TAN APPLICATION SERVICES IN AHMEDABAD

Call Us Today +91 80000 57972

We, at K M Gatecha & Co LLP, provide our clients with TAN application services in Ahmedabad along with the complete range of services related to taxation, accounting, investment planning and Government compliances to individuals and companies in an efficient and hassle-free manner. We also believe in providing our potential clients with all the necessary information regarding the services that they are looking to avail.

PAN card Application and Correction services in Ahmedabad

TAN APPLICATION SERVICES IN AHMEDABAD

TAN APPLICATION SERVICES IN AHMEDABAD provided at K M Gatecha & Co LLP:

TAN Application services in Ahmedabad:

- Collection of Documents,

- Verification of Documents,

- Filling and filing of form,

- Submission of documents,

- Application for TAN number,

- Follow-up with authorities,

- Issuance of TAN number,

- Preparation and filing of TDS and TCS returns.

TAN Number:

TAN is an abbreviation for Tax Account Number which is a unique 10-digit alphanumeric number which is to be obtained by any individual or company which deducts tax or collects tax at source (TDS and TCS).

Uses:

- To be quoted in:

- TDS/TCS returns,

- TDS/TCS challans,

- TDS/TCS certificates which are issued,

- Annual information return,

- Any other prescribed documents.

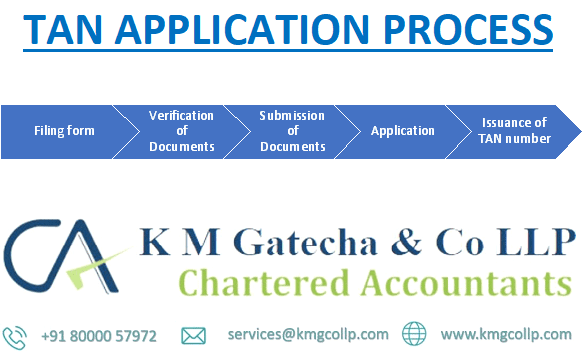

Process of obtaining TAN number:

- Filing form,

- Verification of documents,

- Submission of documents,

- Application for TAN number,

- Issuance of TAN number.

Documents require for TAN application:

- All mentioned documents must be self-attested in blue ink,

- Duly filled and signed application form,

- Passport sized photograph of authorised partner,

- ID proof of all partners,

- Address proof of company,

- Partnership deed,

- Account statement of company for last 3 months,

- Registration certificate of business,

- KYC details of one partner,

- 2 passport size photographs,

- Government ID proof,

- Address proof.

Salient Features of TAN number:

- Mandatory to be quoted in TDS/TCS returns and Challans,

- TAN number has a lifetime validity,

- Any individual or company can have one TAN number for one PAN card.

- After obtaining TAN number, quarterly filing of TDS and TCS returns is compulsory on the last day of the month following the end of a quarter (i.e., 31st of July, October, January and May),

- The payment made by TAN number holder and the validity of TAN number can be checked on the TRACES website,

- Penalties for non-filing of TDS/TCS returns is INR 200 per day from the last date of filing of returns.

FAQS on TAN APPLICATION SERVICES IN AHMEDABAD

Any individual or company which deducts or collects tax on behalf of the Income Tax Department must obtain a TAN number.

Yes, you can apply for TAN number on the Protean-TIN website. You can fill and submit the form online.

It usually takes between 7-15 business days to obtain a TAN number.

TAN number is compulsory for any business or individual who deducts or collects tax at source.

- No, it is compulsory to quote TAN number in TDS/TCS returns and challans.

- Without TAN number TDS and TCS returns cannot be filed.

No, it is illegal of have more than one TAN number for one PAN card.

Our Other Services

CA Firm in ahmedabad

Being the best ca firm in Ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Tax Consultant

We as the best tax consultant in Ahmedabad, india provide tax consultancy including direct and indirect tax consultancy.

Audit Firm in ahmedabad

We provide bank audits, stock audits, forensic audits, statutory audits, concurrent audits, tax audits, internal audits, information system audit services.

Accounting firm in ahmedabad

We provide bookkeeping, accounting, tally accounting, zero accounting, quick book accounting, Zoho accounting services.

GST Consultant

Our GST services include GST registration, GST payments, GST refunds services,e way bill consultant, GST return, GST classification, GST compliances, etc.

Chartered Accountant In Ahmedabad

We as the most-trusted chartered accountant in Ahmedabad provide all chartered accountant services under one roof.

Tax Accountant

We provide tax accounting services for effective tax planning and making tax provisions.

Income Tax Services In Ahmedabad

We provide income tax audits, income tax return filing, corporate income tax services, etc.