As per the Income Tax Act of 1961, income tax must be deducted at source as per provision of the Income Tax Act, 1961.TDS stands for Tax Deducted at Source. The purpose of making the lower deduction certificate of TDS is that it enables the government to collect tax as and when income arises.

Often, there is a situation when the actual tax liability is less than that deducted. the TDS is first deducted and then the recipient of income claims a refund of TDS at the time of filing of his Income Tax Return. This is a time consuming, complicating, and frustrating process as income tax returns (ITR) can only filled after the end of financial year.

Section 197 and 197A

- To reduce the complication faced by taxpayers, Section 197 of income tax act 1961 provides the facility of deduction of tax at lower or nil tax rate deduction of TDS, if at the time of filing return, the taxpayer realize that his tax liability is less than what he actually paid, then he can claim the refund for the same. in the case where the taxpayers thinks that his tax liability for the year will be zero or less than TDS rate applicable on a particular source of income, section 197 and 197A permits him to apply for a lower rate of TDS.

- Taxpayers claiming low rate, no TDS needs to submit the application to the Assessing Officer (AO) in the prescribed Form 13.

- In case the taxpayer does not apply for the certificate, they can still claim the refund in their Annual Return.

FORM 13:

- An application in Form 13 must be filed with the Assessing Officer (TDS) that application for lower or Nil TDS u/s 197 is to be made by the taxpayer in Form 13.

- Such Form 13 can be filed either online or manually.

- Assessing officer will review the documents / information submitted and may ask for further queries and documents. If the application satisfies the AO, he will process the issue of the certificate/reject the application.

DOCUMENTS TO SUBMITTED WITH FORM 13

- Complete set of ITR, Computation of income and Assessment orders (if applicable) for previous 3 financial years.

- Copies of financial statement along with audit report (if any) for previous 3 financial years. In case of assesse having business or profession income.

- Profit and loss account for the current financial year.

- Tax deduction account number (TAN) of all parties responsible for paying you along with estimated amount to be paid by them.

- Copy of PAN card

- Estimated income during financial year for which you are applying.

PROCEDURE FOR ONLINE FILING OF FORM 13

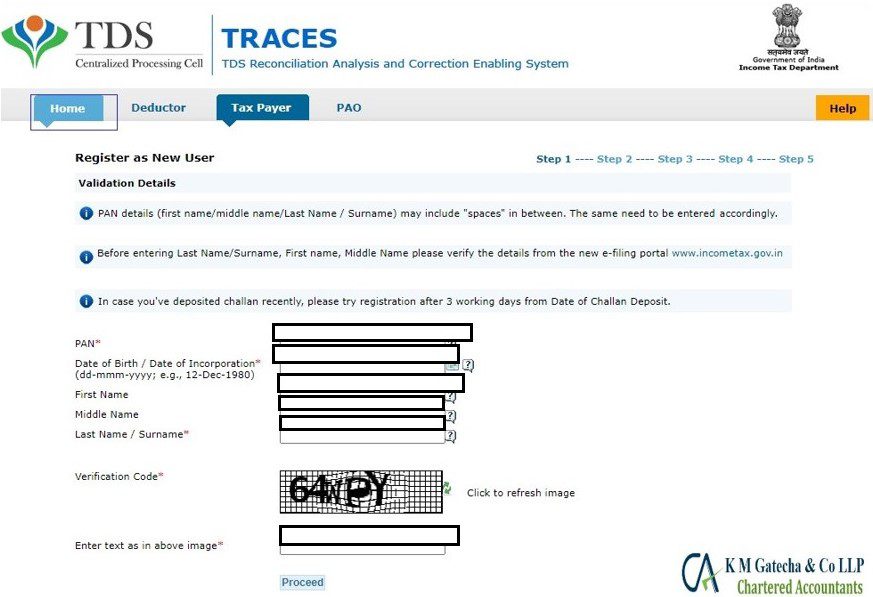

Step 1- taxpayer who is not registered at TRACES Shall be first required to register at TRACES(www.tdsscpc.gov.in) for login and filing application in form 13.

Step 2- Go to “statement/forms> request for form 13 and select residential status.

Step 3- checklist for 197 will appear. click on proceed.

Step 4- select “with (TAN & Amount) – deductor TANs & Amount

Step 5- select no. of entries. If more than 50, offline upload of annexures is necessary.

Step 6- fill up the required details. Click on “proceed”

Step 7- click on “template” and fill computation of estimate income.

Step 8- the taxpayer needed to preview and submit the form 13 along with supporting documents online, using digital signature or through electronic verification code (EVC).

POINT TO REMEMBER

- The certificate issued under section 197 is only valid for the assessment year mentioned in the certificate otherwise the form will reject.

- Lower/nil certificate will be only valid for the period mentioned in the certificate.

Frequently Asked Questions

Lower deduction certificate facilitates the payment of certain sum on deduction of TDS at a lower rate.

Yes, if you have paid the excessive tax, it will be refunded. To Get your additional tax refund, you will have to first file ITR.

– To verify the details, go to TRACES website (tdscpc.gov.in/app/login) and login to TRACES Portal using your login credentials and TAN. On logging in to the portal, go to Validate Lower Deduction Certificate u/s 197 under Statements/Payments menu.

Table of Contents

Toggle