NRI tax filing services

Call Us Today +91 80000 57972

K M GATECHA & CO LLP provides NRI tax filing services in Ahmedabad.We have a potent team of experts to assist you with tax planning, NRI tax filing, compliance with various laws and transactions, purchase, and sale of property and liaisoning services.Are you an NRI who earns income from India or owns assets in India? If yes, then you need to file your income tax returns in India and comply with the tax laws and regulations. NRIs find it exceedingly difficult to manage their finances in India due to several reasons. The taxation system in India itself is complex and constantly evolving due to the nature of economy of India (developing). Even the residents of India itself find it difficult, let alone NRIs, to stay up to date with the amendments or new introductions in laws or regulations or even small modifications in certain laws which results in small to notable change in their tax liabilities. Then there is the topic of compliances which NRIs need to fulfill. This is where we, K M Gatecha & Co LLP, come to assist you, the NRIs with the best of services that can be provided in Ahmedabad (for sure) and one of the best in India, with all the processes and compliances. Efficient online NRI Tax Filing Services in Ahmedabad. Expert assistance for hassle-free NRI tax filing India. stay compliant. Contact us today!

NRI Tax Filing Services in Ahmedabad

NRI tax filing

NRIs are required to file tax/IT returns for all and any income that is accrued in India or by services provided in India though their Income is exempt from most taxes.

Our team at K M Gatecha & Co LLP has comprehensive knowledge, experience and understanding of the NRI taxation services which not only result in better service but also accelerates and eases the entire process of preparing and filing Tax returns for our esteemed clients.

NRI tax filing services on Property Sale and TDS compliance

As per of our NRI tax filing services,apart from filing of tax returns we also assist and empower our NRI clients by managing their property and other investments in India. We diligently work towards saving your time, money and ease the fiscal management aspect of your investments.

NRI Tax filing consultancy

We at K M Gatecha & Co LLP use the full potential of the expert team to provide you with state-of-the-art tax consultancy services to manage your tax matters and compliances. We provide expert NRI tax filing services in handling complex income tax notices and income tax compliances.

We aim at maximizing not only the wealth but also the value of the wealth for our clients, and so we provide commercially focused tax advisory services. We focus on understanding your understanding your business or job beyond our own expertise so that our aim is coordinated with yours regarding what is your vision regarding the business and investments, and thus we customize our solution according to your vision.

We adopt a vision-oriented approach to maximize the results all while optimizing tax compliance with the NRI taxation regulatory framework.

Liaisoning Services and NRI ITR filing in Ahmedabad

The NRI taxation services include liasoning services for NRIs who intend to set up a branch office or liaison office in India under RBI permissions.

The team at K M Gatecha & Co LLP has good knowledge and experience at handling all the steps required for setting up the same starting from understanding the right structure for the organization to completing the set up and commencement of operations in India.We are also known for NRI tax filing services in Ahmedabad.

We help you in creating and structuring the optimum entry strategy for India and along with that we liaison with various authorities to ensure smooth flow of the operation regarding the compliance with all statutory registrations.

We assist the organizations in evaluation of the best structuring options, selection of the optimum option based on their goals and economic situation of the market as well as organization, fulfilling required approvals, documentation, attestation requirements and annual compliance matters. Thus we also help in NRI itr filing in Ahmedabad.

NRI Tax filing services and planning services

The Taxation in India itself is overly complex and evolving but it gets even more complex and time consuming when it comes to matters of NRIs inheriting assets in India, setting up base in India, Returning NRIs and the new NRIs, as they do not understand the exemptions, deductions and mandatory requirements.

K M Gatecha & Co LLP comes to the rescues of all the NRI tax filing services in Ahmedabad along with our professional, well-read, and proficient NRI tax consultants who with all the experience help you in proper tax planning which minimizes and optimizes your tax liability in the country.

We also provide professionals and income tax consultant in Ahmedabad to the NRIs who aim at liquidating all their inheritance or remunerate the sales proceeds of the same or manage it to achieve optimum tax efficiency and there by achieving reduction in tax liability.

Tax planning is also a crucial aspect for returning NRIs and first-time emigrants, and it is our basic parts of Tax Planning Services. We are well known for our best NRI tax filing services in Ahmedabad.

Other professional Services

- Determination of residential status according to Income Tax Act 1961

- Professional support in filing PAN applications

- Advisory on FEMA

- Tax planning to optimize your tax liability under DTAA

- Tax representation before tax authorities for any anomalies or clarifications

- Opening NRE, NRO and FCNR accounts

- Transfer of funds from NRE or NRO accounts

- Handling of Inheritance and wealth tax

- TDS RETURN ON PURCHASE OF PROPERTY FORM 26QB

- Banking and remittances

- Repatriation of capital and income

NRI ITR filing in Ahmedabad

However, NRI tax filing can be be a daunting task, especially if you are not familiar with the tax rules and procedures. You may face various challenges, such as:

- How to calculate your taxable income and tax liability in India?

- How to claim the benefits of the tax treaties and exemptions available to NRIs?

