FCRA Registration Services

Call Us Today +91 80000 57972

Charitable Trusts, Societies, and Section 8 Companies must obtain FCRA Registration if they wish to receive Contributions or Donations from Foreign Sources.

Phone No - +91 80000 57972

Mail us at - services@kmgcollp.com

What is FCRA Registration services?

Everything you need to know about FCRA Registration for NGOs

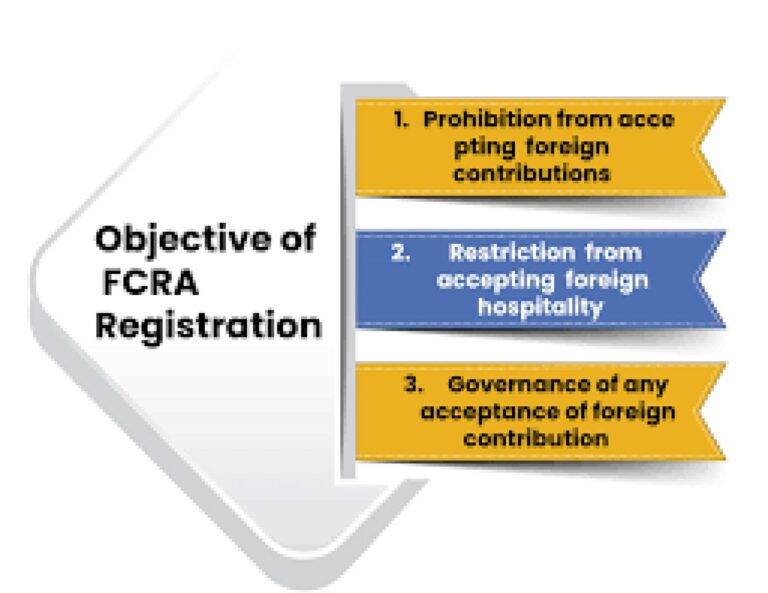

The Foreign Contribution Regulation Act (FCRA) is a law that requires charitable institutions to register if they wish to receive funds or donations from foreign sources. This act was established in 2010.

As per Section 6 of the Foreign Contribution Regulation Act, 2010, organizations with a specific cultural, social, educational, religious, or economic purpose are required to obtain FCRA Registration

As per Section 6 of the Foreign Contribution Regulation Act, 2010, organizations with a specific cultural, social, educational, religious, or economic purpose are required to obtain FCRA Registration before accepting foreign contributions/donations. Hire the best CA in Ahmedabad.

Mandatory Requirement For FCRA Registration services:

- The Organization must be officially registered as charitable purposes.

- The Organization must consent to obtain foreign contributions only through a designated bank account.

- The Organization must be officially registered on the NGO Darpan Registration.

- The organization should have been in operation for the last 3 years. Check out the best FCRA registration services in ahmedabad.

Types of FCRA Registration services:

There are two types of FCRA Registration in India:

Proper FCRA Registration (FCRA Registration in normal course):

- In order to obtain the correct FCRA Registration, the applicant must have been functioning as an NGO for at least 5 years.

- The Non Profit Organization must have invested at least 10 Lakh rupees over the course of the last three years in order to advance its main objectives (not including administrative expenses).

- The individual applying must provide financial records from the previous three years, which must be audited by a qualified Chartered Accountant.

- If a recently established Organization wishes to receive contributions or donations from foreign sources, they may submit an application for approval to the Ministry of Home Affairs for a stated purpose, activity, and source, through the Prior Permission process.

- Form FC-3A must be filed in order to obtain FCRA Registration.

Validity for FCRA Registration in normal course:

Generally, the FCRA Registration is valid for a period of 5 years from the date it is approved.

This period of five years must be renewed in order to continue receiving foreign contributions.

Prior Permissions Registration:

- Alternatively, if a Non-Profit Organization that has recently been established is open to receiving any kind of outside funding, then it can apply to receive Prior Authorization Registration.

- Prior Approval Registration must be completed in order to access funds that are designated for a specific purpose.

- Form FC-3B must be filled out in order to obtain authorization under the FCRA.

