TAN Number is a crucial identification for every taxpayer in India. It is a 10-digit alphanumeric code assigned to individuals or entities responsible for deducting or collecting taxes at the source. Whether you’re acting in an individual capacity or as a business, having a TAN number is essential for seamless daily operations in India.

This number must be quoted when filing payment challans, certificates, Annual Information Returns, TDS (Tax Deducted at Source), TCS (Tax Collected at Source), and similar transactions. Without a valid TAN number, the TIN (Taxpayer Identification Number) facilitation centres will reject any returns filed. Additionally, banks will not process TDS and TCS challans without it.

What Is TAN Number?

TAN number is a unique identifier issued by the Income Tax Department and consists of 10 characters—four alphabets, five digits, and an ending alphabet (e.g., PDES03028F). The first three letters signify the jurisdiction code, and the fourth represents the deductee’s name.

Under Section 203A of the Income Tax Act, 1961, providing a TAN number in all TDS returns is mandatory for compliance with Indian tax regulations. It is necessary for reporting tax deductions on salary, dividends, and interest payments and must be included in all TDS/TCS returns, challans, and certificates. Failing to quote the TAN number can lead to a penalty of Rs.10,000.

How To Find Your TAN?

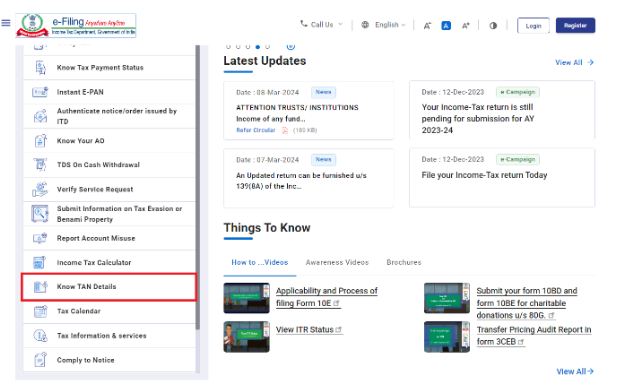

It is now possible to check your TAN details by using either your TAN number or your name. If you’ve forgotten your TAN, you can easily retrieve it. Follow these steps to find your TAN number:

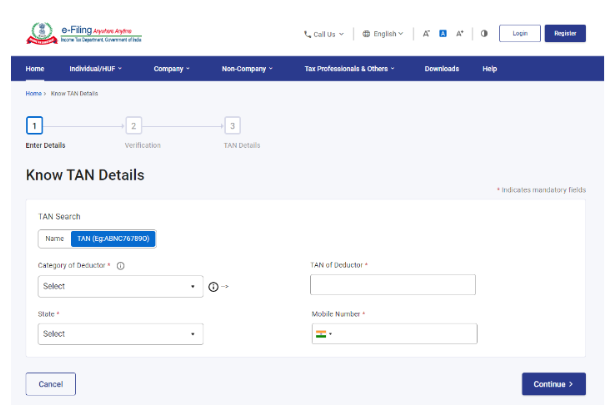

Step 1: Visit the official Income Tax e-Filing website and select the option “Know TAN Details”.

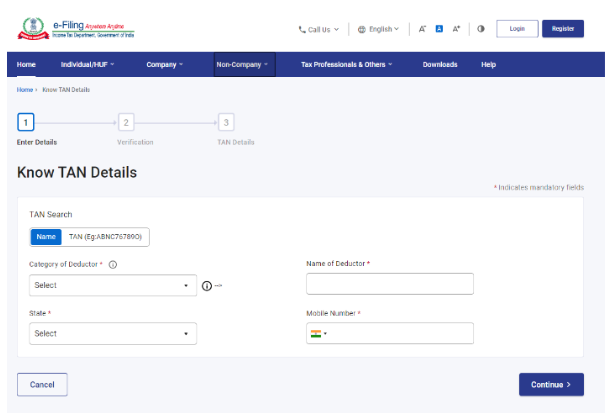

Step 2: Under the ‘TAN Search’ section, you will see the options ‘TAN’ or ‘Name.’

Step 3: Choose either ‘TAN’ or ‘Name’ based on your preference.

Step 4: If you opt for the Name option, select the ‘Category of Deductor’ and state, then enter the Deductor’s Name, your registered mobile number, and click on ‘Continue.’

If you choose the TAN option, select the ‘Category of Deductor’ and state, then enter the Deductor’s TAN. Provide your registered mobile number and click ‘Continue.’

Step 5: You will receive an OTP on your registered mobile number.

Step 6: Enter the OTP and click on the ‘Validate’ button. Your TAN details will be displayed on the screen.