- How to file your tax returns online or offline in India for NRI tax filing?

- How to deal with the tax notices, assessments, appeals, and refunds in India?

- How to manage your investments, properties, bank accounts, and other assets in India?

To overcome these challenges, you need the help of a professional and reliable NRI tax filing service provider who can handle your NRI taxation matters efficiently and effectively. Why choose K M GATECHA & CO LLP for NRI tax filing service provider due to following qualities:

- Expertise and experience in NRI taxation, including knowledge of the latest tax laws and regulations in India

- Online and offline service delivery, using advanced technology and tools to ensure accuracy, speed, and convenience

- Effective communication skills, understanding your needs and expectations, and providing you with regular and transparent updates

- Ability to handle complex and difficult situations, such as tax notices, assessments, appeals, refunds, etc.

- Ability to provide value-added services, such as property sale and purchase, investment advisory, liaisoning with authorities, etc.

If you are looking for such a NRI tax filing service provider in India, then you should consider K M GATECHA & CO LLP as your destination. It has many advantages for NRIs who want to avail NRI tax filing services in Ahmedabad , India

K M GATECHA & CO LLP is considered best chartered accountant’s firms that offer NRI taxation services. Our CA firm have qualified and experienced professionals who can assist you with your tax planning, NRI ITR filing in Ahmedabad, tax compliance, and other related matters. We are considered one of the top chartered accountant’s firms that offer NRI taxation services in Ahmedabad & NRI tax filing services.

Navigating NRI ITR filing in Ahmedabad is now effortless with our expert assistance. Our dedicated team ensures seamless tax filing for non-resident Indians, addressing every unique financial aspect. With in-depth knowledge of international tax laws and local regulations, we guarantee accurate and timely submissions. Trust us to optimize your tax returns, offering tailored solutions for your financial peace of mind. Experience hassle-free NRI ITR filing services in Ahmedabad with us. You can contact us today on services@kmgcollp.com.

Faqs on NRI Tax Filing Services

- A person is a resident of India according to Income Tax Act 1961 if:-

- He/she is in India for 182 days or more in the previous year

- He/she is in India for 60 days or more in the previous year and 365 days or more in the years immediately preceding the previous year

- If an Indian Citizen or person of Indian origin comes on a visit to India or if and Indian citizen is going abroad for employment during the previous year, then in the second condition 60 days is replaced by 182 days.

- Person of Indian origin is a person who or whose parents or grandparents were born in any region of Undivided India.

- A company is a resident of India if the company is Indian or during the previous year, the control or management was situated in India.

An NRI is a person who does not fulfill the above conditions of being a resident of India.

- Dividends from shares of domestic companies

- Interest on NRE and FCNR (Foreign Currency Non-Repatriable) accounts

- Long term capital gains from listed equity shares as well as equity oriented mutual funds

- Interest on government issued savings certificates and notified bonds

- An Indian Resident can be either Resident and Ordinary Resident (ROR) or Resident but Not Ordinarily Resident which depends on the fulfillment of the following two conditions. If both the conditions are fulfilled, then the person is ROR otherwise he/she is RNOR

- Residing in India in any of the two out of ten previous fiscal years preceding the previous year and

- Physical presence in India for 730 days or more in the seven previous fiscal years preceding the previous year.

The answer is yes. Once your residence has been determined, the next step is to determine whether your income is taxable in India under the residence established under the Income Tax Act 1961.

- For resident individuals: Your worldwide income is taxed in India, which means that income earned in India or abroad is taxed in Indi

- For Non Resident Indians: Only income earned or accrued in India or deemed to be earned or accrued in India or deemed to be earned or accrued in India is taxable in India. Therefore, your income from any country other than India is not taxed in India.

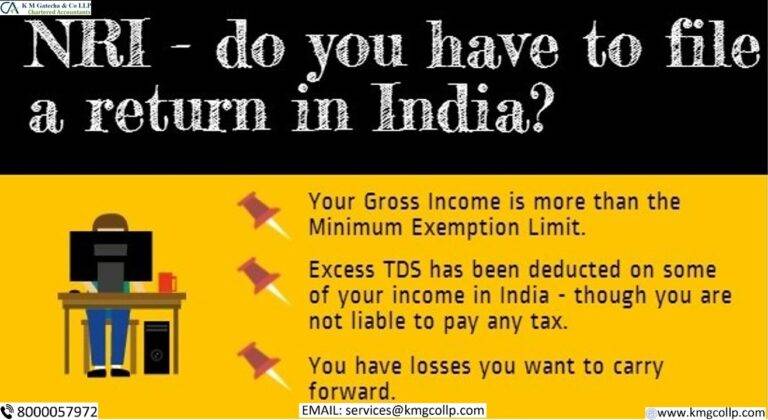

Normally, you have to file a tax return if:

- Your gross income earned or accrued in India exceeds the basic exemption limit of Rs. 2,50,000.

- Excess TDS resulting in a refund due to TDS deducted on rent or interest or any such income. Hence for claiming a refund ITR is required to file.