Validity for Prior Permission FCRA Registration:

- The registration for Prior Permission from the FCRA will be valid for a period of 5 years from the date of approval.

- Until the date when the foreign contribution has been completely used in accordance with the prior approval, whichever comes first.

Why choose KMG CO LLP firm as your Service Provider for “FCRA Registration online in India”?

KMG CO LLP is a well-known business platform and a modern idea, offering complete incorporation, compliance, advisory, and consultancy services for customers in India and overseas. Applying for FCRA Registration online in India is quick, effortless, most economical and quickest with us! Additionally, we assist you in registering your Not-for-Profit Organization (NGO). In addition, you can get your NGO registered under Section 12AB and Section 80G of the Income Tax Act.

Benefits of FCRA Registration in India (FCRA registration services)

- Organizations registered with the FCRA will have a positive reputation amongst people.

- Registration under the Fair Credit Reporting Act (FCRA) is beneficial for organizations that strive to promote the public good and engage in social work.

- The FCRA Registrations helps organizations to obtain foreign contribution and government assistance in a lawful manner.

- The applicant may be eligible for full governmental backing as FCRA Registration is a Government mandate mandated by the regulating authority.

- An organization registered under the FCRA can receive donations from foreign sources, as well as on-going assistance and investment from other organizations.

Documents Required for FCRA Registration Online (FCRA Registration Services)

FCRA Registration (FC-3A)

- Registration Certificate of Association.

- Memorandum of Association/Trust Deed.

- Activity Report for the Last 3 Years.

- Audited Statement of accounts for the last three years.

- NGO Darpan Certificate

- PAN of trust/society/section 8 company

- Affidavit of Trustees/directors

FCRA Prior Permission (FC-3B) (FCRA Registration Services)

- Registration Certificate of Association.

- Memorandum of Association/Trust Deed.

- Commitment Letter from the organization & agreement.

- Project Report for which FC will be received.

- NGO Darpan Certificate

- PAN of trust/society/section 8 company

- Affidavit of trustees/directors. Hire the best FCRA registration services.

Check out the best FCRA registration services

Recent Posts

- Step-by-Step Process to Claim GST Refunds Efficiently

- Benefits of Regular Audits for Limited Liability Partnerships

- APEDA Registration Consultants in Ahmedabad: Expert Guidance for Exporters

- MIS Reporting Consultants in Ahmedabad: Expert Financial Insights for Business Growth

- NGO Registration Consultants in Ahmedabad: Expert Guidance for Trust, Society & Section 8 Company Formation

- Top Startup Consultants in Ahmedabad: Expert Guidance for Business Launch & Growth

- Startup Advisory Services in Ahmedabad: Complete Business Support for Startups & Founders

- One Person Company (OPC) Registration in Ahmedabad: Step-by-Step Guide, Fees & Legal Requirements

- Top 10 Reasons You Need a Chartered Accountant for Company Compliance in India

- Why Hiring a Chartered Accountant (CA) for Company Compliance is Critical: A Complete Guide for Indian Businesses

FAQs on FCRA Registration Services

The prerequisite for registration under FCRA is that the applicant should be registered under an existing statute which includes:

- Societies Registration Act, 1860 or

- Indian Trusts Act, 1882 or

- Section 8 of Companies Act, 2013, etc

Non-profit entities such as trusts, societies, and Section 8 companies must obtain FCRA Registration under Section 6 (1) of the Foreign Contribution (Regulation) Act, 2010 in order to accept any type of foreign contribution or donation, be it money or items. It is a requirement regardless of the form of contribution.

The Financial Credit Reporting Act (FCRA) is not overseen by the Reserve Bank of India, but instead is regulated by the Ministry of Home Affairs of the Government of India as an internal security measure.

A donation from an Indian who has gained citizenship from another country is considered a foreign contribution, including those with a PIO card and Overseas Citizens of India. However, this does not apply to Non-resident Indians who still maintain Indian citizenship.

Yes, Banks must also report transfers of funds from one organization registered with the Foreign Contributions Regulation Act to another.