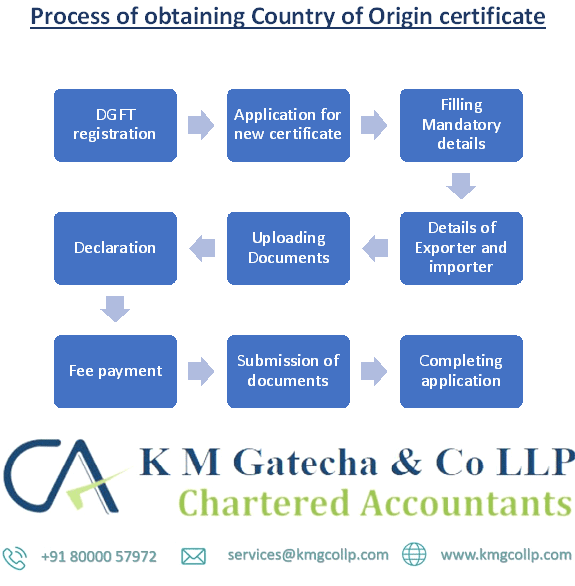

Process of Certificate of Origin:

- DGFT portal registration,

- Apply for new Certificate,

- Filling mandatory details,

- Details of exporter and importer,

- Uploading documents,

- Declaration by exporter,

- Payment of fees,

- Submission of documents,

- Completing and submitting application.

Documents required for Certificate of Origin Services:

- Covering letter (on original letterhead of business) requesting issuance of Certificate of Origin, to be addressed and submitted to the Director General of Indian Chamber of Commerce.

- Copies of invoices or packing list,

- Attested copy of letter of authorization,

- Completed form of certificate of origin purchased from Indian Chamber of Commerce,

- Letter of credit, purchase or email order stamped and signed by the exporter,

- In case of goods which are first imported then exported to another country:

- Clearance certificate from customs department showing that all taxes and duties have been cleared.

- Second set of documents for ICC

What is a Certificate of Origin (CO):

- Certificate of Origin is an important international trade document which certifies that the goods which are being exported are procured, manufactured/processed, produced, or made in a specific country which is also called the Country of Origin.

- The Certificate of Origin shows the product’s nationality and serves as a declaration of origin and authenticity of country by the exporter to meet the requirements of customs department and trade regulations.

- It is issued by the Indian Chamber of Commerce (ICC).

Different categories of Certificate of Origin:

- Non-preferential certificate:

- It is a certificate of origin which indicate the origin country of the product but does not qualify or come under preferential or lower tariff definition,

- During trade wars or sanctions, the non-preferential certificate of origin shows that the product is not originating from a sanctioned country,

- It is used within the WTO framework for most favoured nation treatment specified under Article 1.2 of the Agreement on Rules of Origin.

- Preferential certificate:

- Preferential certificate of origin certifies that the product is originating from the specified nation and complies with the definition of a specified bilateral or multilateral free trade agreement,

- This certificate is required by importing countries to determine preferential treatment of imported products under the agreement,

- This certificate is more useful and widely used.

Why is certificate of origin required?

There are many instances where CO is required, some of them are:

- For Customs:

- Ensures traceability and security of goods entering the country,

- Ascertains taxes and duties applicable,

- Exporters:

- Customs clearance is simpler and faster,

- Increases productivity for businesses.

- Importers:

- Helps in knowledge about:

- Clearances,

- Taxes and duties,

- Clearance process,

- Prevents detaining of products,

- Assists in getting preferential treatment for the imported goods.

- Helps in knowledge about:

EXCELLENTTrustindex verifies that the original source of the review is Google. Best services you can get for your financial activities. Services provided is excellent. You can be rest assured sitting at your home as they professionally take care of the activities. Had the best experience.Trustindex verifies that the original source of the review is Google. Very good and fast service. With constant follow-up.Trustindex verifies that the original source of the review is Google. Recommend a CA for income tax-related work with quick and efficient service.Trustindex verifies that the original source of the review is Google. Excellent service from KM Gatecha firm, they resolved my case very promptly and I will definitely recommend them for any taxation services.Trustindex verifies that the original source of the review is Google. It's good platform with quality service assurance and timely closure with the personalized guidance. Thanks for support and all the best!Trustindex verifies that the original source of the review is Google. It was a great experience working with Milap. Dedicated, Accurate and wants to get work done on your behalf. I contacted him 7 hours ago to file tax on my behalf and all work is done in matters of hours. If you are looking for someone in India as NRI to work on your taxes he is the person who will do wonderful job. Thank you 🙏Trustindex verifies that the original source of the review is Google. Best chartered accountant in ahmedabad for comprehensive services related to private limited company registration,GST filing and registration,tax filing and audit services. Highly recommend for best and professional services.👍

FAQS-CERTIFICATE OF ORIGIN SERVICES

- The country of origin is defined as the place where the goods or product is procured, manufactured, or processed.

- Application for country of origin must be made on the DGFT portal and Indian Chamber of Commerce issues this certificate.

- Usually, it takes 5 to 7 business days to obtain country of origin certificate.

- Country of origin certificate makes the exporter eligible to export the goods to different countries and makes him competitive compared to others.

- CO certificate helps the importers in faster clearance of goods and assists in getting preferential treatment for valid goods.

Our Other Services

CA Firm in ahmedabad

Being the best ca firm in Ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Tax Consultant

We as the best tax consultant in Ahmedabad, india provide tax consultancy including direct and indirect tax consultancy.

Income Tax Services In Ahmedabad

We provide income tax audits, income tax return filing, corporate income tax services, etc.

Chartered Accountant In Ahmedabad

We as the most-trusted chartered accountant in Ahmedabad provide all chartered accountant services under one roof.

Tax Accountant

We provide tax accounting services for effective tax planning and making tax provisions.

Accounting firm in ahmedabad

We provide bookkeeping, accounting, tally accounting, zero accounting, quick book accounting, Zoho accounting services.

GST Consultant

Our GST services include GST registration, GST payments, GST refunds services,e way bill consultant, GST return, GST classification, GST compliances, etc.

Audit Firm in ahmedabad

We provide bank audits, stock audits, forensic audits, statutory audits, concurrent audits, tax audits, internal audits, information system audit services.

Got a Question?

FAQ

GST rate for consultancy services is 18%.

GST consultant is a professional who helps to manage goods and services matters like gst returns,taxes payment,tax reconciliation,ITC reconciliation,gst refund services,gst registration, classification of goods and services,etc.

GST rate for labour charges is widely 18%.

GST rate for labour contractor is 18%.

GST rate for works contract is 18%.

GST rate for professional services is 18%.

Highest gst rate in India is 28%

No, gst not charged on dental services.

There are four rates of GST for regular registered person those are 5%,12%,18% and 28%. For person registered under composition scheme there are two rates and those are 1% and 2%.

Yes, GST applicable on labour charges.