NRI Business consulting services

Call Us Today +91 8000 57972

We, at K M Gatecha & Co LLP, provide NRI business consulting services along with numerous other services such as accounting services, audit services, company registration services, GST filing, returns and refund services, Income Tax returns preparation and filing services to our clients in an efficient and hassle-free manner. We also believe in providing our clients with the complete knowledge about the service that they are looking to avail.

NRI Business consulting services-Best NRI Business consulting services in India

NRI Business consulting services

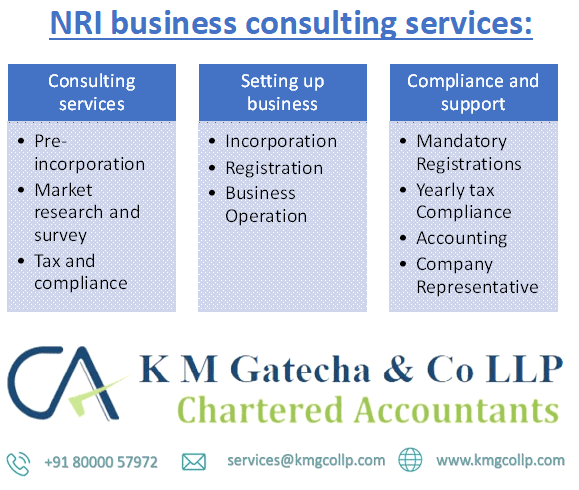

NRI business consulting services provided at K M Gatecha & Co LLP:

- Consulting services:

- Pre-incorporation services (consultation before entering any business):

- The pre-incorporation services include consultation about which type of company to be formed (foreign company, foreign subsidiary, branch office or marketing office) along with the proper analysis of each with pros and cons so that you can make an informed decision.

- Market research and survey:

- In market research and survey services, our expert team provides our clients with the comprehensive insight of the business that they are looking into setting up a business,

- Business strategies and plan are prepared on basis of studying the market, conducting surveys, studying current companies which are operating in the market and future opportunities and challenges.

- Tax and compliance implications regarding any transactions that are to be done in the business:

- This advisory is necessary to avoid any hassles in import and export or local trade,

- The consultation is beneficial to avoid any problems with the Tax departments of India.

- Setting up a business service:

- Incorporation services,

- Registration services,

- Business operation services.

- Compliance and support services:

- Mandatory registrations such as GST registration, labour licenses, industrial licenses, import and export Code

- Yearly tax compliances such as returns filing and certifications for company,

- Accounting and compliances services for MIS and other reports which have to be provided to the parent company,

- Company representative services.

- Investment consulting services for Foreign Direct Investments,

- Joint venture or associate company research and handshake services.

- Pre-incorporation services (consultation before entering any business):

Types of business or companies which can be set up by NRIs in India:

- Wholly owned Company,

- Subsidiary Company,

- Limited liability partnership Company,

- Join venture company,

- Foreign company,

- One person company,

- Partnership firm where at least on partner is an Indian resident,

- Proprietorship, private limited or limited company through FDIs (Foreign Direct Investments).

Process of NRI business consulting:

- Market research and survey,

- Planning of type of company,

- Incorporation business or investment in currently running company,

- Setting up business operations,

- Appointing representative, associate company, or registered office,

- Yearly tax and other compliances.

Documents required for NRI business consulting:

- For market research and survey:

- Type or product in which NRI wishes to start business in,

- Investment details,

- NRI status details.

- For company registration (all documents to be attested by consulate of foreign embassy in India):

- Passport,

- Resident permit,

- Business visa,

- Bank statement or utility bill,

- PAN card,

- Proof of identity,

- Aadhar Card,

- Current Address proof,

- For foreign nationals who want to be directors:

- DSC (digital Signature),

- DIN (director identification number),

- Registration with the MCA,

- Filing form SPICe+.

- For accounting, tax and compliance services:

- Financial statements,

- Books of accounts,

- Directors’ reports,

- All supporting documents.

FAQS on NRI Business consulting services-Best NRI Business consulting services

- Yes, a NRI can form a partnership firm where at least one of the partners is a resident of India.

- An Indian citizen who stays abroad for 183 days or more in one financial year or an Indian citizen who stays in India for less than 365 days in the last four financial years is classified as a NRI according to the Government of India.

Earlier NRIs could not form an OPC in India but after the companies (incorporation) Second amendment Rules, 2021, a NRI can form OPCs in India.

- Yes, a NRI can invest in a company through FDIs but the FDIs need prior approval from the Reserve Bank of India.

EXCELLENTTrustindex verifies that the original source of the review is Google. Best services you can get for your financial activities. Services provided is excellent. You can be rest assured sitting at your home as they professionally take care of the activities. Had the best experience.Trustindex verifies that the original source of the review is Google. Very good and fast service. With constant follow-up.Trustindex verifies that the original source of the review is Google. Recommend a CA for income tax-related work with quick and efficient service.Trustindex verifies that the original source of the review is Google. Excellent service from KM Gatecha firm, they resolved my case very promptly and I will definitely recommend them for any taxation services.Trustindex verifies that the original source of the review is Google. It's good platform with quality service assurance and timely closure with the personalized guidance. Thanks for support and all the best!Trustindex verifies that the original source of the review is Google. It was a great experience working with Milap. Dedicated, Accurate and wants to get work done on your behalf. I contacted him 7 hours ago to file tax on my behalf and all work is done in matters of hours. If you are looking for someone in India as NRI to work on your taxes he is the person who will do wonderful job. Thank you 🙏Trustindex verifies that the original source of the review is Google. Best chartered accountant in ahmedabad for comprehensive services related to private limited company registration,GST filing and registration,tax filing and audit services. Highly recommend for best and professional services.👍

Our Other Services

CA Firm in ahmedabad

Being the best ca firm in Ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Tax Consultant

We as the best tax consultant in Ahmedabad, india provide tax consultancy including direct and indirect tax consultancy.

Audit Firm in ahmedabad

We provide bank audits, stock audits, forensic audits, statutory audits, concurrent audits, tax audits, internal audits, information system audit services.

Accounting firm in ahmedabad

We provide bookkeeping, accounting, tally accounting, zero accounting, quick book accounting, Zoho accounting services.

GST Consultant

Our GST services include GST registration, GST payments, GST refunds services,e way bill consultant, GST return, GST classification, GST compliances, etc.

Chartered Accountant In Ahmedabad

We as the most-trusted chartered accountant in Ahmedabad provide all chartered accountant services under one roof.

Tax Accountant

We provide tax accounting services for effective tax planning and making tax provisions.

Income Tax Services In Ahmedabad

We provide income tax audits, income tax return filing, corporate income tax services, etc.