Section 8 Company registration services in Ahmedabad

Call Us Today +91 80000 57972

We, at K M Gatecha & Co LLP, provide services of Section 8 Company registration along with many other services such as accounting services, audit services, company registration services, GST filing, returns and refund services, Income Tax returns preparation and filing services to our clients in an efficient and hassle-free manner. We also believe in providing our clients with the complete knowledge about the service that they are looking to avail.

Simple steps for Section 8 Company registration services in Ahmedabad-Best Company formation services in India

Section 8 Company registration services in Ahmedabad

The Section 8 Company registration services in Ahmedabad that we provide at K M Gatecha & Co LLP:

- Checking for name availability and obtaining name,

- Drafting MOA in format prescribed in for INC-13,

- Drafting AOA,

- Obtaining Digital signatures for directors,

- SPICe 32 form documents collection,

- Filing SPICe 32 form,

- Completion of process,

- Obtaining registration details for Section 8 Company,

- GST registration, returns and refund services,

- Accounting services for section 8 Companies,

- ITR preparation and filing services for section 8 companies.

Section 8 Company:

- Section 8 company is a non-profit organization which promotes arts, science, sports, education, research, social welfare, charity, protection of environment or similar pursuits,

- There are 3 legal forms in which these kinds of companies can exist in India, i.e., trusts, societies and Section 8 companies,

- The organization uses its income or assets in promoting the above objectives,

- Does not distribute profits or dividends to its members.

- Section 8 companies work under the uniform law of Companies Act,2013.

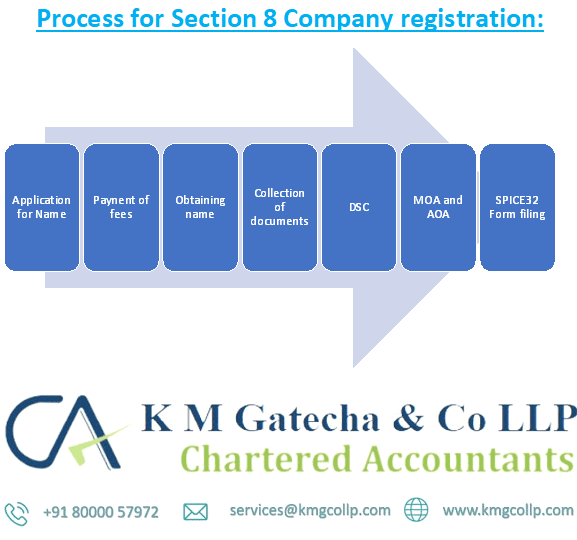

Section 8 company registration process:

- Application for name availability:

- Application for availability of name must be made in “RUN” facility.

- The name should include foundation, association, federation, chambers, electoral trust or similar.

- The fee for “RUN” is INR 1000/- and object clause should be attached,

- Name once approved is valid for 20 days.

- DSC of First Directors,

- Preparation of MOA (memorandum of association), AOA (articles of association) and other documents)

- MOA should be in form INC-13,

- No prescribed format for AOA,

- MOA and AOA should be signed by each subscriber and name, address, description and occupation of the subscriber should be mentioned.

- SPICe 32 form filing:

- Attachments along with SPICe 32:

- MOA

- AOA

- Declaration in form INC-14 by a practicing CS/CA/CWA,

- Declaration by each person making the application in form INC-15,

- An estimate of future annual income and expenditure of the company for the next 3 years,

- Approval of name from CRC,

- Consent and declaration by first directors in Form DIR-2,

- Self-declaration by subscribers in form INC-9,

- Aadhar card of first directors and subscribers,

- Proof of registered office such as rent deed, sale deed or lease agreement,

- Latest utility bill as proof of address for registered office address,

- Attachments along with SPICe 32:

Benefits of Section 8 Company registration:

- Exemption of stamp Duty,

- Tax deductions for donors under u/s 80G,

- Can be formed without share capital,

- Not required to add suffix such as limited or private limited,

- More credibility compared to other Non-profit organization such as trust or society.

FAQS on Section 8 Company registration services in Ahmedabad-Best Company formation services in ahmedabad

Yes, a company can form another section 8 company, but it should only be formed for the purpose specified under section 8 companies.

- Any Individual or HUF can form a section 8 company,

- The company needs at least 2 directors or shareholders who should fulfil all compliances and requirements of section 8 company incorporation under the Company Act, 2013.

Section 8 company comes under the purview of the Company Act,2013 so if the company comes under the purview of GST Act, it is required to obtain a GST number.

If the section 8 company is registered under section 12AA of Income Tax Act, then the income of the section 8 company is exempted from income tax.

No, section 8 company can only accept donations and not deposits.

Yes, as a section 8 company is a separate legal entity, it can buy, own and rent land.

A section 8 company requires minimum of 2 directors or subscribers.

Our Other Services

CA Firm in ahmedabad

Being the best ca firm in Ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Tax Consultant

We as the best tax consultant in Ahmedabad, india provide tax consultancy including direct and indirect tax consultancy.

Audit Firm in ahmedabad

We provide bank audits, stock audits, forensic audits, statutory audits, concurrent audits, tax audits, internal audits, information system audit services.

Accounting firm in ahmedabad

We provide bookkeeping, accounting, tally accounting, zero accounting, quick book accounting, Zoho accounting services.

GST Consultant

Our GST services include GST registration, GST payments, GST refunds services,e way bill consultant, GST return, GST classification, GST compliances, etc.

Chartered Accountant In Ahmedabad

We as the most-trusted chartered accountant in Ahmedabad provide all chartered accountant services under one roof.

Tax Accountant

We provide tax accounting services for effective tax planning and making tax provisions.

Income Tax Services In Ahmedabad

We provide income tax audits, income tax return filing, corporate income tax services, etc.