Relief Under Section 89(1) of the Income Tax Act

Section 89(1) of the Income Tax Act provides relief for income received in arrears or in advance due to changes in taxation laws. The relief is granted by recalculating the tax liability on such arrears according to the tax rules applicable in both the year of receipt and the year to which the income pertains.

If there is an increase in the tax outflow due to a rise in tax slab rates in the year of receipt, this increase is eligible for relief under Section 89(1). This ensures that taxpayers are not unfairly burdened by higher tax rates applicable in the year of receipt.

What Is Relief Under Section 89(1)?

Section 89(1) of the Income Tax Act offers relief from paying higher taxes on arrears or advance income due to changes in tax rates over the years. When your total income for a year includes past dues, such as salary arrears or advance payments, you might face a higher tax burden because tax rates may have increased since the income was originally due.

To alleviate this, Section 89(1), in conjunction with Rule 21A, provides a mechanism to recalculate your tax liability. This ensures that you are not unfairly taxed more because of delays in receiving the income. Specifically, the relief allows you to avoid paying additional tax due to the increased tax rates in the year of receipt compared to the year when the income was originally earned.

In essence, this provision helps you avoid extra tax liability caused by the delay in payment, providing a more equitable tax treatment for arrears or advance income.

For detailed information on how to calculate this relief, you can refer to the specific guidelines provided under Section 89(1).

What is Form 10E?

Form 10E is a document required for claiming tax relief under Section 89(1) of the Income Tax Act, 1961. This form is used when an individual is eligible for relief on salary or pension received in arrears or in advance. The relief helps reduce the additional tax burden that may arise due to changes in tax rates over time.

Who Should File Form 10E?

Form 10E should be filed by individuals who have received any of the following types of income during the previous financial year:

- Arrears of Salary

- Family Pension in Arrears

- Advance Salary

- Gratuity

- Commuted Pension

- Compensation on Termination of Employment

Filing Form 10E is mandatory to claim the tax relief provided under Section 89(1).

How to File Form 10E Online

To file Form 10E online, follow these steps:

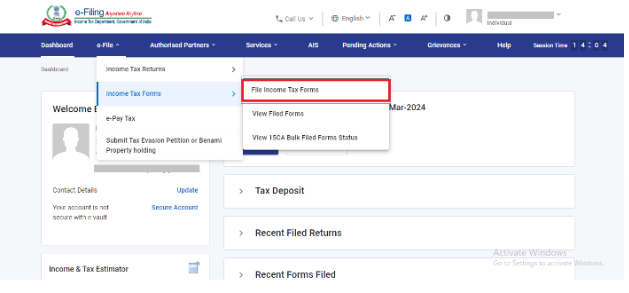

- Log In: Access the e-Filing portal using your User ID and password.

- Navigate to Income Tax Forms:

- Click on the ‘e-File’ tab.

- Select ‘Income Tax Form’ from the dropdown menu.

- Choose ‘File Income Tax Forms’.

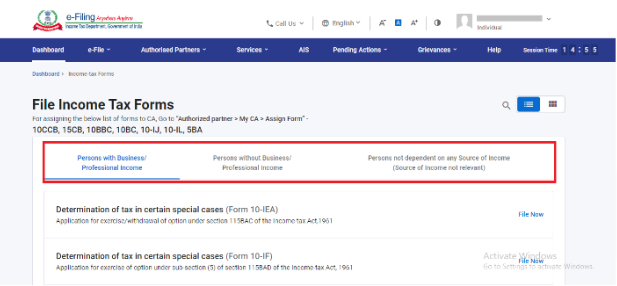

Step 3: Selecting the Appropriate Form Type

After you choose ‘File ITR Forms’, a new screen will display three options:

- (i) Individuals with Business/Professional Income

- (ii) Individuals without Business/Professional Income

- (iii) Individuals with No Income Sources

Select the option that best describes your income category.

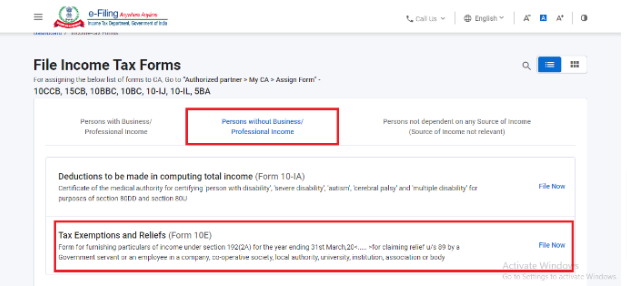

Step 4: Choose the Correct Option

Select the second option, ‘Individuals without Business/Professional Income’. You will find the link to Form 10E under this category.

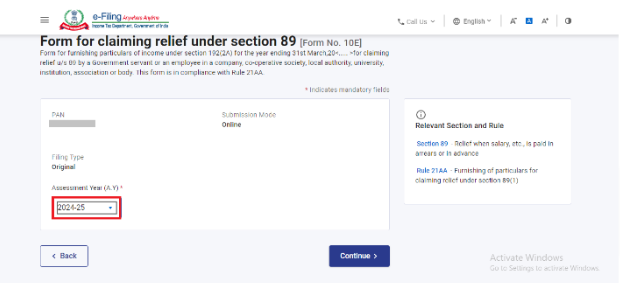

Step 5: Choose the Assessment Year

Pick the assessment year for which you wish to file Form 10E. For the financial year 2023-24, select Assessment Year 2024-25.

