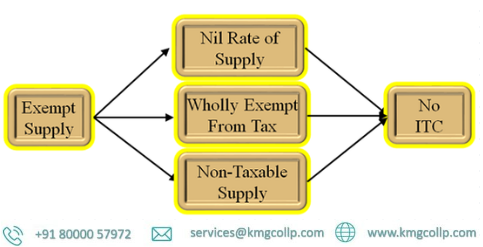

We’ve come a long way from when the GST law will be in effect. Despite this, there are a lot of questions that remain unanswered. One of these is the difference between supplies that are exempt from taxation and supplies that are not subject to GST or taxation because the law does not include definitions for some supplies. I tried to understand the meanings and differences of the terms used above through this article.

In addition, aggregate turnover takes into account exempt supplies for the purpose of calculating the threshold limit for registration, but does not take into account non-GST supplies. After this, we are also required to reverse input tax credit on inward supplies that are used for exempt outward supplies in accordance with Rule 42 of the CGST Rule, 2017. So it is vital to exactly grasp the essential distinctions between these provisions.

Non taxable Vs Non GST Supplies-

Section 2(78) of the Act has defined the term Non Taxable Supply as hereunder-

A supply of goods or services, or both, that is exempt from taxation under this Act or the Integrated Goods & Services Tax Act is referred to as a “Non taxable Supply.”

Therefore, an activity or transaction must first have a supply. On the off chance that an action or exchange falls outside the extent of supply, it can’t be said as a non available stock. The meaning of supply has been given in area 7 of the Demonstration and it is a comprehensive definition which covers pretty much every exchange of labor and products except if uncommonly prohibited under plan III. So the exercises and exchanges determined in Timetable III are not supply. As it isn’t supply so it can’t be said as non available stockpile however can be said as Non-GST Supply (talked about in later para).

Non Available Stockpile is supply under area 7 of the demonstration which isn’t chargeable to burden due to avoided by charging segment i.e by segment 9 of the Demonstration. Subsequently supply of alcoholic alcohol for human utilization, oil unrefined, fast diesel, engine soul, flammable gases and flying turbine fuel is a non available inventory.

The term Non-GST supply is no place characterized in the Demonstration and exercises and exchange determined in plan III is definitely not a non available stockpile as examined above so we can report it as Non GST supply. As a result, we can draw the conclusion that there is no supply under the NON-GST Act because only activities and transactions carried out by the government and local authorities as public authorities, as well as the transition, are included in the GST.

Exempt vs. Nil rated supply-

Exempt supply is defined under section 2(47) of the CGST Act, 2017 (hereinafter referred as “The Act”) as reproduced below-

Non-taxable supply is included in the definition of “Exempt Supply,” which refers to any supply of goods or services or both that is exempt from tax under section 11 or section 6 of the Integrated Goods and Services Tax Act.

No. of notification February 2017, Central Tax (Rate) for Goods and Notification No. 12/2017: The power granted by section 11 of the CGST Act was used to issue the Central Tax (Rate) for services. According to the definition of exempt supply, the goods and services mentioned in these two notifications are therefore exempted goods.

The GST Law contains no definition of nil rated supply. The fact that the tariff for exempt supply is higher than 0% is the primary distinction between nil-rated and exempt supply. However, the exemption notification does not necessitate payment of tax. While in the event of Nothing appraised supply, the duty is at Nothing rate so there is no expense without the exclusion warning.

In accordance with section 9(1), the rates for goods are published in Notification No. 01/2017: Central Tax (Rate), with six schedules outlining the 2.5%, 6%, 9%, 14%, 1.5%, and 0.125 percent tax rates. There is no schedule that imposes a tax at zero percent, or NIL rated.

In the case of services, only one service is listed as having a rating of zero in Notification No. 11/2017: S.No. 11 Central Tax (Rate) 24 i.e Backing administrations to agribusiness, ranger service, fishing and creature farming.

FAQs

Is nothing appraised supply excluded in GST?

No. of notification February 2017, Central Tax (Rate) for Goods and Notification No. 12/2017: The power granted by section 11 of the CGST Act was used to issue the Central Tax (Rate) for services. According to the definition of exempt supply, the goods and services mentioned in these two notifications are therefore exempted goods. The GST Law contains no definition of nil rated supply.

Under the GST, what is exempt supply?

Supply exempt from GST: The term “exempt supply” is defined in Section 2 (47) of the Central Goods and Services Tax Act of 2017 as “supply of any goods or services, or both, which attracts nil rate of tax or which may be wholly exempt from tax under section 11, or under section 6 of the Integrated Goods and Services Tax Act.” This definition also encompasses supply that is not subject to taxation.

What exactly is GST’s zero-rated supply?

The government offers certain reliefs and benefits to businesses in order to increase exports. One such alleviation gave under the GST system is called No Appraised Supplies in GST. Zero Rated Supplies in GST apply to any supplies made by a registered dealer as an export (of goods or services) or supply to an SEZ.

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.

Table of Contents

Toggle