GST Registration Services in Ahmedabad

Call Us Today +91 80000 57972

We, at K M Gatecha & Co LLP,Chartered accountant in Ahmedabad provide GST cancellation services along with numerous other services such as accounting services, audit services, company registration services, GST filing, returns and refund services, Income Tax returns preparation and filing services to our clients in an efficient and hassle-free manner. We also believe in providing our clients with the complete knowledge about the service that they are looking to avail.

GST cancellation services

GST cancellation services in Ahmedabad

Services provided for GST cancellation at K M Gatecha & Co LLP:,Chartered Accountant in Ahmedabad

• Evaluation of eligibility of cancellation,

• Obtaining Digital signature if needed,

• Collection of documents,

• Preparation of application,

• Filing of application,

• Replying to any queries generated,

• In case of GST cancellation initiated by tax officer or department K M Gatecha & Co LLP provides services of replying to show cause notice issued through form GST REG 16 ( form GST REG-17).

Types of GST cancellations:

• GST cancellation requested by taxpayer,

• GST cancellation ordered by Tax officer or department:

o Cancellation can be ordered by officer or department in the following cases:

No business is conducted at the premises,

Bills/invoices are generated without supply of goods/services,

Violates anti-profiteering provisions,

GSTR-3B not being filed for 2 consecutive months (one quarter for QRMP scheme),

Availing of input tax credit in violation of provisions of section 16 of GST act or other rules.

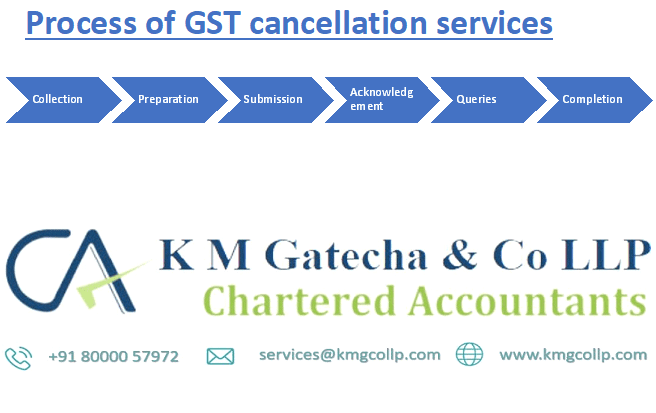

Process of cancellation of GST by taxpayer:

• Collecting documents,

• Preparing application (GST REG-21 for migrated taxpayers, GST REG-16 for other taxpayers),

• Submitting documents and application,

• Receipt of acknowledgment,

• Reply to any queries if generated,

• Completion of procedure and cancellation of GST number.

Reasons/eligibility for cancellation of GST number by taxpayer:

• Discontinuation of business,

• Business turnover does not qualify minimum threshold of GST applicability,

• Change in constitution of business under section 25(3), 22 and 24 of GST Act,

• Merger, acquisition, or transfer of business.

• If GST returns are not filed for the last 6 months,

• If under section 10 of GST Act, GST returns are not filed for last 3 months,

• If the GST number was registered unlawfully (by means of fraud, wilful misstatement, hiding of facts),

• Voluntary cancellation,

• Non-voluntary/SUO Moto cancellation,

Process of cancellation of GST number when ordered by tax office or department:

• Tax officer or department orders cancellation of GST number and issues show-cause notice to taxpayer through form GST REG-17,

• Taxpayer must reply in form REG-18 within 7 days from date of service of notice, justifying why his/her GST number should not be cancelled,

• If the reply is accepted, then order will be pass in form GST REG-20 and the GST cancellation proceedings will be stopped otherwise the GST number will be cancelled within 30 days through form GST REG-19.

Documents required for GST cancellation:

• GST number which has to be cancelled,

• Pending sales and purchase invoices,

• Stock details of raw material, semi-finished goods and finished goods,

• Details of any liabilities, fines or penalties related to GST,

• Receipts of payments made against these liabilities or fines.

Pre-requisites for GST cancellation services:

• Clearance of all GST dues,

• All taxes have to be paid for all pending sales invoices,

• Clearance of penalties and fines related to GST.

EXCELLENTTrustindex verifies that the original source of the review is Google. Best services you can get for your financial activities. Services provided is excellent. You can be rest assured sitting at your home as they professionally take care of the activities. Had the best experience.Trustindex verifies that the original source of the review is Google. Very good and fast service. With constant follow-up.Trustindex verifies that the original source of the review is Google. Recommend a CA for income tax-related work with quick and efficient service.Trustindex verifies that the original source of the review is Google. Excellent service from KM Gatecha firm, they resolved my case very promptly and I will definitely recommend them for any taxation services.Trustindex verifies that the original source of the review is Google. It's good platform with quality service assurance and timely closure with the personalized guidance. Thanks for support and all the best!Trustindex verifies that the original source of the review is Google. It was a great experience working with Milap. Dedicated, Accurate and wants to get work done on your behalf. I contacted him 7 hours ago to file tax on my behalf and all work is done in matters of hours. If you are looking for someone in India as NRI to work on your taxes he is the person who will do wonderful job. Thank you 🙏Trustindex verifies that the original source of the review is Google. Best chartered accountant in ahmedabad for comprehensive services related to private limited company registration,GST filing and registration,tax filing and audit services. Highly recommend for best and professional services.👍

Our Other Services

CA Firm in ahmedabad

Being the best ca firm in Ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Tax Consultant

We as the best tax consultant in Ahmedabad, india provide tax consultancy including direct and indirect tax consultancy.

Audit Firm in ahmedabad

We provide bank audits, stock audits, forensic audits, statutory audits, concurrent audits, tax audits, internal audits, information system audit services.

Accounting firm in ahmedabad

We provide bookkeeping, accounting, tally accounting, zero accounting, quick book accounting, Zoho accounting services.

GST Consultant

Our GST services include GST registration, GST payments, GST refunds services,e way bill consultant, GST return, GST classification, GST compliances, etc.

Chartered Accountant In Ahmedabad

We as the most-trusted chartered accountant in Ahmedabad provide all chartered accountant services under one roof.

Tax Accountant

We provide tax accounting services for effective tax planning and making tax provisions.

Income Tax Services In Ahmedabad

We provide income tax audits, income tax return filing, corporate income tax services, etc.

Frequently asked questions

The GST application status can be checked from the online GST portal by logging into the account of business.

Yes, GST number can be cancelled automatically if a firm/business fails to file GST returns for 3 consecutive tax periods.

- The GST cancellation is completed by the officer/department within 30 days of application for GST cancellation,

- The GST cancellation is intimated by form GST REG-24.

Yes, it is mandatory to file GSTR-10 after GST number is cancelled or surrendered.

Yes, there is no curb of acquiring GST number after a GST number is cancelled.

- Yes, you can get more than 1 GST number on one PAN card,

- It is mandatory for a business to get different GST number for each individual working units.

o No, cancellation of GST number can only be revoked within 30 days of application.

o After 30 days, you need to apply for a new GST number.