Change in DIN

Call Us Today +91 80000 57972

We, at K M Gatecha & Co LLP, provide Change in DIN Services along with numerous other services such as accounting services, audit services, company registration services, GST filing, returns and refund services, Income Tax returns preparation and filing services to our clients in an efficient and hassle-free manner. We also believe in providing our clients with the complete knowledge about the service that they are looking to avail.

Company Name Change services

Change in DIN services

Services provided for Change in DIN at K M Gatecha & Co LLP:

- Evaluation of Change,

- Collection of Documents,

- Filling and filing of Form,

- Submission of documents,

- Replying to queries,

- Completion of procedure,

- Handing over DIN after changes.

Process of Change in DIN:

- Application for account on MCA website,

- Downloading Form DIR-6,

- Certification of Form DIR-6 by practicing Chartered accountant or Company secretary,

- Filing and Filing of Form DIR-6,

- Submitting documents for Proof of change (self-attested),

- Queries generated by MCA,

- Reply to Queries,

- Approval by MCA.

Documents required for Change in DIN:

- Different changes in DIN require different documents but the basic documents required are:

- Proof of nationality,

- Proof of date of birth,

- PAN card,

- Aadhar Card,

- Voter’s ID,

- Passport,

- Driving License,

- Utility bill not more than 2 months old,

- For foreign nationals:

- Address proof should not be more than 1-year-old,

- Form DIR-7 needs to be attached.

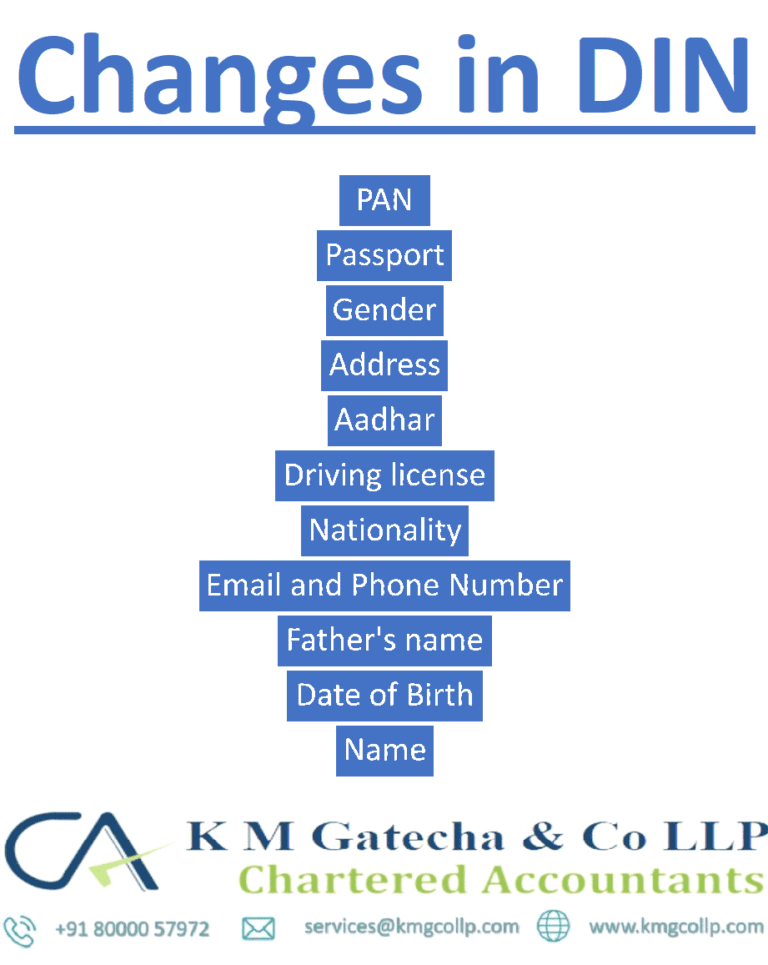

The changes in DIN that are allowed under Companies Act,2013:

- Name of Director/designated partner,

- Father’s name,

- Nationality,

- Date of birth,

- PAN card Number,

- Passport number,

- Driving license number,

- Permanent residential address,

- Occupation,

- Email id and phone number,

- Educational qualification,

Details required to be filled in DIR-6:

- Name of directors/designated partners,

- Date of birth,

- Voter’s ID/passport number/license/Aadhar number,

- Email Id/Mobile number,

- Residential address,

- Father’s names,

- Nationality,

- Gender,

- PAN card Number.

When can a change in DIN application be rejected:

- Documents not attested by authorized person:

- Proof of identity,

- Proof of residential address,

- Supporting documents have expired or not within prescribed time frame,

- Documents such as proof of identity or residential address are not attached,

- Difference in address details filled from the address proof submitted,

- Gender not filled correctly in form,

- Duplicate DIN application,

- Any other reasons.

FAQS on Change in DIN

- Yes, changes can be made in DIN after filling form within 30 days of change, and approval by MCA.

- DIN does not need to be renewed as it is for a lifetime,

- But DIR-3 KYC needs to be completed before 30th September of every year as per compliance requirement laid down by MCA.

- No, according to regulations laid down by MCA an individual can have only 1 active DIN,

- A person can apply for another DIN after cancellation of the previous DIN.

- A DIN is valid for a lifetime.

- No, a person has to acquire DSC before applying for a DIN as it is a mandatory requirement for DIN.

- Yes, having a DIN is mandatory under GST.

- If a DIN is disqualified, then a director can appeal to the NCLAT (national company law appellate tribunal) and obtain a stay order which is valid for 30 days within which the director has to submit a presentation contesting his DIN disqualification.

- According to the regulation a person can have only 1 DIN, so if the person is Director in multiple companies, then also, he will have 1 DIN.

- Yes, DIN is required to become a director in any company.

- When a director does not fulfill his legal responsibilities and is declared unfit to be a director then the DIN is disqualified.

Our Other Services

CA Firm in ahmedabad

Being the best ca firm in Ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Tax Consultant

We as the best tax consultant in Ahmedabad, india provide tax consultancy including direct and indirect tax consultancy.

Audit Firm in ahmedabad

We provide bank audits, stock audits, forensic audits, statutory audits, concurrent audits, tax audits, internal audits, information system audit services.

Accounting firm in ahmedabad

We provide bookkeeping, accounting, tally accounting, zero accounting, quick book accounting, Zoho accounting services.

GST Consultant

Our GST services include GST registration, GST payments, GST refunds services,e way bill consultant, GST return, GST classification, GST compliances, etc.

Chartered Accountant In Ahmedabad

We as the most-trusted chartered accountant in Ahmedabad provide all chartered accountant services under one roof.

Tax Accountant

We provide tax accounting services for effective tax planning and making tax provisions.

Income Tax Services In Ahmedabad

We provide income tax audits, income tax return filing, corporate income tax services, etc.