Changing the registered mobile number or email ID on the GST portal is a straightforward process. The method you follow will depend on the number of authorized signatories associated with the business.

When the Authorized Signatory is the Partner/Promoter

Steps to Update Mobile Number or Email ID:

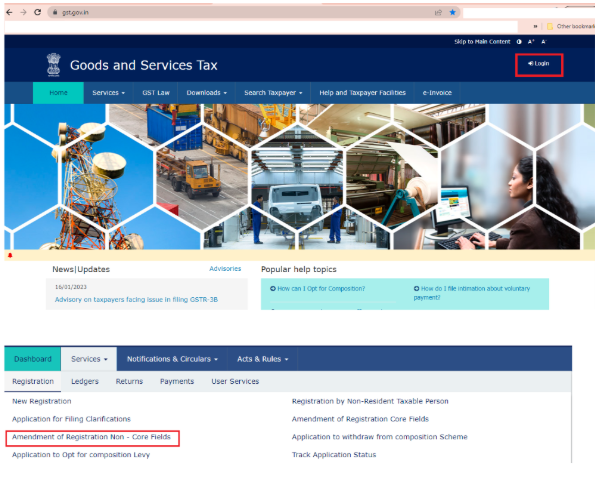

- Log in to the GST Portal

- Navigate to Services → Registration → Amendment of Registration (Non-core Fields).

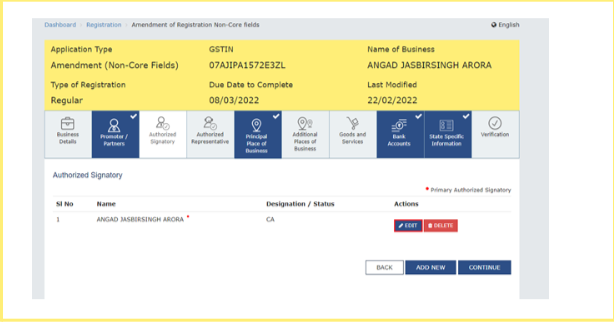

- Edit Authorized Signatory Details

- Open the ‘Promoter/Partners’ tab.

- Locate the authorized signatory whose details you need to update. Click ‘Edit’ under the ‘Actions’ column.

- Modify Contact Information

- Update the mobile number or email address as required.

- Click ‘Save’ to proceed.

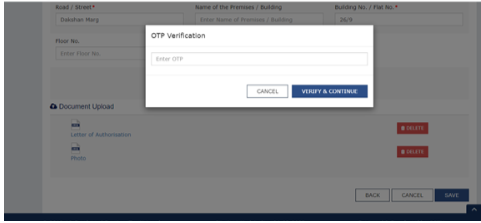

- OTP Verification

- An OTP will be sent to the newly entered mobile number and email address.

- Enter the OTPs to confirm the changes.

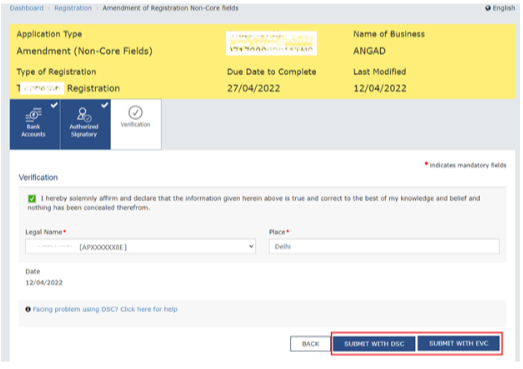

- Submit the Verification Form

- Go to the ‘Verification’ tab.

- Fill in the necessary details, check the declaration box, and submit the form using DSC, E-signature, or EVC.

Note: If using EVC mode, the OTP will be sent to the updated mobile number and must be entered for final verification.

- Application Status and Approval

- Once submitted, you will receive an ARN (Application Reference Number) to track the request.

- A confirmation message stating ‘Changes Approved’ will indicate that the mobile number and email ID have been successfully updated.