TAN Application Online

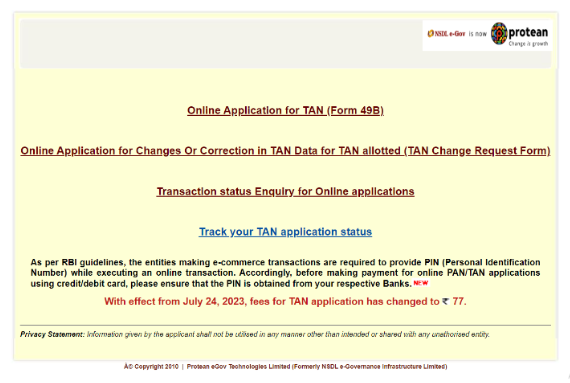

Step 1: Visit the official NSDL TAN website.

Step 2: Click on the option ‘Online Application for TAN (Form 49B)’.

Step 3: Select the ‘Apply for new TAN’ option and choose the relevant category of deductors.

Step 4: The TAN application form will appear. Fill out the form carefully, ensuring all mandatory fields marked with * are completed. If any data does not meet the required format, an error message will be displayed. You must correct these errors before re-submitting the application.

Step 5: If your form has no errors, a confirmation screen will appear. You can select the edit option on this screen if you need to modify any information.

Step 6: Once you’ve reviewed all the details, click ‘Confirm.’

Step 7: Proceed to pay the required fees online. Payment can also be made via cheque, DD, or credit/debit card in favor of NSDL-TIN.

Step 8: After successful payment, you will receive an acknowledgement slip with a 14-digit acknowledgement number, which can be used to track your application status. Save and print the slip, and send it along with the required documents to Protean eGov Technologies Ltd.

TAN Application Offline

Step 1: Visit the nearest TIN Facilitation Centre and obtain Form 49B. Alternatively, you can download it from the Income Tax website. If your business is not registered under the Companies Act, you will need to fill out Form INC-7.

Step 2: After completing the form, submit it at the TIN counter along with the processing fee. Payment can be made via cheque, cash, or demand draft (DD).

How To Find Your TAN Jurisdiction Building Name?

Follow these steps to know the name of your TAN jurisdiction building:

Step 1: Go to the official Income Tax website.

Step 2: Navigate to the ‘Important Links’ section.

Step 3: Click on ‘Jurisdiction’.

Step 4: Select your state.

Step 5: You will be redirected to a PDF file.

Step 6: Find your TAN jurisdiction building’s name in the list provided in the PDF.

How To Download TAN Certificate?

Follow these steps to download your TAN certificate online:

Step 1: Go to the NSDL TIN website to download your TAN certificate.

Step 2: Select ‘Application Type’ as ‘TAN-New/ Change Request’.

Step 3: Enter your ‘Acknowledgement Number’ received during your TAN application.

Step 4: Input the captcha code and click on ‘Submit’.

Step 5: Your TAN status will appear on the screen.

Step 6: Look for the statement ‘Click here to download your TAN Allotment Letter’ and click on it to download your TAN certificate.

Conclusion

It is essential to obtain a TAN number for filing TCS, TDS, or any other tax returns. Failure to quote your TAN number while submitting tax returns can lead to a penalty of Rs.10,000. Therefore, it is crucial to apply for your Tax Deduction and Collection Account Number as soon as possible.

FAQs on TAN (Tax Deduction and Collection Account Number)

- What is TAN?

TAN stands for Tax Deduction and Collection Account Number, a unique 10-digit alphanumeric code issued to individuals or entities responsible for collecting or deducting taxes at the source. - Who needs to apply for TAN?

Any individual, business, or entity responsible for deducting or collecting taxes (TDS/TCS) must apply for a TAN to comply with tax laws. - How can I apply for TAN?

You can apply for TAN either online through the NSDL TIN website by filling out Form 49B or offline by submitting Form 49B at the nearest TIN Facilitation Centre. - Is TAN mandatory for all taxpayers?

TAN is mandatory for individuals and entities required to deduct or collect tax at source (TDS/TCS). Without a TAN, you cannot submit TDS/TCS returns. - How can I download my TAN certificate?

You can download your TAN certificate online by visiting the NSDL TIN website, selecting ‘TAN-New/Change Request’, entering your acknowledgement number, and clicking on ‘Submit’. - What happens if I don’t quote my TAN while filing TDS or TCS returns?

Failure to quote your TAN while filing TDS or TCS returns can lead to a penalty of Rs.10,000. - How do I retrieve my TAN if I forget it?

You can retrieve your TAN by visiting the Income Tax e-Filing website and using the ‘Know TAN Details’ option, where you can search using your name or TAN. - How long does it take to get a TAN?

Once you submit your TAN application, it typically takes 7-15 working days to receive your TAN allotment. - Can I update my TAN details?

Yes, you can update your TAN details by submitting a change request application on the NSDL TIN website.

10. Is there a fee for applying for TAN?

Yes, there is a nominal processing fee when applying for TAN, whether online or offline. You can pay via cheque, demand draft, or online payment methods.

Table of Contents

Toggle