- For carrying forward losses or setting of gains against loss.

No. Income tax return is being filed online though income tax portal i.e efiling portal.NRI do not need to be physically present to file and verify NRI tax return. NRI can file NRI tax return online from anywhere in the world. NRI can now check NRI ITR electronically from anywhere. NRI can send the signed copy of ITR-V to CPC Income Tax Department Bangalore or e-verify within 30 days from the date of filing of ITR.

Yes. The basic exemption ceiling also applies to non-residents. However, this exemption is not available if your income consists only of short-term capital gains [Section 111A] or long-term capital gains because it is taxed at a special rate. Similarly, if your income is solely from other income taxed at a special rate, such as lottery winnings, the base exemption cap will not be available. Hence benefit of basic exemption limit is not available if NRI has capital gain as income source.

Irrespective of residency status, rental income from Indian properties is considered income generated in India and is taxed in India. Therefore, the rental income is taxable for NRI. Basic exemption limit of Rs. 250,000 applies to this.

Yes, NRI must pay a tax advance if the tax payable by NRI for a financial year is Rs 10,000 or more. The prepaid tax must be paid quarterly according to the due date indicated. However, interest under Section 234B and Section 234C will apply if NRI does not pay the advance tax by before the payment due date.

If your property is 3 years old there will be a long-term capital gain on the sale. These profits are taxed at 20%. However, you can avoid paying capital gains tax by taking advantage of the investment options available under various regulations to reduce your tax liability. The tax implications of NRI also apply to inheritance. If the property is inherited, remember to consider the date of purchase from the original owner to calculate whether it is a long-term or short-term capital gain. In this case, the cost of the property is that of the previous owner.

Income tax rates for NRIs are the same as for resident individuals in India. However, the NRIs will not get senior and super senior basic exemption tax limits as resident Indians get.

A double taxation avoidance agreement, or DTAA, is an agreement between two countries to avoid taxing the same income in both countries. To apply for DTAA benefits in India, the assessee must present a certificate of tax residency. Taxpayers can obtain a certificate of tax residency from the government of the country where the NRI is located.

NRI can get excess income tax refund by filing income tax return in India.

Gains/losses on shares sold after 12 months from the date of purchase are long term in nature taxable at 10% and short term gain is taxable at 15%.

Income earned and received outside India is not taxed in India. However, any income earned, accrued or received in India is taxed at a flat rate.

Interest earned on NRE Fixed Deposits is tax exempt in India. However, interest on the FD’s NRO account received from the NRI is taxable. Interest earned on any type of NGO bank account is taxable.

Steps to file ITR for NRIs

Step 1 –Determine residential status of NRI

Step 2- Reconciling income with 26as,AIS and TIS

Step 3- Computing taxable income

Step 4- Computing tax payable

Step 5- Considering benefit of DTAA

Step 6- Filing correct ITR form for NRI

Step 7- Input of NON liable income details

Step 8- validation of bank account on income tax portal

Step 9- Inclusion of necessary details in ITR including assets and liabilities

Step 10- Uploading ITR and e verifying

Following documents are required for filing NRI income tax return:

- Pan card(Permanent account number) this is compulsory for filing ITR in India

- bank account details and its validation in income tax portal

- Passport of NRI to validate nationality and residential status of NRI

- Income proof like salary slip, interest certificate, capital gain statement,etc. to reconcile income with AIS,TIS and form 26as.

NRI can apply for lower TDS or tax exemption certificate on sale of property by making application for lower tds or taxa exemption by making application in form 13 to local tax jurisdictional officer.

37/2017 Exempt non-residents from linking PAN to Aadhaar under the Income Tax Act if they do not have Aadhaar. This means that if non-residents have Aadhaar and PAN, they must link PAN to Aadhaar.

Non-Resident Indians (“NRIs”) can apply for a PAN through Form No. 49A is submitted to the PAN Application Center of UTIITSL or Protean (formerly known as NSDL eGov) with required documents and prescribed fees .And than PAN is delivered physically also.

Our Other Services

CA Firm in ahmedabad

Being the best ca firm in Ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Income Tax Return Consultant in Ahmedabad

We as the best tax consultant in Ahmedabad, india provide tax consultancy including direct and indirect tax consultancy.

Audit Firm in ahmedabad

We provide bank audits, stock audits, forensic audits, statutory audits, concurrent audits, tax audits, internal audits, information system audit services.

Accounting firm in ahmedabad

We provide bookkeeping, accounting, tally accounting, zero accounting, quick book accounting, Zoho accounting services.

GST Consultant

Our GST services include GST registration, GST payments, GST refunds services,e way bill consultant, GST return, GST classification, GST compliances, etc.

Chartered Accountant In Ahmedabad

We as the most-trusted chartered accountant in Ahmedabad provide all chartered accountant services under one roof.

Tax Accountant

We provide tax accounting services for effective tax planning and making tax provisions.

Income Tax Services In Ahmedabad

We provide income tax audits, NRI itr filing in Ahmedabad, corporate income tax services, etc.