(When the Authorized Signatory is Different from the Promoter)

If the authorized signatory is not the promoter or there are multiple authorized signatories, follow these steps to update the registered mobile number or email ID on the GST portal.

Steps to Update the Contact Details:

- Log in to the GST Portal

- Navigate to Services → Registration → Amendment of Registration (Non-core Fields).

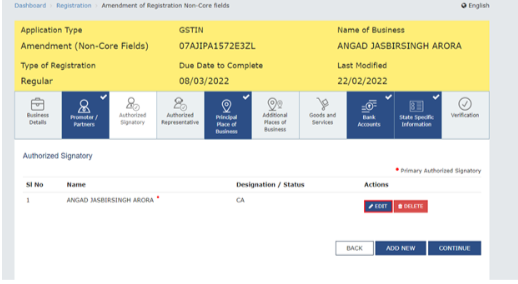

- Add a New Authorized Signatory

- Open the ‘Authorized Signatory’ tab and click on ‘Add New’.

- Enter the New Signatory’s Details

- Provide the necessary details of the new authorized signatory whose email and mobile number you want to use.

- Click ‘Save’ to proceed.

- Submit the Verification Form

- Go to the ‘Verification’ tab.

- Enter the required details, check the declaration box, and submit the form using DSC, E-signature, or EVC.

- Wait and Re-login

- Wait for 15 minutes before logging in again.

- Go to Services → Registration → Amendment of Registration (Non-core Fields).

- Update the Primary Authorized Signatory

- Open the ‘Authorized Signatory’ tab.

- Deselect the existing primary authorized signatory.

- Set the New Authorized Signatory as Primary

- Select the newly added authorized signatory as the primary one.

- Ensure the correct mobile number and email address are entered.

- An OTP will be sent for verification.

- Complete the Verification

- Follow the same verification process as mentioned in Step 4.

- Application Status and Confirmation

- Upon submission, you will receive an ARN (Application Reference Number) to track the request.

- Once approved, a confirmation message stating ‘Changes Approved’ will indicate that the mobile number and email ID have been successfully updated.

Need Help?

FAQs

1. Can I update my registered mobile number or email ID on the GST portal?

Yes, you can update your registered mobile number or email ID on the GST portal by amending the registration details under ‘Amendment of Registration (Non-core Fields)’. KMG CO LLP provide the best GST services.

2. What are the different ways to change the registered mobile number or email ID?

The process depends on the number of authorized signatories in the business:

- If the authorized signatory is the same as the promoter, the details can be directly updated under the ‘Promoter/Partners’ section.

- If there are multiple authorized signatories, a new signatory must be added, and the primary signatory must be updated before making changes. (GST portal)

3. Will I receive an OTP when updating my mobile number or email ID?

Yes, an OTP will be sent to the new mobile number and email ID for verification before the changes are finalized.

4. What if I don’t have access to the current registered mobile number or email ID?

If you no longer have access to the registered mobile number or email ID, you must:

- Add a new authorized signatory with updated contact details.

- Set them as the primary signatory and remove the previous one.

- Complete the verification process using DSC, E-signature, or EVC.

5. How long does it take to update the mobile number or email ID on the GST portal?

The process is usually instant once the verification is completed. However, in some cases, it may take a few hours for the changes to reflect.

6. How can I track the status of my application after submitting the changes?

After submitting the update request, an ARN (Application Reference Number) will be generated. You can use this ARN to track the status of your application on the GST portal.

7. Will I receive a confirmation after my mobile number or email ID is updated?

Yes, once the changes are approved, you will receive a confirmation message stating that the mobile number and email ID have been successfully updated.

8. Is it necessary to update both mobile number and email ID together?

No, you can choose to update either the mobile number, email ID, or both, based on your requirement.

9. Do I need to submit any documents to change my contact details?

No additional documents are required. The process is completed through the GST portal using OTP verification and authentication.

10. What should I do if my update request is not approved?

If your request is not approved, check the reason for rejection in the ARN tracking section. You may need to re-submit the request with the correct details or contact the GST helpdesk for assistance.

Table of Contents

Toggle