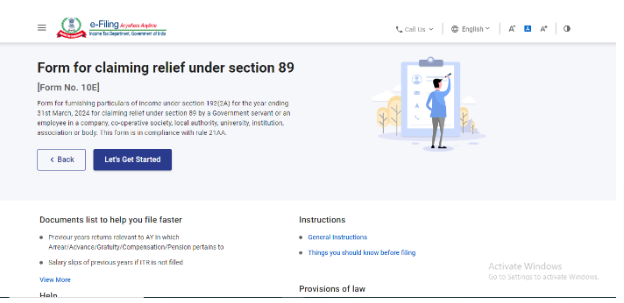

Click on ‘Continue’. On the next screen, select ‘Let’s Get Started’ to proceed.

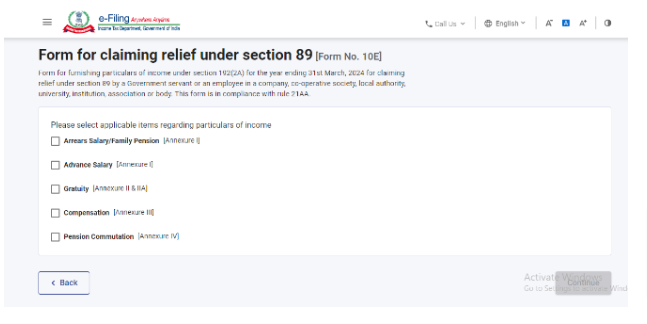

Step 6: Select the Relevant Annexure

If you are filing Form 10E to claim relief for salary arrears, choose Annexure I or the applicable fields relevant to your situation.

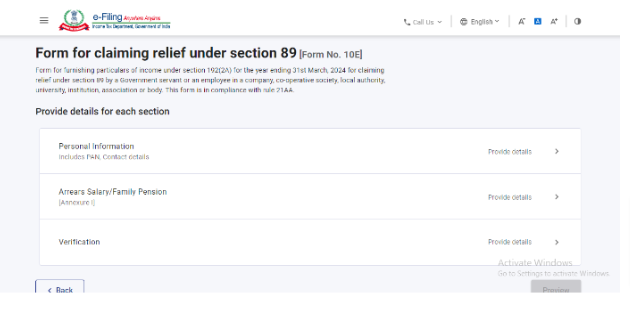

Step 7: Complete and Submit Form 10E

After filling out all the required schedules, proceed with the submission of Form 10E.

Income Tax Notice for Non-Filing of Form 10E

Since the Financial Year 2014-15 (Assessment Year 2015-16), it has been mandatory for taxpayers to file Form 10E to claim relief under Section 89(1) of the Income Tax Act. If you have claimed this relief but failed to submit Form 10E, you may receive a notice from the Income Tax Department. The notice will state:

“Relief under Section 89 has not been granted in your case because Form 10E has not been filed. Submission of Form 10E is required as per Section 89 of the Income Tax Act.”

Key Points About Form 10E

- Mandatory Filing: Form 10E is required for individuals seeking tax relief under Section 89(1).

- Online Submission Only: The form must be completed and submitted online via the Income Tax portal; offline downloads and submissions are not allowed.

- Non-Compliance Notice: If Form 10E is not filed after claiming tax relief under Section 89(1), the Income Tax Department may issue a notice for non-compliance.

- Pre-Filing Requirement: Form 10E must be filed online before submitting your income tax return.

- Assessment Year Selection: Even if the arrears pertain to previous financial years, you must select the assessment year in which you received the arrears when filling out Form 10E.

FAQ’s

Can I Claim Relief Under Section 89 in My ITR Without Filing Form 10E?

If you claim relief under Section 89 in your Income Tax Return (ITR) without submitting Form 10E, your ITR will be processed. However, the relief under Section 89 will be disallowed during processing. You may receive an intimation under Section 143(1) indicating that the relief has been denied due to the absence of Form 10E.

Can I Submit Form 10E After Filing My Income Tax Return (ITR)?

No, Form 10E must be filed before you submit your Income Tax Return (ITR) to claim the tax relief under Section 89(1).

Can I Use Form 10E to Claim Relief for VRS Compensation if I’ve Already Claimed Tax Exemption?

No, you cannot use Form 10E to claim relief for Voluntary Retirement Scheme (VRS) compensation if you have already claimed tax exemption for it under Section 10(10C). Section 89(1) does not apply to VRS compensation that has been exempted under Section 10(10C).

Can I Download and Fill Out Form 10E Offline?

No, Form 10E is only available online and cannot be downloaded. It must be filled out and submitted directly through the e-Filing portal.

Who Can File Form 10E?

Form 10E can be filed by all registered individual users on the e-filing portal to claim relief under Section 89 of the Income Tax Act, 1961.

Can I File Form 10E to Claim Relief Under Section 89 in the New Tax Regime?

Yes, you can claim relief under Section 89 by filing Form 10E under both the old and new tax regimes.

What is the Deadline for Filing Form 10E?

Form 10E must be submitted before filing your Income Tax Return (ITR). For Assessment Year 2024-25, the last date to file your ITR is July 31, 2024. If you are filing a belated return, the deadline extends to December 31, 2024.

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.

Table of Contents

Toggle