income Tax Audit Services in Ahmedabad

Call Us Today +91 80000 57972

Our clients are our foremost assets hence we always tend to

provide customer centric tax compliance services. Looking for tax audit services in Ahmedabad? K M GATECHA & CO LLP provides income tax audit and tax filing. Contact us for reliable tax audit services in Ahmedabad. We deliver services keeping

ourselves in their shoes and thus delivering what exactly client expects.

Clients look for CA who understand all rules, regulations and Indian tax system

and delivers best services. K

M GATECHA & CO LLP has also team of experts professional blended with

expert tax knowledge and diverse experience. We provide best tax audit services

in Ahmedabad. As best CA in Ahmedabad our services includes accounting,company

formation,tax filing, etc.

Income Tax Audit Services in Ahmedabad

What is income tax audit?

Section 44AB of the Income Tax Act 1961 states that if the turnover or total annual income of a business exceeds a prescribed limit, its accounts must be audited by a chartered accountant. The CPA provides its findings and observations in the tax audit report on forms 3CA/3CB and 3CD.A tax audit services is an independent examination of an entity’s books by an auditor, as required by the Income Tax Act 1961. Tax audits and the timely, transparent and clearly documented filing of tax returns is an important task for any assessee undergoing an audit. To achieve this goal, an independent tax auditor is needed to perform the task.

K M GATECHA & CO LLP is your best choice and trusted confidant, our team of experienced and dedicated auditors will add value to your account for best tax audit services in Ahmedabad. We truly understand the sensitivity and importance of tax company for businesses and other assessees and ensure that the highest level of ethical standards and the highest quality are maintained in our services.

Submitting tax accruals and tax returns with timely, transparent and clear information is an important task for all business. This requires the work of an independent tax accountant. KM GATECHA & CO LLP is your best choice and trust, our team of experienced and dedicated professionals will add value to your account. We truly understand the sensitivity and importance of taxation for companies and other auditors, and ensure that our services maintain the highest ethical standards and premium property.

We firmly believe that our customers are our most valuable asset. When creating services for customers, we must stand in their position and offer them exactly what they need. We understand that you are looking for an auditor who can deal with complex issues to understand all the rules, regulations and intricacies of the Indian tax system. KM GATECHA & CO LLP has a team of tax experts from various fields and years of experience. We provide hassle-free income tax audit services in Ahmedabad and tax compliance services for you.

The audit team of K M GATECHA & CO LLP has been working in this industry for decades and conducts tax audits for small, medium or large companies.

What are objectives of income tax audit in India?

- Ensure that accounting books are properly maintained and correct and have them certified by a chartered accountant.

- Auditors identify discrepancies in the books of accounts so that they can be corrected and accurate accounts maintained.

- Provide the required information, including deduction, depreciation, and legal compliance in the reporting format prescribed by the tax authority.

- Ensure that tax returns are accurate and filed correctly in accordance with the Income Tax Act.

Difference between tax audit and statutory audit

Tax audits differ from statutory audits in several ways. The audit policy is executed in a way that ensures that the company’s financial information is reliable, reasonable, transparent, fair and accurate. Tax auditing is keeping the profit books and ensuring that the correct information is reflected on the company’s income tax and deductions.

Got a Question?

FAQ on tax audit services

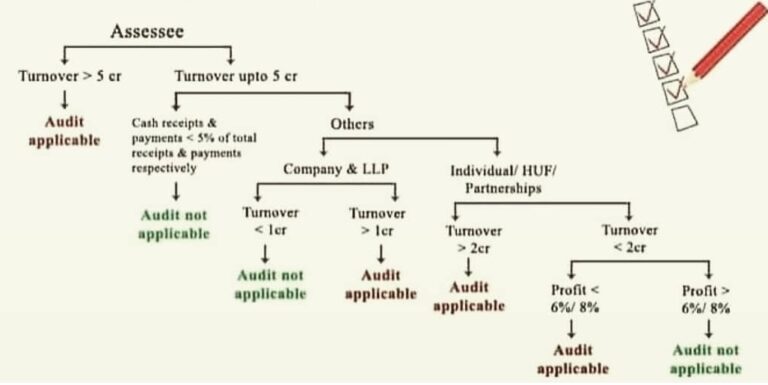

All assessee whose turnover exceed limit specified under income tax are eligible for tax audit.

Tax audit limit for professional is Rs.50 lacs.

1) Login to https://eportal.incometax.gov.in/iec/foservices using PAN and password.

2) Navigate to Authorised partner section > My Chartered Accountant (CA) > Add CA.

Income tax audit is required to check various compliances by taxpayer under section 44AB with income tax provisions and also aims to fulfill requirements of Income Tax law.

Tax audit is as per Income Tax Act and statutory audit is as per various statues for eg: company audit as per company law.

Penalty for non filing of Tax audit report is lower of two from below as per section 271B:

1) 0.5% of the total sales, turnover, or gross receipt

2) Rs. 1,50,000

For assesses whose accounts are audited under any other law, tax audit report is prepared by auditor in form 3CA and annexure to audit report in form 3CD and for all other assesses tax audit report is prepared by auditor in form 3CB and annexure to audit report in form 3CD.

The law requires tax audit reports to be submitted by September 30 of the relevant assessment year. For assessees responsible for transfer pricing audits, the deadline is November 30 of the relevant assessment year.

Tax audit can be done with help of chartered accountant or firm of chartered accountant.

Our Other Services

Chartered Accountant in Ahmedabad

We as leading chartered accountant in ahmedabad provide all chartered accountant services under one roof.

Income Tax Services in Ahmedabad

We provide income tax return filling, income tax audit services in Ahmedabad, corporate income tax services, etc.

GST Consultant

Our GST services includes GST returns, GST registration, GST payments, GST refunds services, e way bill consultant, GST compliances, GST classification, etc.

Audit firm in Ahmedabad

We provide tax audit services in Ahmedabad, bank audit, stock audit, forensic audit, concurrent audit, statutory audit, internal audit information system audit services.

Accounting Firm In Ahmedabad

We provide accounting, bookkeeping, tally accounting quick book accounting, zero accounting, zoho accounting services.

Tax Consultant

We as tax consultant in ahmedabad provide tax consultancy including direct and indirect tax consultancy.

CA Firm In Ahmedabad

Being top ca firm in ahmedabad we provide CA services all over India. We have our associates spread over many cities.

Tax Accountant

We provide tax accounting services for effective tax planning and making tax provisions.